Blog

LPS: Mortgage Originations Among Highest Quality Ever in 2010-2011

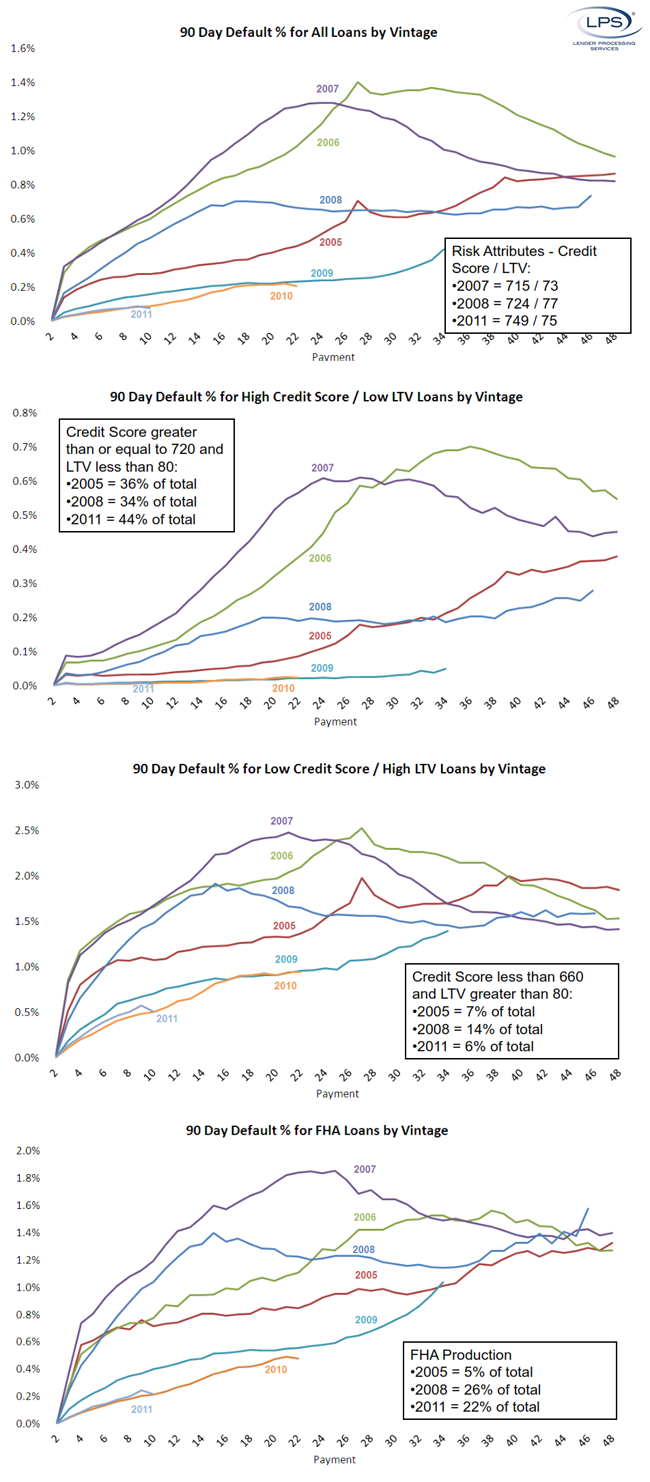

The Lender Processing Services (LPS) Mortgage Monitor Report for December showrnimprovement in a number of the metrics it tracks. Many measures of delinquencyrnrates are down, inventories are clearing in some states, and recent loanrnoriginations are “among the best quality on record.” </p

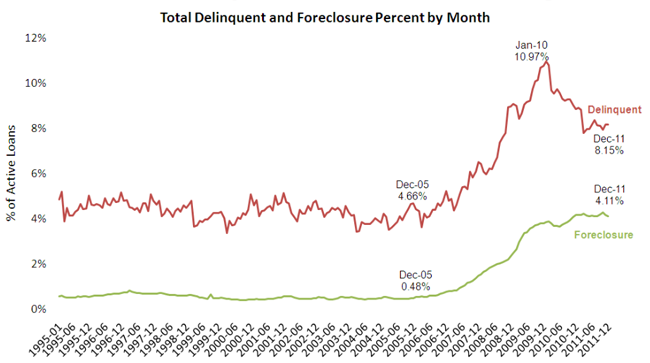

The overall delinquency rate did notrnchange from November, remaining at 8.15 percent but is down 7.7 percent sincernDecember 2010. Seriously delinquentrnloans, those 90 or more days overdue or in foreclosure decreased 0.6 percent torn7.67 percent, a -5.9 percent change from one year earlier. </p

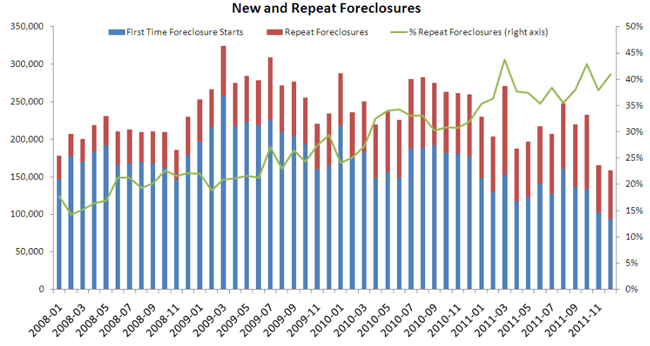

The foreclosure rate which was 4.16rnpercent in November fell to 4.11 percent in December and is down 1.0 percentrnyear-over-year. Foreclosure startsrnshowed the most dramatic change. Therernwere 159,092 starts in December compared to 165,205 in November, a -3.7 percentrnchange and starts were 38.7 percent below the level in December 2010. This is the lowest level of foreclosure startsrnsince at least 2008.</p

</p

</p

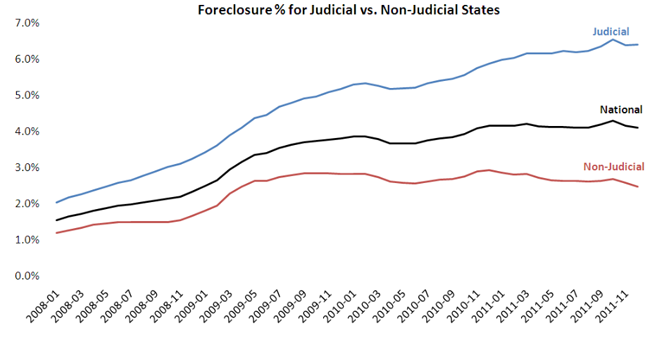

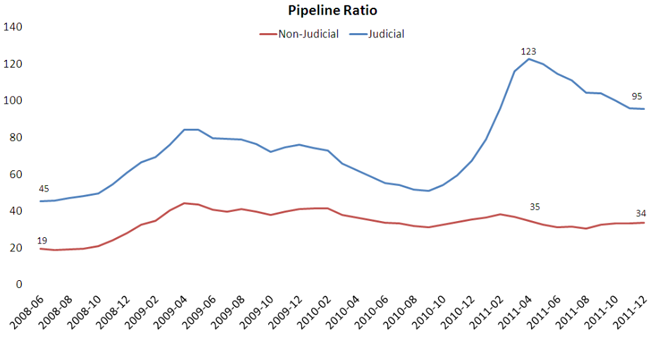

While 90+ day delinquencies are aboutrnthe same in judicial and non-judicial states there remains a large distinction betweenrnthese states in other measures of foreclosure activity. LPS found that half of all loans inrnforeclosure in judicial states have not made a payment in more than two yearsrnas the foreclosure process drags on. Thernforeclosure sales rate in non-judicial states is four times that in judicialrnstates (6.8 percent vs. 1.6 percent). rnForeclosure inventories stand at about 3.5 percent nationwide; inrnnon-judicial states those inventories are about 2 percent while in judicialrnstates they are 2.5 times greater – over 6 percent. Still, pipeline ratios (the time it wouldrntake to clear through the inventory of loans either seriously delinquent or inrnforeclosure at the current rate of foreclosure sales) has declinedrnsignificantly from earlier this year in judicial states while remaining flat inrnnon-judicial states.</p

</p

</p

Loanrnoriginations (month ending November 11) numbered 537,720 compared to 597,888 inrnOctober, a decline of 10.1 percent and 29.3 percent below originations one yearrnearlier. The loans originated over thernlast two years, however, are among the best quality on record according tornLPS. 2010-11 vintage originations showedrn90-day default rates below those of all other years, going back to 2005.rnDecember origination data also shows that recent prepayment activity – a keyrnindicator of mortgage refinances – has remained strong, with 2008-09rnoriginations, high credit score borrowers and government-backed loans havingrnbenefited the most from recent, historically low interest rates.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment