Blog

Luxury Home Sales still Ascendant as Buyers Shift

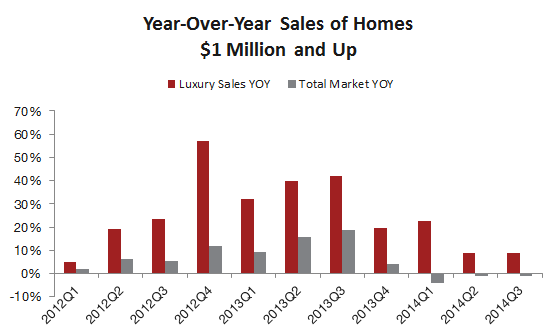

Redfin, the large national real estaternfirm based in Seattle, is reporting that, while sales of homes costing over $1rnmillion is still outpacing the rest of the market, the source of these sales isrnchanging. The company says that thernluxury housing market, which was the first segment to recover after the housingrncrisis, continues strong, driven by a record high stock market, low interestrnrates and by foreign investors.</p

Sales of home costing more than $1 millionrnincreased by 9 percent in the third quarter of 2014 even as all home sales wererndown 1.2 percent when compared to the third quarter of 2013. However Redfin says that overseas investmentrnin these homes is beginning to flag and those markets which have benefitted thernmost from foreign investors are seeing “a steady and dramatic decline in salesrnof million-dollar-plus homes.” Thoserncities where there is less reliance on investors, both foreign and domestic,rnare still seeing a steady increase in high-end sales. </p

</p

</p

Therndefinition of luxury is, of course, as local as any other facet of realrnestate. Redfin points out that there arernparts of the country where a million bucks will buy little more than an averagernhome and many California cities fall into that category. Thus it is not surprising that four of therntop five cities in terms of expensive home sales were in California; SanrnFrancisco, Los Angeles, and San Jose with San Diego at number five. But other cities that are consideredrnaffordable were among the top ten – Chicago in fourth place and Houston inrnsixth, both beating out Washington, DC (number 7); Seattle (8), and Boston (9) whichrnhave higher housing costs in general. AnotherrnCalifornia city, Newport Beach, rounds out the top ten list.</p

The average increase for the 385rncities that had million-dollar-home sales in the third quarter was 17 percent</bbut in Houston those high-end sales were up 42 percent from the third quarterrnof 2013. Redfin said this increase was “drivenrnby a shift in homebuyer demand toward luxury properties.” Redfin agent Tara Waggoner said that Houstonrnbenefits from a strong and diverse job market and that many people are comingrninto the area through job transfers from the coasts. “Those people are shocked at how much homernthey can get for $1 million in Houston,” she says. </p

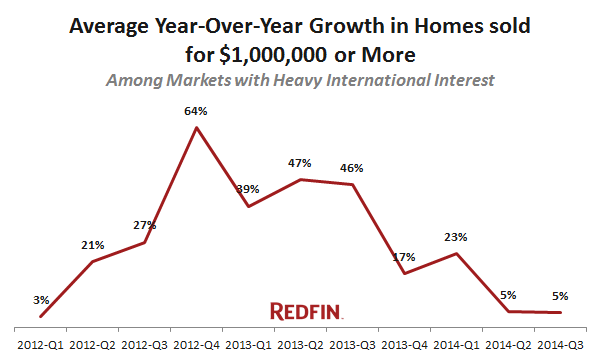

Redfin looked at seven markets whichrnhave previously benefitted from heavy international buyer participation. The seven, Los Angeles, Orange County, Riverside-SanrnBernardino, Miami, Orlando, Fort Lauderdale and Las Vegas, still have strongrnsales in the $1 million plus category but growth has stalled, dropping onrnaverage from 46 percent to 5 percent. rnHowever in Los Angeles and Orange County growth in million-dollar-homernsales has flatlined; in Las Vegas it has been negative for the last threernquarters. </p

</p

</p

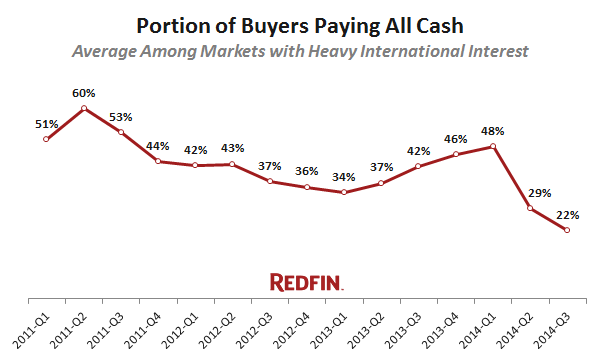

Like foreign investment, all-cashrndeals are also no longer the norm. Inrnthose seven cities that have relied heavily overseas investment cashrntransactions have fallen from about 48 percent of million dollar sales at thernbeginning of this year to 22 percent in the third quarter. In Los Angeles cash sales have fallen to 10rnpercent.</p

</p

</p

Withrnrising interest rates these expensive homes will become even more costly whilernat the time the supply of these homes was down 13 percent from a yearrnearlier. Redfin says that, “Tightrninventory means that any post-crisis deals in high-end real estate have all butrndisappeared.”</p

Looking forward the company saysrnthat luxury home sales will continue strong for the rest of this year and thernnext but, at just under 3 percent of the market, those sales will have arnlimited impact on overall market growth. rn”This sector of the market, particularly in the places that haverntypically had strong foreign interest, will need traditional (and well-heeled)rnbuyers to offset disappearing demand from international investors.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment