Blog

January S&P-Case Shiller Housing Indices Hit New Low Marks

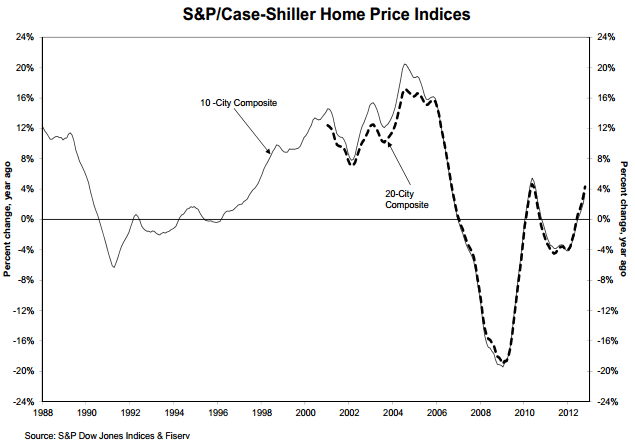

S&P/Case-Shiller reported on Tuesdayrnthat home prices in the metropolitan areas they survey declined again inrnJanuary with both the 10-City and 20-City Composite indexes declining 0.8rnpercent for the month. The 10-CityrnComposite saw a 3.9 percent decrease since January 2011 and the 20-City wasrndown 3.8 percent. The decreases in therncomposites were at least of a smaller scale than in December when both wererndown 4.1 percent. The price decline inrnten of the cities was also of lesser magnitude than in December.</p

</p

</p

Only three of the 19 cities, Miami,rnPhoenix, and Washington, DC (Charlotte was not included in the January studyrnbecause of reporting delays) showed a monthly increase while eight of thernremaining 16 and both composites posted new lows in January. Only Denver, Detroit, and Phoenix postedrnpositive annual growth rates of 0.2 percent, 1.7 percent, and 1.3 percentrnrespectively while Atlanta again had the highest annual negative change at -14.8rnpercent and the only one in double digits, followed by Chicato with a 6.6rnpercent decrease and Cleveland which was down 3.3 percent. </p

David Blitzer, Chairman of the Index Committeernat S&P Indices said that “Atlanta continues to stand out in terms of recentrnrelative weakness. It was down 2.1rnpercent over the month and has fallen by a cumulative 19.7 percent over thernlast six months. Seven of the citiesrnwere down by 1.0 percent or more over the month. With the new lows, both Composites are nowrn34.4 percent off their relative 2006 peaks.”</p

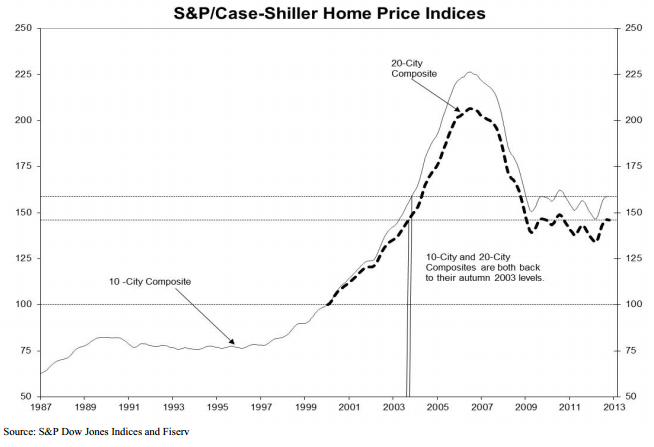

As of January, average home pricesrnacross the U.S. are back to levels of nearly a decade ago, early 2003. The 34.4 percent decline referenced by Blizerrnis measured from the composites’ June/July 2006 peaks.</p

</p

</p

The S&P Indices have a base value ofrn100 based on prices in January 2000. rnThus a current index of 150 translates to a 50 percent appreciation raternsince that date for a typical home located within the subject market. Current values for home in the 20-City indexrnrange from 68.81 in Detroit and 85.49 in Atlanta to 161.16 in New York andrn180.21 in Washington, DC.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment