Blog

Is Fed Endorsing Ending to Too Big to Fail?

Annual reports from financialrninstitutions rarely make the best seller list, but the one published by thernFederal Reserve Bank of Dallas is beginning to rocket around the Internetrnbecause of an essay it contains. Thernessay, written by Harvey Rosenblum, Executive Vice President and Director ofrnResearch at the Bank is titled “Choosing the Road to Prosperity: Why We Must End Too Big to Fail – Now.” </p

The essay is stunning enough in and byrnitself, but in an accompanying cover letter the Dallas Fed’s President RichardrnFisher expressly endorses it, in effect putting at least a part of the FederalrnReserve System on record as advocating an end to Too Big to Fail (TBTF) institutions. </p

“In addition to remaining a lingering threat tornfinancial stability,” Fisher says, “these mega banks significantly hamper thernFederal Reserve’s ability to properly conduct monetary policy.” Likening the economy to a car he said thatrnthe Fed had filed the tank with plenty of cheap, high-octane gasoline, but itrntakes more than gas to propel a car. “Ifrnthere is sludge on the crankshaft – in the form of losses and bad loans on thernbalance sheets of the TBTF banks – then the bank-capital linkage that greases thernengine of monetary policy does not function properly to drive the realrneconomy. No amount of liquidity providedrnby the Federal Reserve can change this.”</p

PropagatingrnTBTF has also resulted in an erosion of faith in American capitalism, he said,rnand diverse groups “argue that government-assisted bailouts of recklessrnfinancial institutions are sociologically and politically offensive. From an economic perspective, these bailoutsrnare certainly harmful to efficient workings of the market.”</p

Rosenblum’srnessay tracks the downfall of the economy but less as a tick-tock than as arnsociological study. It is long andrndifficult to summarize so we will do so in two parts.</p

* rn* *</p

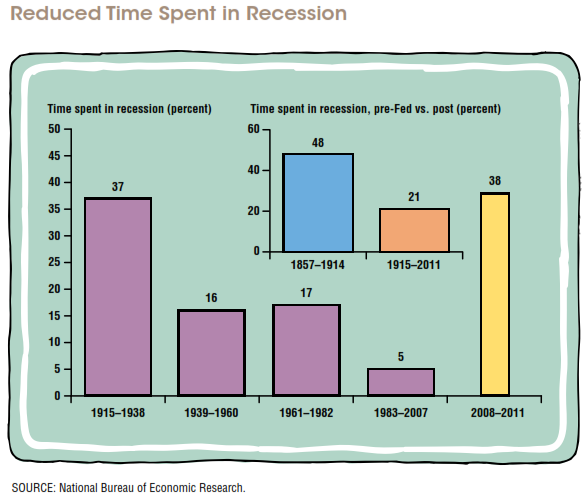

Good timesrnbreed complacency, not right away but over time, as memories of past setbacksrnfade. In 1983 the U.S. entered a 25 yearrnspan interrupted by only two brief shallow downturns accounting for just 5rnpercent of that period. There was strongrngrowth, low unemployment and stable prices.</p

Before thernFederal Reserve was founded in 1913 the economy spent 48 percent of the time inrnrecession, in the 99 years since recessions have affected the economy only 21rnpercent of the time. “When calamitiesrndon’t occur, it’s human nature to stop worrying. The world seems less risky.”</p

</p

</p

In thernrun-up to 2008 the public sector grew complacent and relaxed thernfinancial systems constraints, explicitly in law and implicitly in enforcement,rnand felt secure enough to pursue social engineering goals such as expandingrnhome ownership. The private sector alsornbecame complacent, downplaying the risks of borrowing and lending.</p

There was greed;rncapitalism cannot operate without self-interest and most of the time competitionrnand laws keep it in check. But whenrncompetition declines incentives often turn perverse and self-interest canrnbecome malevolent. That’s what happenedrnin the years before the financial crisis. rnNew technologies and business practices reduced “skin in the game,” andrngreed led “innovative legal minds” to push boundaries of integrity.</p

Successrnled to complicity. The banks werernmaking money, investors wanted part of it, and credit rating agencies gotrninvolved. The Fed kept interests ratesrntoo low too long, contributing to the speculative binge in housing and pushingrninvestors to seek higher rewards in riskier markets. “Hindsight leaves us wondering what financialrngurus and policymakers could have been thinking. But complicity presupposes a willful blindness. Why spoil the party when the economy isrngrowing and more people are employed? rnImagine the political storms and public ridicule that would sweep overrnanyone who tried.”</p

“Easyrnmoney leads to a giddy self-delusion.” rnThe certainty of rising housing prices convinced some homebuyers thatrnhigh-risk mortgages weren’t that risky; that draining equity to pay for newrncars or a vacation was prudent. Buyingrninto the exuberance gave people what they wanted, at least for a while.</p

Theserntraits, complacency, greed, complicity, and exuberance were intertwined withrnconcentration, the result of a natural desire to grow bigger, more important,rnand a dominant force in one’s industry. rnConcentration amplified the speed and breadth of the subsequent damagernto the banking sector and the economy as a whole.</p

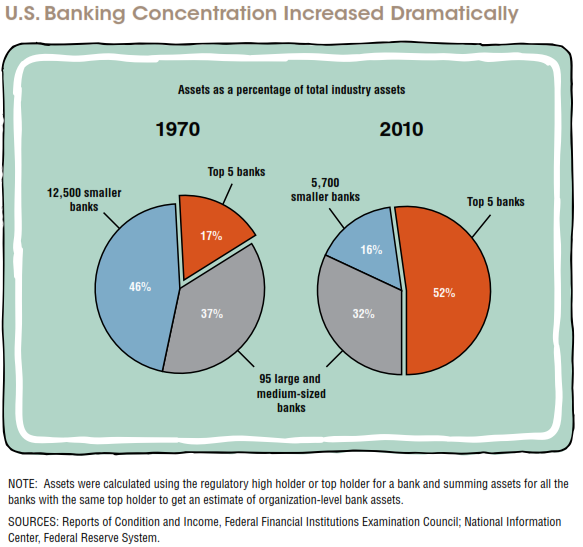

Since thernearly 1970s the share of the banking industry assets controlled by the fivernlargest institutions has more than tripled from 17 percent to 52 percent. These mammoth institutions were built onrnleverage which was often hidden by off-balance sheet financing. The equity share of assets dwindled as banksrnborrowed to the hilt to chase easy profits in new, complex and riskyrninstruments and balance sheets deteriorated. rnAccounting expedients allowed banks to claim they were healthy untilrnthey weren’t. Write-downs were laterrnrevised by several orders of magnitude to acknowledge mounting problems.</p

</p

</p

With sizerncame complexity as banks stretched their operations to include proprietaryrntrading and hedge fund investments and spread their reach into dozens ofrncountries. “Complexity magnifies thernopportunities for obfuscation and top management may not have known everythingrnthat was going on, especially in regards to risk and regulators didn’t have thernresources to oversee the banks’ vast operations.</p

Thesernlarge, complex institutions aggressively pursued profits in overheated markets,rnpushed the limits of regulatory ambiguity and lax enforcement. They carried greater risk and overestimatedrntheir ability to manage it and in some cases top management groped around inrnthe dark because their monitoring systems didn’t keep pace with their expandingrnenterprises.</p

A healthyrnfinancial system keeps the economy humming and we take its routine workings forrngranted – until the machinery blows a gasket. rnIt was the biggest investment and commercial banks that took the firstrnwrite-offs on their mortgage backed securities in 2007 and as the housingrnmarket continued to deteriorate policy-makers became alarmed, seeing the numberrnof big globally interconnected banks involved rnand fearing the loss of even one would bring the whole system down.</p

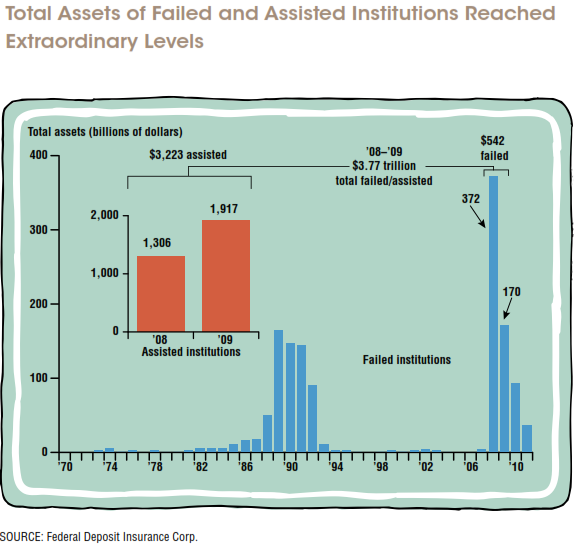

This fearrnwas justified as Lehman Brothers collapsed and credit markets froze forcing therngovernment to inject billions to keep other institutions afloat. “The situation in 2008 removed any doubt thatrnseveral of the largest U.S. banks were too big to fail.” Exhibit 3 (large image, opens in new window) tracks the benchmarks as the systemrnbegan to fall apart.</p

Back thenrnthere were no lists of TBTF institutions; the term did not exist explicitly inrnlaw or policy, and the term itself “disguised the fact that commercial banksrnholding roughly one-third of the assets in the banking system did essentially fail, surviving onlyrnwith extraordinary government assistance.” rnMost did not fail in the strictest sense however bankruptcies, buyouts,rnand bailouts all constitute failure. rnMore than 400 financial institutions did fail outright between 2008 andrn2011.</p

</p

</p

With thernfinancial system disabled, the entire system spun downward into the longestrnrecession in the post-World War II era.</p

In the second part of the essayrnRosenblum looks at the Fed’s reaction to the recession, why TBTF has stymiedrnrecovery, and what might be done about it.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment