Blog

Less Financially Secure Borrowers More Likely to Choose Adjustable Mortgages

Three staff member of the FederalrnReserve Bank of San Francisco have published, on the Bank’s website, results ofrna study about what drives the mortgage choices of borrowers. The three, Fred Furlong, David Lang, andrnYelena Takhtamanova looked at the question of whether lower-rated borrowersrnpaid less attention to loan pricing and interest-rate-related factors because housernprices were rising rapidly. </p

They developed a model to accountrnfor the factors that influence mortgage choice. rnEarlier research has found that mortgage pricing and otherrninterest-rate-related fundamentals are key but they also looked at housingrnmarket conditions and borrower characteristics, such as degree of financialrnconstraint, attitudes towards risk, and mobility. Research has shown that financiallyrnconstrained borrowers, or those with lower credit ratings tend to favorrnadjustable rate mortgages (ARMs) as do homebuyers who expect to only stay in arnhouse a short time because ARMs have lower introductory interest rates. </p

Fixed-rate mortgages (FRM) initiallyrntend to have higher interest rates than ARMs because they are tied to long-termrninterest rates which include a term premium to compensate investors for tyingrnup their money longer. Both FRM and ARM rates include lender margins, that is,rnmark-ups reflecting general credit supply conditions, regional economic andrnhousing market conditions, and individual borrower characteristics. Relativernshifts in FRM and ARM margins can affect financing choices.</p

How much risk borrowers are willingrnto accept also can influence mortgage choice. Borrower risk tolerance canrnaffect sensitivity to loan pricing, income volatility, and affordability inrnchoosing mortgages. Borrowers with low credit ratings may be less sensitive tornrisk, for instance, because of lower cost of default. Research shows that morernrisk-averse borrowers tend to favor FRMs or option ARMs because they prefer tornavoid the risk of future sharp rate increases possible with volatilernadjustable-rate financing.</p

Thus, a mortgage choice model shouldrninclude measures of the term premium, expected short-term interest rates overrntime, FRM and ARM margins, and interest rate volatility. In general, borrowerrnpreference for basic ARMs should increase as the term premium, expectedrnshort-term interest rates, and FRM margins rise, and ARM margins and interestrnrate volatility fall. In other words, the more affordable ARMs become by comparison, the more they’re favored. No surprises here…</p

Research also shows that the fasterrnhouse prices are rising, the greater the probability that homebuyers willrnchoose ARMs. In addition, rising house prices can affect the importance ofrninterest-rate-related fundamentals when borrowers choose financing.</p

The researchers say that one view isrnthat the housing boom was a bubble in which financing decisions for somernborrowers were divorced from traditional fundamentals while another is thatrnborrowers paid less attention to fundamentals during the housing boom, but thatrnsuch a shift is consistent with rational decision-making models, givenrnexpectations of further house price appreciation. According to this view, withrnlittle or no change in house prices, homeowner decisions about moving orrnterminating a mortgage would generally reflect life-cycle events, such asrnillness, retirement, and job changes.</p

Rapid house price gains might changernthat. During the boom homeownersrnexpected to gain home equity as prices rose, allowing them to refinance even ifrnthey didn’t plan to move or expected to flip houses soon after buying them. Such short-term mortgages might make ARMs morernattractive and reduce borrower sensitivity to interest-rate-relatedrnfundamentals. In other words, they didn’t care as much about the riskier nature of the loans because they planned on being out of them relatively quickly.</p

Finally, studies suggest thatrnborrower financial literacy may affect mortgage choice. Borrowers who choose ARMs appear more likelyrnto underestimate or not understand how changes in interest rates would affectrntheir loans. Hence, systematic differences in levels of financial literacyrnamong borrowers at different risk levels could affect sensitivity tornfundamentals. </p

The study’s model of mortgage choicernallows for an examination of how these factors affected the decisions ofrnborrowers at different credit risk levels. The authors studied a sample ofrnabout 9 million first-lien mortgages originated between January 1, 2000, andrnDecember 31, 2007 allowing for three mortgage choices: FRMs, basic ARMs, andrnoption ARMs. Key model determinants arernFRM and ARM margins, the 10-year Treasury term premium, expectations forrnshort-term interest rates over time, and interest rate volatility. Controlsrnincluded loan-to-value ratios, borrower credit risk, the two-year averagernchange in house prices, and a measure of house price volatility. Finally, creditrnrisk groups were defined by FICO scores: low, 660 or below, high, 760 or above,rnand medium 661 to 759.</p

The model allows the impact ofrninterest-rate-related fundamentals to change as house prices rise. Thernestimates show that rising house prices have a sizable influence on the effectrnthese fundamentals have on mortgage choice. The size of this effect differsrnaccording to borrower credit ratings.</p

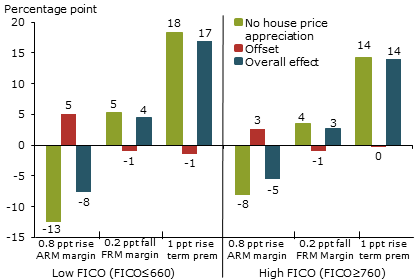

Fig. 1</p

</p

</p

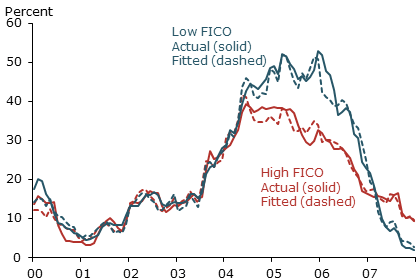

Figure 1 shows the impact of marginsrnand term premiums on the probability of borrowers choosing an ARM. The green bars indicate those factor’srnmarginal effects if house prices are static. rnA higher margin makes ARMs less attractive so the marginal effects arernnegative. The low FICO group shows arngreater effect indicating they are more sensitive to ARM mortgage pricing thanrnthe higher FICO cohort. “Specifically,rnif house prices were flat, a 0.8 percentage point increase in the ARM marginrnwould reduce the probability of low FICO borrowers choosing an ARM 13rnpercentage points and high FICO borrowers 8 percentage points. It is useful torncompare this with the ARM share of mortgage originations, shown in Figure 2,rnwhich peaked at 50%.”</p

The two year average house pricernappreciation was 16 percent. The redrnbars show the offsetting effects of this with a reduction of one-third in thernARM margin to 8 percentage points for low FICO borrowers and 5 points for highrnFICO borrowers. Similarly, house pricernappreciation reduces the impact of increases in the FRM margin and term premiumrnon mortgage choice. Thus, even accounting for the influence of house pricerngains, lower FICO borrowers generally were at least as sensitive, if not morernsensitive, to fundamentals as the high FICO borrowers.</p

Fig. 2</p

</p

</p

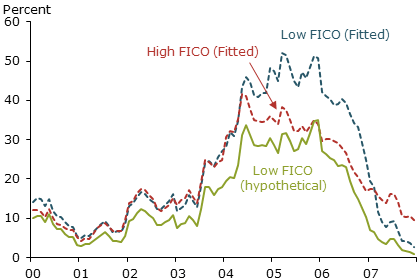

But, if low and high FICO borrowersrngave similar consideration to interest- rate-related fundamentals, why were lowrnFICO borrowers more likely to select ARMs during the housing boom? Credit risk measures, including FICO scoresrnand lender designation of borrowers as subprime, explain most of the differencernin ARM shares. The authors considered whether borrowers would have made thernsame mortgage choice if, all else equal, they had different credit ratings. InrnFigure 3, for each month in the sample, they replaced the actual FICO score andrnsubprime designation of each borrower in the low FICO group with the averagernscore and subprime share of the high FICO group. The results of thisrnhypothetical exercise, shown by the green line, suggest that the low FICOrngroup’s ARM share would have been closer to that of the high FICO group hadrntheir credit risk been similar.</p

Fig. 3</p

</p

</p

One could interpret the results as creditrnrisk measures being associated with borrower level of financial sophisticationrnor the findings could reflect economic decisions related to risk aversion,rncredit constraints, or differences in how quickly borrowers expect tornrefinance. The authors conclude risingrnprices during the housing boom muted the influence of interest raternfundamentals on borrower mortgage choice, especially among borrowers with lowerrncredit ratings. But when house pricesrnrose rapidly, those borrowers responded at least as strongly as higher-ratedrnborrowers to changes in fundamentals. “This suggests,” they say, “that therngreater propensity of low FICO borrowers to choose ARMs is more consistent withrnmortgage choice reflecting economic considerations rather than lack ofrnfinancial sophistication among low FICO borrowers.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment