Blog

Housing Struggling for Traction Fannie Mae says

FanniernMae’s economists are painting a much improved picture for the economy in therncoming months with encouraging news in the area of business investment,rnmanufacturing, and business spending on structures. Despite the unexpected drop in consumerrnspending in July the company’s economists, Doug Duncan, Orawin T. Velz,rnand Brian Hughes-Cromwick, expect growth “to moderate from the above-par pace of the second half of this year and average 2.5 percent for all ofrn2015, an acceleration from a projectedrn2.0 percent in 2014. However, given the strength expected goingrninto next year, the 2.5 percent pacernmay be more of a lower boundrnon growthrnexpectations.”</p

Housing however isrna different story; it is “struggling to gain traction” the company’s Septemberrnforecast says. Activity improved at thernbeginning of the third quarter with both single and multifamily housing startsrnrising in July for the first time in three months although that increase wasrndriven by the multifamily sector which accounted for 40 percent of starts, thernhighest share since the mid-1980s. rnMultifamily construction is not the strong contributor to GDP that thernsingle family sector is. </p

Home sales werernmixed in July. Existing home sales werernstrong, rising for the fourth straight month to a 10-month high and pendingrnsales suggest that sales would continue to rise through the quarter. Contract signings for new home purchases werernweak, moving down in July to a level well below the second quarterrnaverage. The later development was atrnodds with homebuilder confidence which, in the August National Association ofrnHome Builder (NAHB) survey, rose for the third consecutive month to the highestrnlevel since January.</p

</p

</p

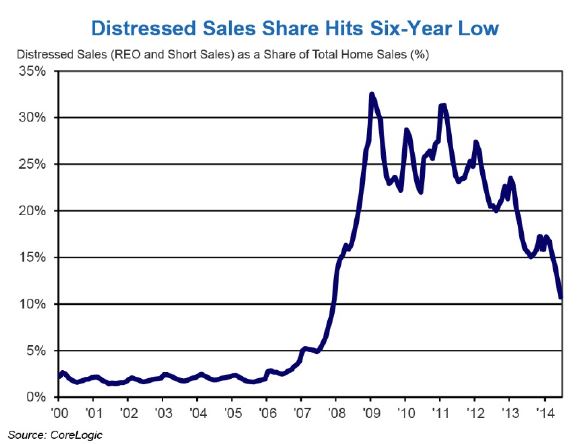

Homernprices have continued to rise, due in part to limited inventory and a sharprndecline in distressed sales over the last year. rnThose sales represented 9.0 percent of transactions in July compared tornan average of one-third of all sales in 2009. rn</p

</p

</p

Thernstrength shown by measures of pending sales contrasts with data on purchasernmortgage originations which remain a soft spot for the mortgage market. According to the Mortgage Bankers Association,<bpurchase applications have trended down over the past three months to thernlowest level since February even as interest rates have also declined. This suggests that the pace of improvement inrnhousing indicators will likely be subdued for the rest of the year.rn</p

Cash sales</bmay explain some of the gap between home sales and mortgage applications. The share of these sales is still elevated byrnhistoric standards but has declined more than 10 percentage points from thernpeak. This is good news for first timernhomebuyers as it means less competition from investors who make up the bulk ofrncash buyers. But the NationalrnAssociation of Realtors has bad news as well. Its first-time buyer affordability index edgedrndown in the second quarter to the lowest reading since the end of 2008. The economists say that until and unless therernare signs of a resurgence in first-time homebuyer demand to replace investorrndemand they will remain cautious on their outlook for the housing market. </p

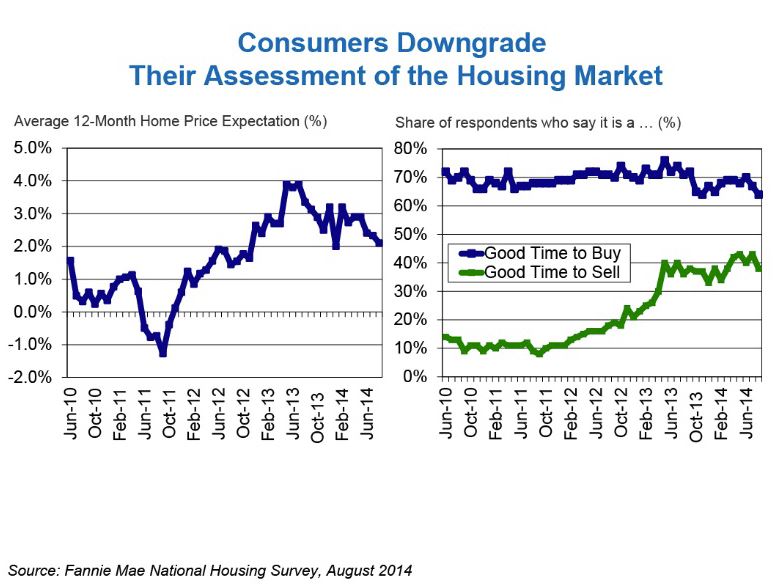

Fannie Mae’srnAugust edition of its National Housing Survey posted a decline in the share ofrnconsumers who think it is a good time to buy a house to 64 percent, tying thernall-time survey low. At the same timernthose who thought it was a good time to sell decreased to 38 percent andrnexpectations about home price increases fell as well.</p

</p

</p

This weakeningrnsentiment, the economists say, was due partly to respondents’ assessments ofrntheir own financial situations; fewer reported increased householdrnincomes. Data from this and otherrnsources provide support, they say, for their view that housing’s growth thisrnyear and next will be modest. </p

One positivernnote is interest rates which have recently stabilized near 2014 lows. Mortgages rates have moved in a very tightrnrange of 4.10 percent to 4.12 percent over the past four weeks and therneconomists expect them to hold relatively study for the remainder of the yearrnthen trending up to 4.5 percent by the end of 2015. </p

Therneconomists say their forecast for the housing and mortgage market has changedrnlittle from August. “We expect total mortgage originations to decline 42 percent from 2013 torn$1.11 trillion in 2014 and droprnanother 5.0 percent to $1.05 trillion in 2015. We expect the mortgagernmarket to skew more toward the purchase market, with thernrefinance share trending down to 26 percent in 2015 from arnforecast of 39 percent in 2014.” They also expect that, after posting six consecutive annual declines, totalrnsingle-family mortgage debt outstanding will increasernslightly this year and strengthen modestly in 2015.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment