Blog

LPS: Foreclosure Backlog May be Starting to Move

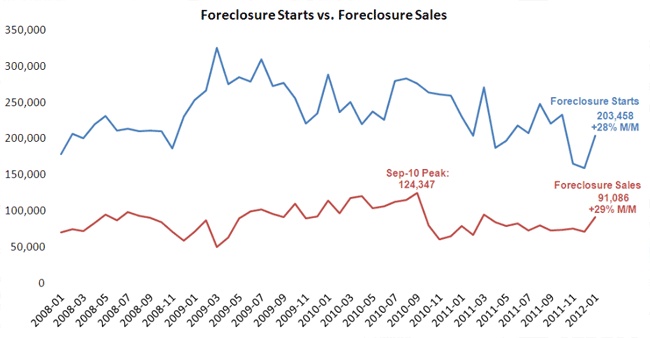

Both foreclosure starts and foreclosurernsales jumped significantly in January according to data released today byrnLender Processing Services (LPS), Inc. rnStarts were up 28 percent and sales 29 percent over the Decemberrnfigures. LPS commented that while onernmonth’s worth of data is not necessarily indicative of a trend, it mightrnsuggest that the backlog of foreclosures is beginning to move.</p

</p

</p

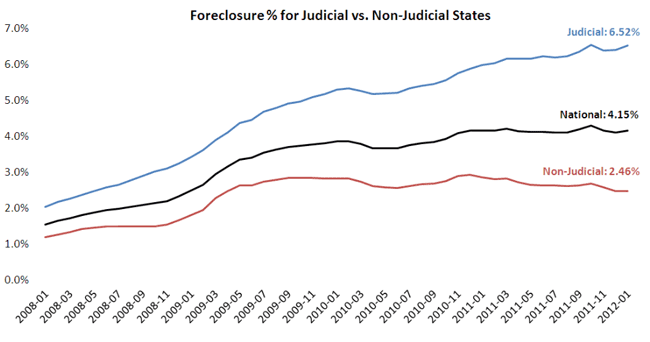

According to the LPS Mortgage Monitor, therndelinquency rate in January fell 2.2 percent from December and 10.5 percentrnform one year earlier to a rate of 7.97 percent. Foreclosure starts numbered 203,453 duringrnthe month compared to 159,092 in December and foreclosures were at a rate ofrn4.15 percent in January compared to 4.11 percent in December and 4.16 percentrnin January 2011. Loans that werernseriously delinquency (90+ days) or in foreclosure were up 0.2 percent month-over-monthrnand down 6.8 percent year-over-year to 7.69 percent.</p

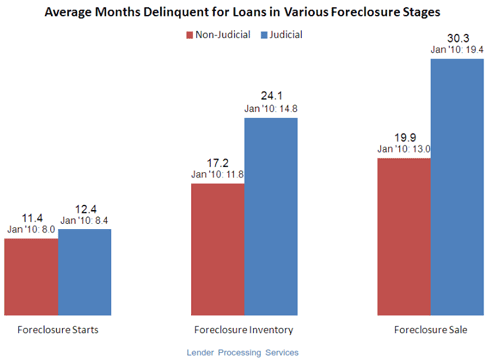

The foreclosure backlog continues to be skewedrntoward judicial foreclosure states because of the length of the process. While the national foreclosure rate is 4.16rnpercent, the rate in non-judicial states is 2.46 percent while the rate in judicial statesrnis triple that number, 6.52 percent. By the time of sale the average loan in arnjudicial state has been delinquent for 30.3 months compared to 19.9 months in non-judicialrnstates.</p

New delinquencies are low at 1.4 percentrnnationally, but there are pockets of problems must notably in Nevada, Florida,rnMississippi, Arizona, and Georgia.</p

</p

</p

</p

</p

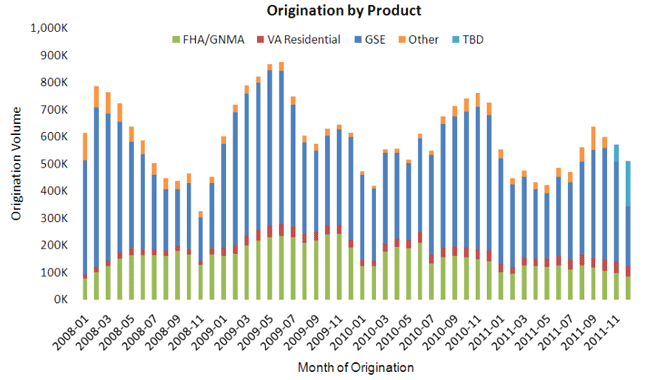

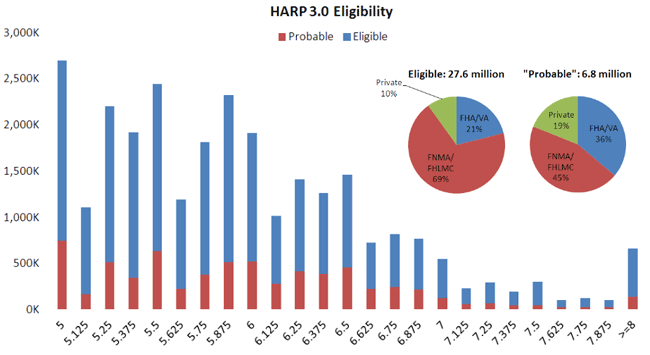

LPS reports that originations have continuedrnto fall from their peak in September and that the new refinancing initiatives proposedrnby the Obama Administration are presenting new opportunities for originators.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment