Blog

Lenders Expect Easing in both Mortgage Demand, Credit Standards

In its latest MortgagernLender Sentiment Survey Fannie Mae detected an interesting switch in attitudesrnand opinions in two areas. Thernthird-quarter survey, the third since Fannie Mae originated the series lastrnMarch, found that large lenders expect to see their underwriting standards easernover the next three months. Perhaps notrncoincidentally, the share of lenders of lenders, regardless of the size of therninstitutions they represent, who expect the demand for purchase mortgages to gornup over the next three months dropped by 26 to 33 percentage points dependingrnon the mortgage type. </p

The largest decline inrnexpectations was for GSE-eligible loans where the percentage of respondents expectingrnborrower demand to increase fell from 54 percent in the second quarter to 21rnpercent. The other categories fared onlyrnmarginally better. Expectations ofrnincreasing demand for non-GSE eligible loans were reported by 53 percent ofrnparticipants in the second quarter but only 27 percent in the third. Only 16 percent looked for increased demandrnin government loans compared to 42 percent the previous quarter. </p

Two hundred fourteen executivernofficers representing 196 lenders participated in the 10 to 15 minute on-linernsurvey. Fifty-seven of the participating institutionsrnwere mortgage banks and 128 were depository institutions. Fifty of the entities were classified as largerrninstitutions with 2012 total industry loan origination volume in the top 15rnpercent or above $1.14 billion. Therernwere 55 mid-sized institutions that participated and those had an originationrnvolume which put them in the 16 percent to 35 percent range or $325 million torn$1.14 billion. The 91 remainingrnrespondents classified as smaller institutions fell below those benchmarks. </p

Overall, most lendersrnreported no major changesrnin their underwriting credit standards for the prior three months and expectedrnno major changesrnfor the next three months. However,rnthe credit tightening for GSE eligible loans noted in the first quarter seemsrnto have gradually trended down in quarters two and three. Larger lenders continuernto be more likelyrnthan smaller lenders to say their creditrnstandards eased over the prior three months and that they expect standards to ease during the next three months, in particular for non-GSE eligible and governmentrnloans. Fannie Mae said perhaps this indicates an effort to boost purchase mortgagernactivity before the year comes to a close.</p

“Lenders’rndiminished purchase mortgage demand outlook is broadly in line with the softenedrnconsumer housing sentiment seen in the August National Housing Survey resultsrnreleased last week,” said Doug Duncan, senior vice president and chiefrneconomist at Fannie Mae. “Historically, as lenders face a more competitivernmarket for loan volume, it’s not uncommon to see some loosening in the lendingrnstandards; however, this time, the easing will likely be around thernedges.” These latest third quarter results are largely consistent with FanniernMae’s study released last month, titled “Impact of QM,” thatrnshows larger lenders are more likely than smaller lenders to pursue non-QMrnloans. “Larger lenders are expecting to tap into the non-GSE-eligible andrngovernment loan market to maintain or grow their market share and offset theirrnanticipated slowing mortgage demand as the peak spring/summer selling seasonsrnare coming to an end,” said Duncan.</p

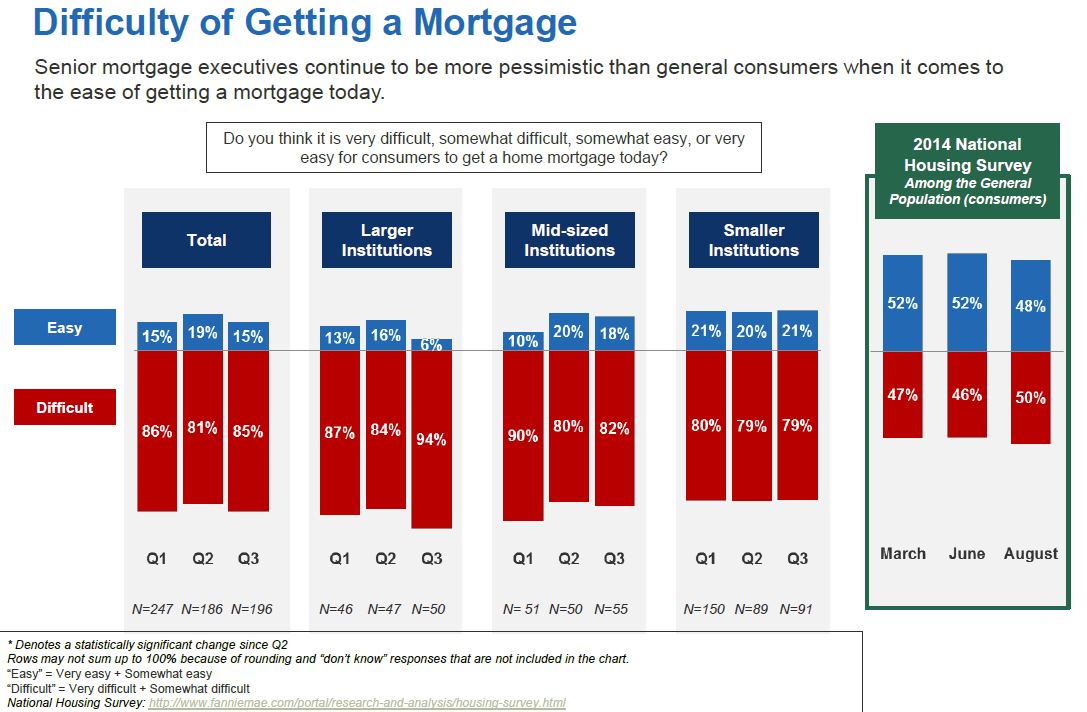

Interestingly seniorrnmortgage executives continue to be much more pessimistic than the generalrnpublic when it comes to the ease of getting a mortgage. Fannie Mae compared the lenders’ responses tornhow easy it would be to get a mortgage to answers to the same question gatheredrnfrom the most recent National Housing Survey conducted with consumer homeownersrnand renters. Only 15 percent of thernsenior executives (down from 19 percent in the second quarter) thought it wasrneasy for consumers to get a mortgage today. rnAmong those consumers themselves 48 percent thought that was true.</p

</p

</p

Those executivesrnhowever have an optimistic streak. Whenrnconfronted with a question about the direction of the economy, 51 percent ofrnthe lenders said it was on the right track compared to 35 percent of NationalrnHousing Survey respondents.</p

The lenders were slightlyrnmore bullish about home prices as well. rnForty-eight percent expect those prices to rise over the next 12 months,rnonly 2 percent expect a decline. Amongrnconsumers price increases were expected by 42 percent and declines by 9rnpercent. The average increase amongrnthose expecting price hikes was 1.9 percent for the executives (down from 3.2rnpercent in the first quarter) and a slightly higher 2.1 percent for consumers.</p

The Mortgage Lender Sentiment Surveyrnwhich was conducted between August 6 and 26 also found that the majority ofrnlenders surveyed reported, as they had in the two previous surveys, that theyrnexpect to maintain both their Mortgage Servicing Rights and their post mortgagernorigination execution strategies for the next three months. However their profit margin outlook appearsrnto have worsened. The net percentage of larger and mid-sized lenders reportingrndecreased profit margin expectations increased from Q2 to Q3.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment