Blog

Lending Opportunity Seen in Home Rehab Biz

Two press releases that came out onrnMonday may point to a new direction for the residential construction market andrnperhaps for housing policy.</p

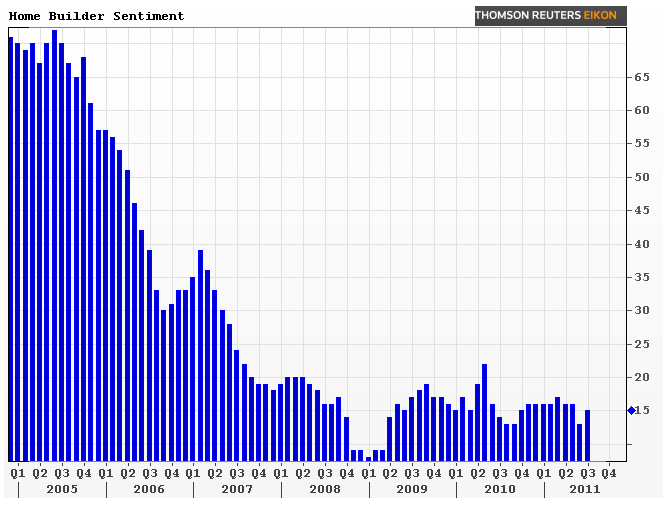

Home builders continue to have little optimismrnabout the new home market according to the National Association of HomernBuilders/Wells Fargo Housing Market Index (HMI) for July. The index, floating near its bottom for since October 2008, did rise two points to 15 but this only partially recouped the threernpoint drop seen in June. </p

The NAHB HPI is a composite index of home builder sentiment about the new homernmarket. Builder members of the NationalrnAssociation of Home Builders (NAHB) are asked for their perceptions of both currentrnsingle-family home sales and sales expectations for the next six months asrn”good,” “fair” or “poor” and asks them to rate traffic of prospectivernbuyers as “high to very high,” “average” or “low tornvery low.” Scores are used to calculate three component indices and thernHPI, a seasonally adjusted index. Any numberrnover 50 for the HPI and each of the components indicates that more buildersrnview sales conditions as good than poor.</p

The component indices also rose slightly from their terrible June levels. The component gauging current salesrnconditions rose two points to 15 while the one measuring expectations for trafficrnover the next six months jumped seven points to 22. The component assessing prospective buyerrntraffic was unchanged at 12. On arnregional basis, the Northeast declined two points to 15 but the Midwest was uprnone point to 12 and the South and West each gained three points to 17 and 14rnrespectively.</p

</p

</p

According to Bob Nielsen, chairman of NAHB, “The improvement in builderrnconfidence in July is a positive sign that the outlook perhaps isn’t quite asrnbleak as was feared in June. Whilernbuilders continue to confront serious challenges with regard to competitionrnfrom foreclosed properties that are priced below replacement cost, inaccuraternappraisals of new homes, and a very restrictive lending environment for newrnhome construction, select markets are showing gradual improvement as consumersrnbegin to take advantage of very favorable buying conditions.”</p

At the same time, the BuildFaxrnRemodeling Index (BFRI) which tracks building permits and construction starts indicatedrnthat May had the highest level of remodeling activity since the Index was firstrnintroduced in 2004.</p

The BFRI is derived from building and permitting information from 4,000rncities and counties throughout the country assembled by BuildFax, a division ofrnBUILDERadius. The BuildFax databaserncurrently covers over 60 percent of the US commercial and residential buildingrnstock.</p

The BFRI for May reveals that residential remodeling activity in May registeredrngrowth in every region of the country and signifies the 19th</supconsecutive month of industry growth. According to BuildFax, the data demonstraternthat many Americans are remodeling their current homes rather than purchasingrnnew ones.</p

The May 2011 index was 124.3, the highest number ever. This was a 22 percent year-over-year increase. Each region increased month-over-month withrnthe Northeast up 9.8 points (12%), the South up 7.3 points (7%), the Midwest uprn16.3 points (18%), and the West up 8.7 points (7%). Even though the Midwest wasrnup month-over-month, it continues to lag the other regions (as it has for thernpast three months) in year-over-year performance, down 10.6 points (11%)rnyear-over-year. All other regions were up year-over-year, with the Northeast uprn7.2 points (9%), the South up 9.5 points (10%), and the West up 20.7 points (21%).</p

Joe Emison, Vice President of Research and Development at BuildFax said ofrnthe index, “Even with the continued struggles in the economy, thernremodeling industry has been a bright spot, as consumers look to make upgradesrnto their current homes, rather than purchasing a new residence. Based on therntrends from the first months of this year, we expect to continue seeing strongrngains from coast to coast.”</p

So how does this have any bearing on housingrnpolicy? Housing starts continue to lag -rnthe Census Bureau reports they were up 3.5 percent in June from May figures butrnwere down almost an identical amount from June 2010. Builders are simply not going to build untilrnthe current inventories of new and existing homes return to more normal levelsrnand the shadow inventory does not loom so ominously over the market. </p

If the emphasis were shifted from newrnconstruction to rehabilitating and improving existing housing stock it couldrnprovide a real jump start to the ailing construction industry. Remodeling dilapidated houses lacks the sexrnappeal of building yet another subdivision or condo complex as well as therneconomies of scale; but it also lacks the infrastructure costs, conservationrnheadaches, and permitting delays. Returningrnsome of the million plus “off market” vacant property to service as well asrnimproving the stock of REO to useable/salable condition might, while creatingrnconstruction jobs, also speed up the timeframe for reducing the inventory and returningrnthe market to normal activity.</p

Adam Quinones, MND’s Managing Editor, notesrnthat the Department of Housing and Urban Development has already announced initiativesrnto rebuild the distressed housing stock. rn”With so many foreclosed properties sitting empty on the market werncan expect remodeling and rehabbing to be a leading indicator of a bottom inrnthe housing market. We already know therernis a dearth of affordable rental housing available to low income renters. Fromrnthat perspective, FHA should open its 203(k) program to investors if they wantrnto accomplish their affordable housing goals.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment