Blog

Loan Age at Historic High -Mortgage Monitor

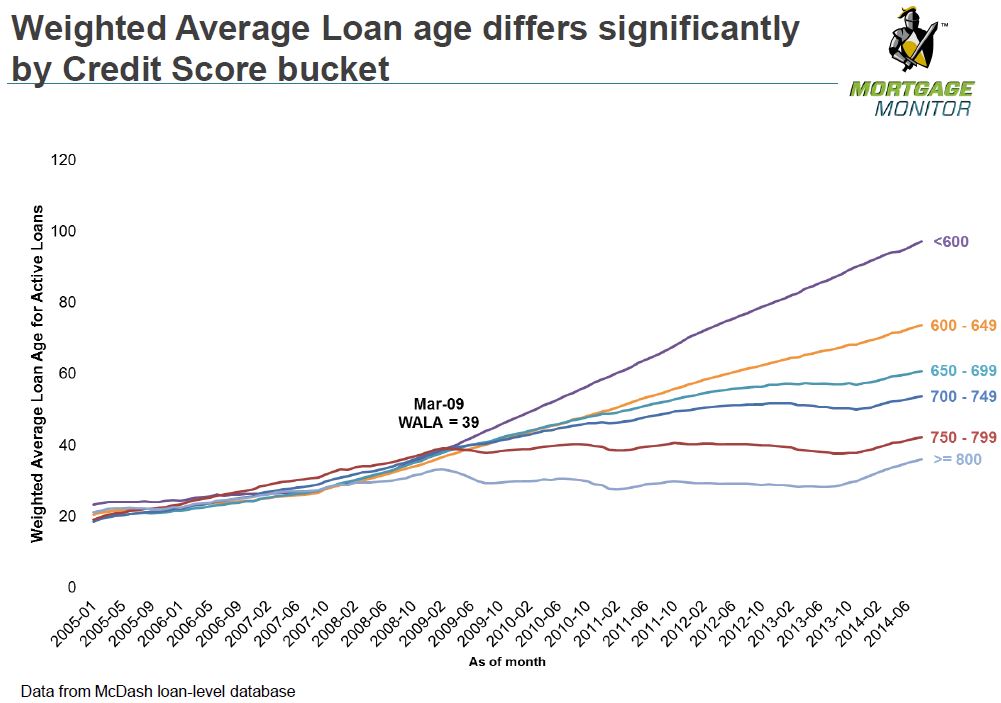

The average age of a mortgage loan outstanding inrn2014 is the highest in history Black Knight Financial Services said today. While the age of mortgages varies acrossrncredit scores, the age of existing loans has been rising steadily and is now atrn54 months. Black Knight’s Mortgage Monitor report for August showsrnthat the increase in age has been driven by lower credit score groups, particularlyrnthose with scores below 650. The chart below shows only a slight increase</bin loan age among groups with a score above 800 while the rate of increase growsrnsteadily as credit scores decline.</p

</p

</p

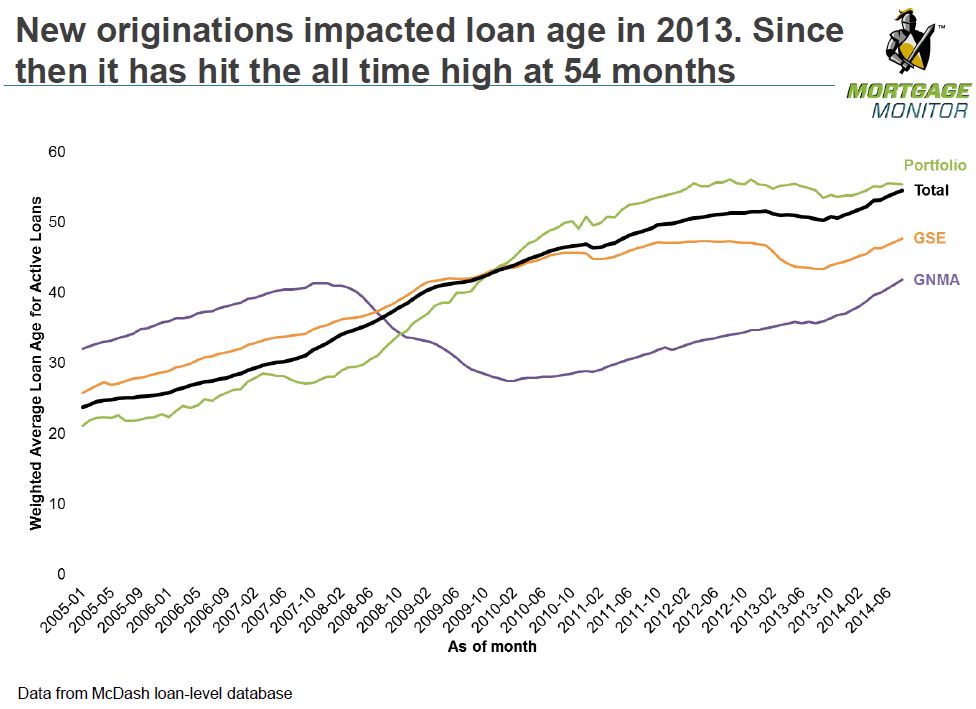

KostyarnGradushy, Black Knight’s manager of Research and Analytics said, “In terms of the entire active mortgage population, averagernloan age has been rising steadily for at least the last nine years. The high volume of originations in 2013rnresulted in a temporary slowdown. However, the average loan age since then hasrnhit its highest level ever at 54 months. </p

</p

</p

Black Knight provides very littlernanalysis to accompany its tables in the Monitorrnbut one would suppose that the dramatically increased age of loans amongrnthose with the lowest credit scores are the result of a higher incident of foreclosuresrnand short sales which eliminated many of the loans written in the mid-2000s,rnhitting hardest at those with less sturdy credit. Many homeowners with lower credit scores werernprobably also unable to take advantage of the refinancing boom which had therneffect of lowering the age of mortgages among the higher credit score groups. </p

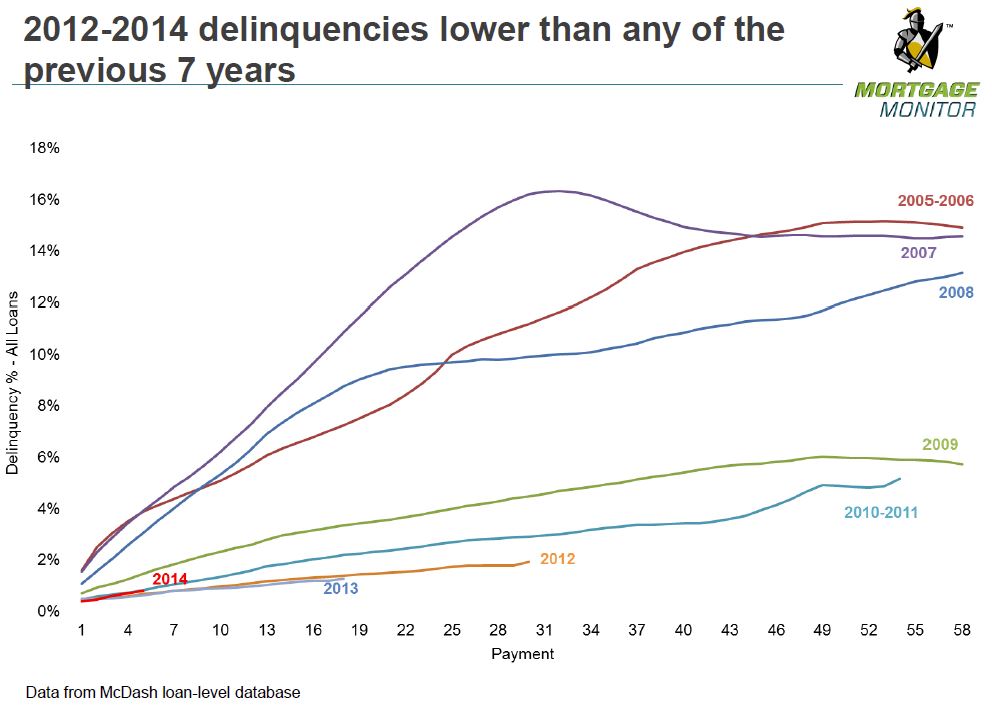

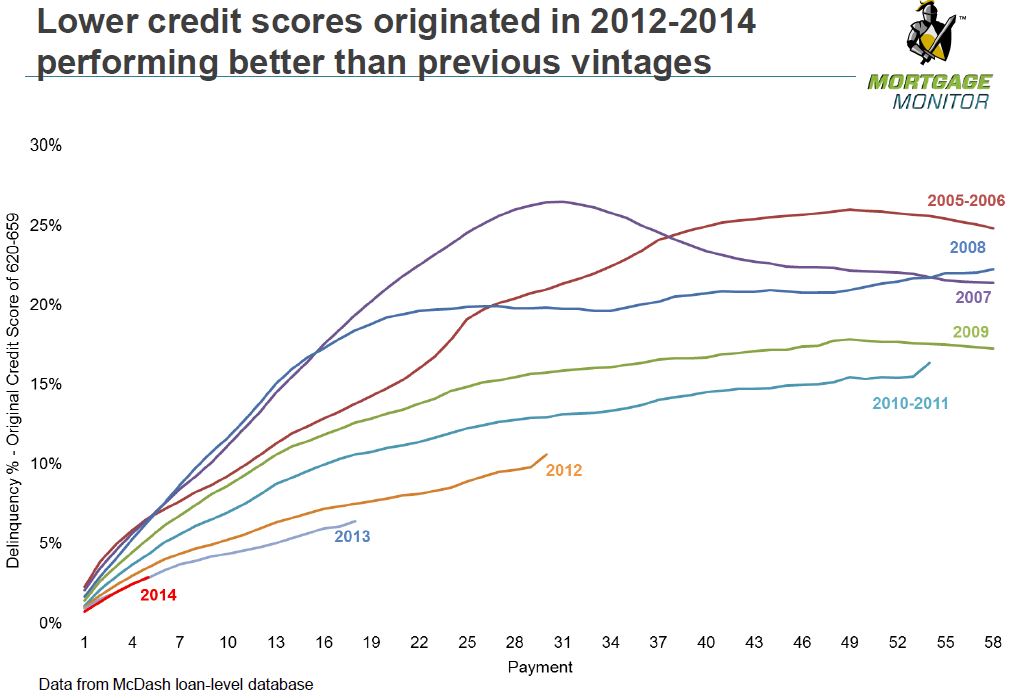

The Monitor also notes that loans originated in the last two years are<bperforming well. Gradushy said, “We alsornlooked again at mortgage performance and found delinquencies in 2012-2014rnvintage loans lower than any of the prior seven years. In fact, even amongrnborrowers with lower credit scores, these vintages are outperforming allrnprevious vintages. This holds true for FHA mortgages as well, where we foundrnthat early-stage delinquencies were lower than in all pre-2012 vintages.”</p

</p

</p

</p

</p

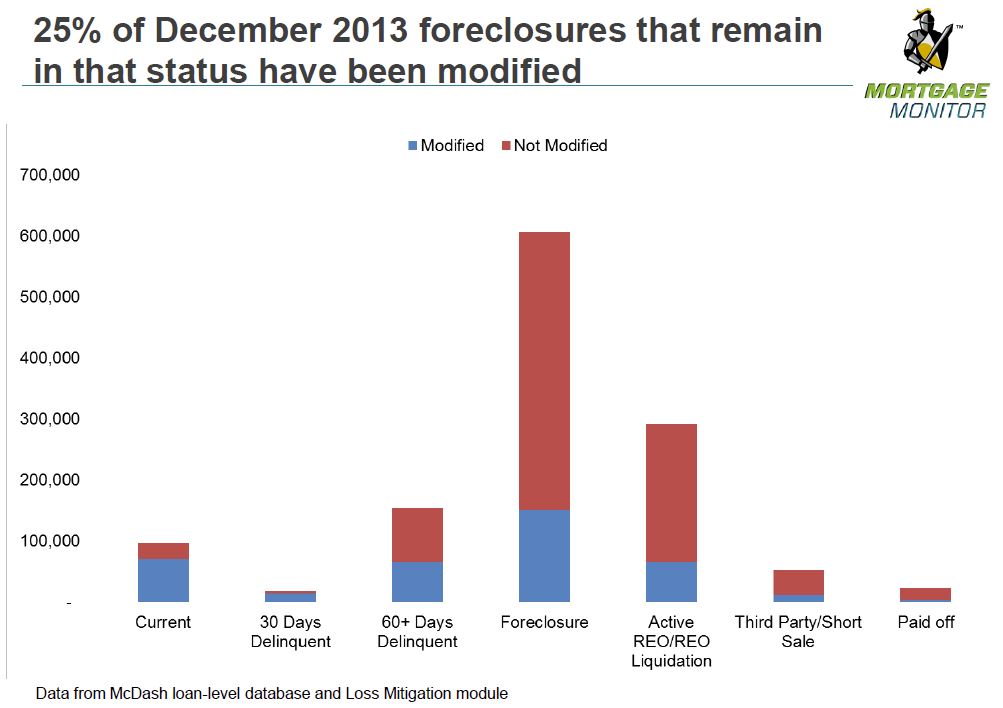

The company said 2014 has changed thingsrnvery little for homeowners who were in foreclosure at the end of 2013. Nearly half of those loans (49 percent) werernstill in foreclosure at the end of August 2014. rnA bit more than a quarter of the loans had been foreclosed, sold in arnshort sale, or paid off. Only around 10rnpercent were current on their payments. Even more disheartening, 25 percent of allrnloans in foreclosure at the end of 2013 were modified at some point over the followingrneight months and then fell back into foreclosure. </p

</p

</p

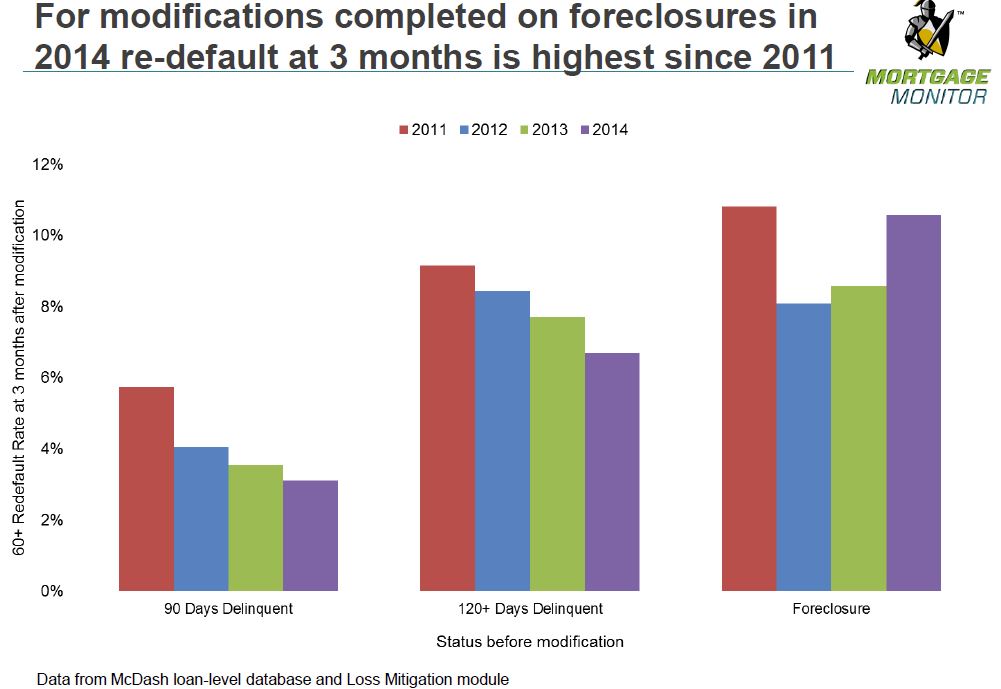

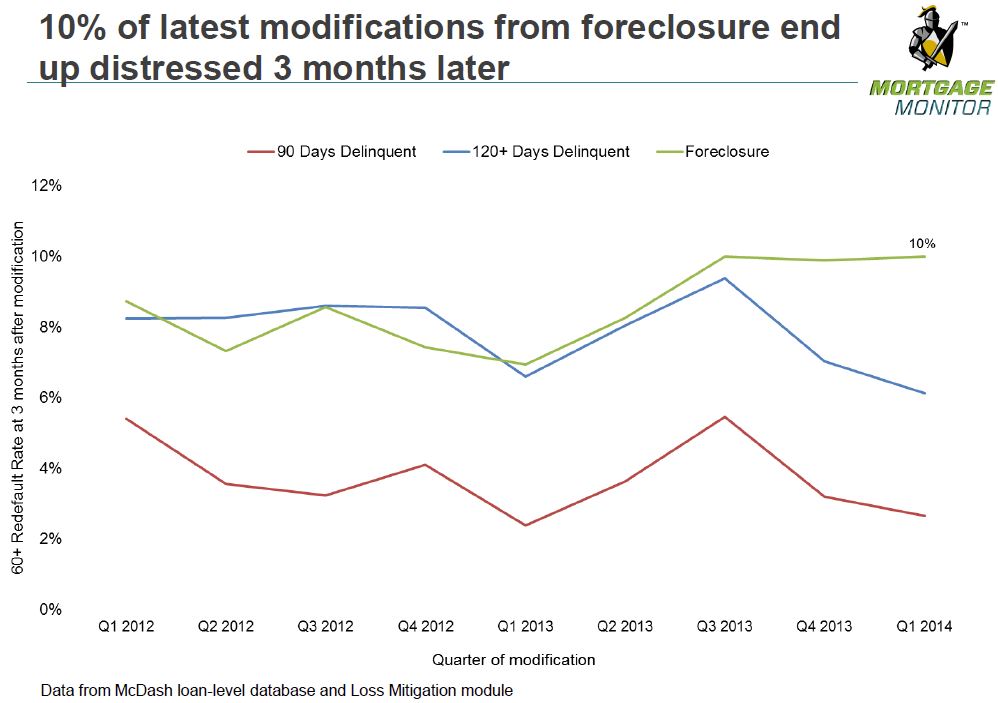

Looking more widely at modificationsrncompleted on loans in foreclosure over the past four years, Black Knight foundrnthe three-month re-default rate on 2014 modifications to be the highest sincern2011. This held true only for modifications on loans in foreclosure, though.rnRe-default rates on modifications of loans in delinquent statuses of both 90rndays and 120 days or more past due actually saw re-default rates decline againrnin 2014, as they have for the last four years.</p

</p

</p

</p

</p

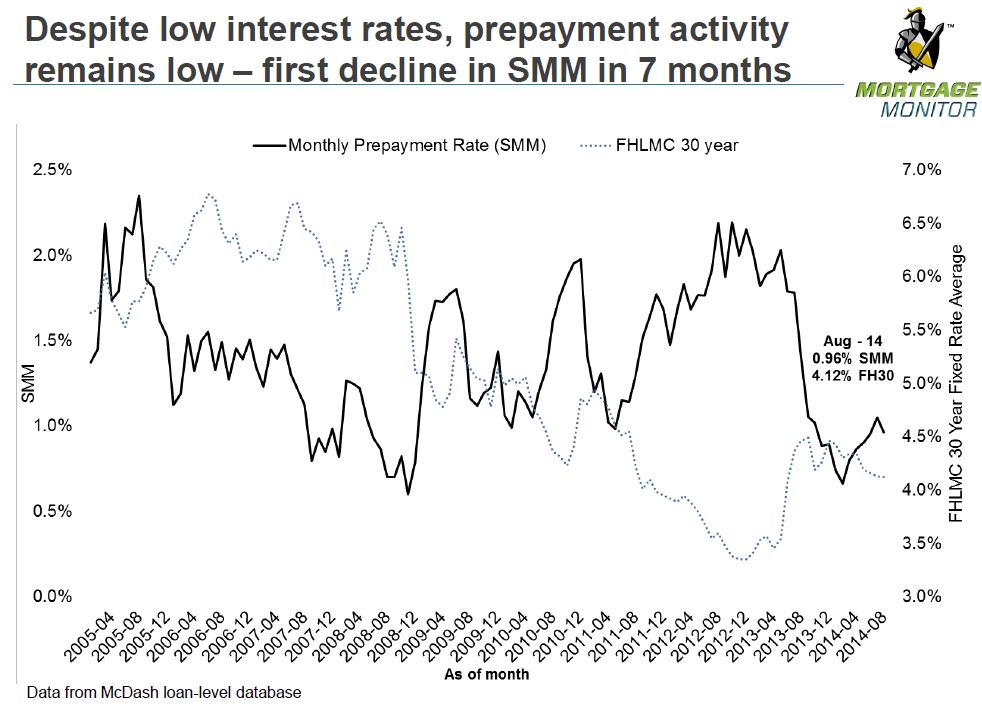

Black Knight also reported that,rndespite continuing low interest rates, the pre-payment rate in August showedrnits first decline in 7 months. rnPrepayments are closely tied to the rate of refinancing. The prepayment rate did not appreciably declinernamong the lowest credit score cohorts, but that group had also not demonstratedrnthe level of prepayment activity rate that was evidenced among high scorerngroups.</p

</p

</p

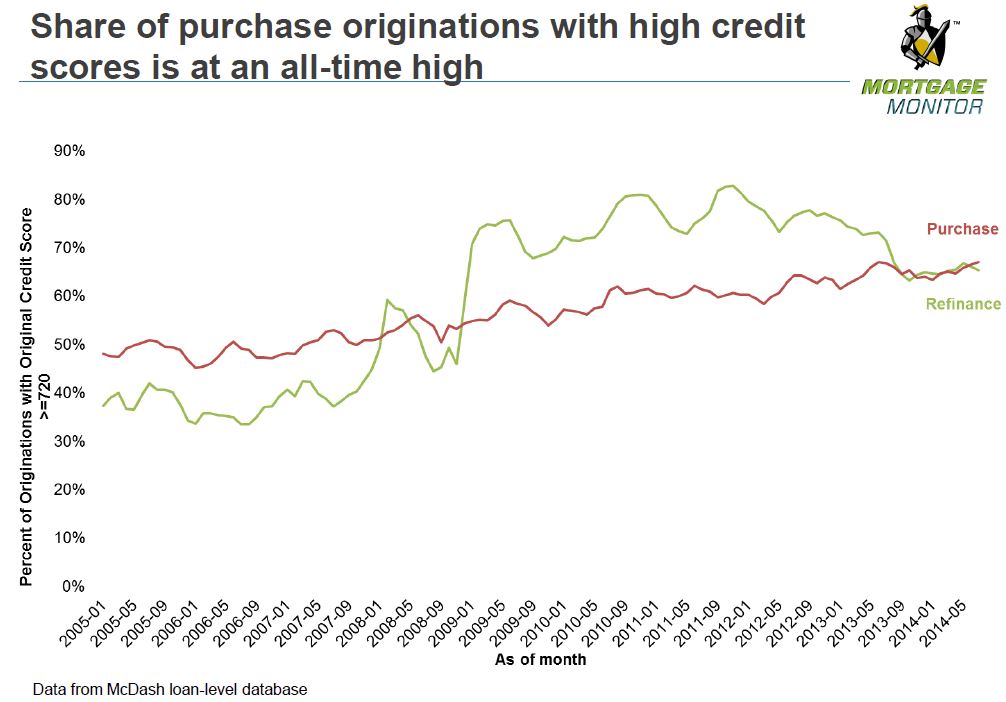

The percentage of purchase mortgagernoriginations to those with credit scores above 720 was at the highest rate onrnrecord in August and nearly identical with that of refinancingrnoriginations. The share of high creditrnrefinances has declined steadily since early 2013.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment