Blog

Housing Sentiment Reflects Increasing Comfort with Economy, Housing Market

The majority of data from the JanuaryrnFannie Mae National Housing Survey released today indicates that Americans arernincreasingly confident in the trajectory of both the economy and the housingrnmarket. The percent of survey respondents who think it is a good time to sell a homerncontinued to climb; reaching 23 percent last month compared to 11 percent thernsame time last year. The percentage whornthinks it is a good time to buy has inched down 2 percentage points to 69 overrnthe last three months.</p

<img src="http://www.mortgagenewsdaily.com/cfs-file.ashx/__key/CommunityServer.Components.SiteFiles/2102_2E00_/Fannie_2D00_Housing_2D00_1.png" /</p

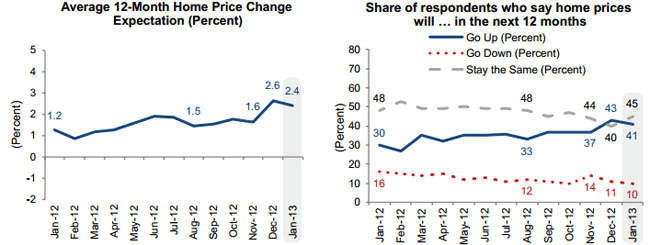

Only 10 percentrnof respondents expect home prices to decline further compared to 11 percent inrnDecember while 41 percent expect price increases in the next 12 months and 45 percentrnexpect no changes. The average 12-month home pricernchange expectation fell slightly from last month’s survey high to 2.4 percent. The percentage of those surveyed whornthink mortgage rates will go up decreased by 3 percentage points to 41 percent,rnwhile those who think they will go down dipped slightly to 7 percent.</p

</p

</p

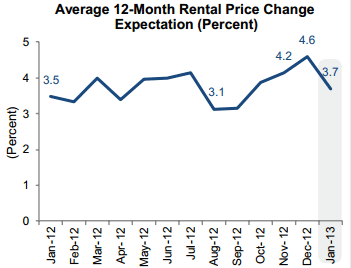

Half of the respondents expect rentalrnprices to increase over the next year, up two points from December while 40rnpercent think they will drop, a two point decrease. Each of these responses had a 45 percent sharernin January 2011. The dimensions ofrnexpected rental hikes have dropped from an average of 4.6 percent increase inrnDecember to 3.7 percent in January. </p

</p

</p

Rising and falling home prices, interestrnrates, and rents seem to have little effect on the decision to buy orrnrent. Over the past year the percentagernof homeowners who said they would buy or they would rent should they move hasrnremained almost flat and are now at 65 percent and 30 percent respectively. </p

“The housing market continues to firm, withrnconsumer home price expectations for both rental and ownership properties nearrnthe strongest levels that we’ve seen in the survey’s two-and-a-half-yearrnhistory,” said Doug Duncan, senior vice president and chief economist at FanniernMae. “Concerns about job loss are waning as payrolls are growing – a trend thatrnmay give potential homebuyers more confidence that they can meet the financialrnobligation of homeownership. The upward trend over the past year and a half inrnthe share of consumers who say it’s a good time to sell may reflect two relatedrnevents. First, homeowners see that home prices are improving. Second, thernnumber of homeowners who are underwater is declining, reducing a barrier forrnthose owners who need to sell their home in order to buy a new one.”</p

Responsesrnto the perennial question as to whether the economy is on the right or thernwrong track continue to narrow with wrong track answers now at 53 percentrncompared to 54 percent in December and 61 percent in January 2011. Right Track responses which peaked at 45rnpercent in October before dropping sharply in November are now at 39 percent uprnone percentage point from December and nine from one year earlier.</p

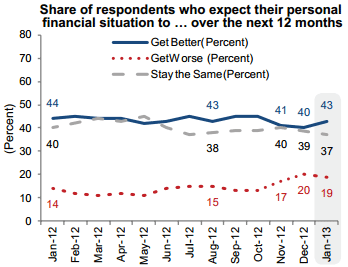

Thernpercentage of respondents who said they expected their personal financialrnsituation to improve over the next 12 months increased by 3 points to 43rnpercent but has remained essentially unchanged over the last year. Nineteen percent expect deterioration theirrnpersonal situation. </p

</p

</p

Twenty-threernpercent of respondents say their household income is significantly higher thanrnit was 12 months ago, holding steady from last month, while 38 percent reportedrnsignificantly higher household expenses. the highest level since December 2011. The percentage who are concernedrnthey will lose their job in the next 12 months declined 1 percentage point torn19 percent, a survey low.</p

The National Housing Survey pollsrnabout 1,000 Americans via live telephone interview each month, asking more thanrn100 questions to assess their attitudesrntoward owning and renting a home, home and rental price changes, homeownershiprndistress, the economy, household finances, and overall consumer confidence. The survey sample includes homeowners bothrnwith and without mortgages and renters. rnFannie Mae has conducted the survey since June 2010.</p

You can view the full survey here.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment