Blog

MBA: 30-Day Delinquencies on the Rise Again

While it reported that mostrndelinquency figures dropped substantially in the second quarter, the MortgagernBankers Association's National Delinquency Survey also carried some disheartingrnharbingers of what might lie ahead. </p

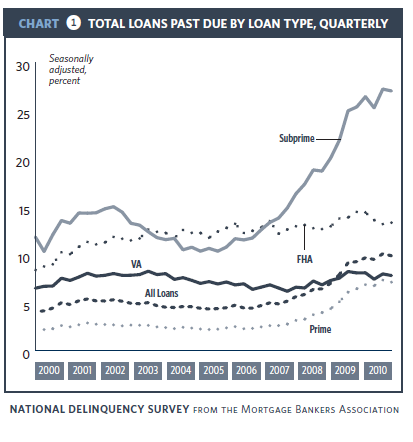

Thernreport showed the seasonally adjusted delinquencyrnrate for all loans at 9.85 percent, a drop of 21 basis points from the firstrnquarter but 61 basis points higher than it was during the second quarter of 2009.</p

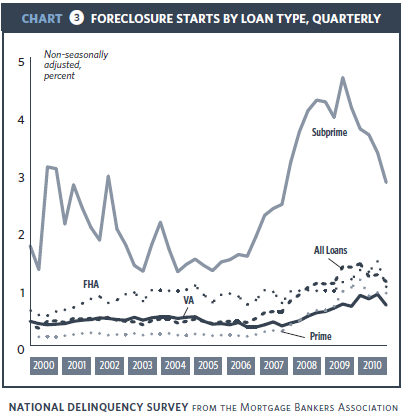

Delinquency rate figures includernall loans that are at least one payment past due, but do not include loans inrnthe process of foreclosure. When thosernare added into the total the delinquency rate rises to 13.97 percent comparedrnto 14.01 in the first quarter. Foreclosure actions were startedrnon 1.11 percent of loans, down from 1.23 percent in the first quarter and 1.35rnpercent in the second quarter of 2009. </p

Nationally, 9.11 percent of loansrnwere seriously delinquent (90 days or more past due or in foreclosure)rnduring the second quarter. This is a decrease of 43 basis points fromrnQ1, however, one year earlier the rate was 7.97 percent. 60-day delinquencies alsorndeclined slightly, from 1.59 percent to 1.52 percent. One year ago that bucket held 1.68 percent ofrnall loans.</p

The states with the highest overallrndelinquency rates were Mississippi (13.66 percent), Nevada (13.23 percent), andrnGeorgia (12.39 percent.) Florida,rnNevada, and New Jersey had the highest foreclosure inventory, while Nevada, Florida,rnand Arizona had the highest percentage of foreclosure starts. 11 states saw increases in the rate ofrnforeclosure starts on a year over year basis, with the largest increases comingrnin Illinois, South Dakota, and New Mexico. The largest decreases were inrnCalifornia, Florida, and Nevada. </p

Across all loan types the delinquency rate currently stands at 7.10 percent for prime loans, down fromrn7.32 percent last quarter but up 69 basis points from Q2 2009; 17.02 percent forrnsubprime loans (27.21 percent in Q1 and 25.35 percent one year ago); FHA, 13.29rnpercent (13.15 and 14.42) and VA, 7.79 (7.96 and 8.06) </p

</p

</p

The Bad News: 30-Day Delinquencies are Up</p

The 30-dayrndelinquency rate for all loans increased from 3.45 percent to 3.51 percentrnquarter-over-quarter. After falling for the last three quarters of 2009, 30-day deliquencies have risen in the first two quarters of 2010. An uptick in early stage delinquencies was recorded by three loan types: primernadjustable rate mortgages (ARMs), subprime fixed-rate mortgages (FRMs), and FHArnFRMs, all of which increased at least six basis points while the rate decreasedrnin every other category.</p

Jay Brinkmann, MBA's chief economist said, “The disappointing news is that, after declining since the beginning ofrn2009, the rate of short-term delinquencies is going up and the increase inrnthese short-term delinquencies may ultimately drive the foreclosure measuresrnback up”</p

Brinkmann cited two causes behind the short-term delinquencies; this metricrnis very closely tied to first-time claims for unemployment insurance, a numberrnwhich fell through most of 2009 but leveled off early this year and has startedrnto rise again. This increase in unemployment directly impacts mortgagerndelinquencies. Second, some percentage of the loans modified over thernlast several years have become delinquent again because those borrowers, byrndefinition, have weak credit. </p

Because it is difficult to interpret the seasonal effects influencingrn this data, the MBA says it is important to call attention to non-adjusted and year over year changes…</p

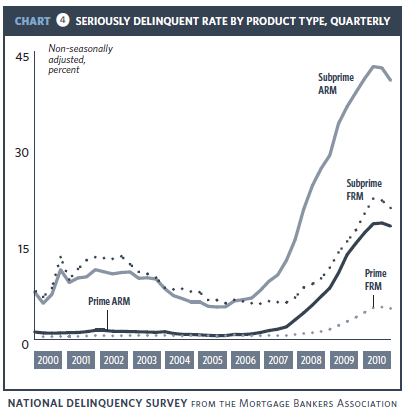

The non-seasonally adjusted delinquency rate increased 71 basis points for prime fixed loans, 149 basis points for prime ARM loans, 141 basis points for subprime fixed loans, and 197 basis points for subprime ARM loans from the second quarter of 2009. The delinquency rate was 107 basis points lower for FHA loans and 29 basis points lower for VA loans relative to the same quarter a year ago.</p

Compared with last quarter, the non-seasonally adjusted seriously delinquent rate decreased for all loan types. The rate decreased 30 basis points for prime loans (from 7.08 percent to 6.78 percent), 189 basis points for subprime loans (from 30.21 percent to 28.32 percent), 65 basis points for FHA loans (from 9.10 percent to 8.45 percent) and 26 basis points for VA loans (from 5.29 percent to 5.03 percent). </p

On a year-over-year basis, the seriously delinquent rate increased 134 basis points for prime loans, 180 basis points for subprime loans, 67 basis points for FHA loans and 34 basis points for VA loans.</p

</p

</p

During the second quarter of 2010, the foreclosure inventory rate increased eight basis points for prime loans (from 3.41 percent to 3.49 percent) and decreased 101 basis points for subprime loans (from 15.39 percent to 14.38). FHA loans saw a 31 basis point decrease in foreclosure inventory rate (from 3.93 percent to 3.62 percent), while the foreclosure inventory rate for VA loans decreased 13 basis points (from 2.63 percent to 2.50 percent).</p

</p<pThe non-seasonally adjusted foreclosure starts rate increased four basisrn points for prime fixed loans and two basis points for VA loans from a year ago. Foreclosure starts rate decreased 78 basis points for prime ARM loans, 53 basis points for subprime fixed loans, 213 basis points for subprime ARM loans, and 13 basis points for FHA loans on a year overrn year basis. </p

</p<pThe non-seasonally adjusted foreclosure starts rate increased four basisrn points for prime fixed loans and two basis points for VA loans from a year ago. Foreclosure starts rate decreased 78 basis points for prime ARM loans, 53 basis points for subprime fixed loans, 213 basis points for subprime ARM loans, and 13 basis points for FHA loans on a year overrn year basis. </p

</p

</p

Brinkman says, “These latest delinquencyrnnumbers contain a mixture of somewhat good news and somewhat bad news. rnThe good news is that foreclosure starts are down and the inventory of homesrnanywhere in the process of foreclosure fell for the first time since 2006 andrnhad the largest drop since 2005. Loans 90 days or more past due, thernlargest share of delinquent loans, also fell. The fact that both the 90+rndelinquency rate fell and the foreclosure start rate fell means that arnsignificant number of these seriously delinquent loans have been successfully modifiedrnand reclassified as performing, current loans” </p

“Ultimately the housing story,rnwhether it is delinquencies, homes sales or housing starts, isrnan employment story,” Brinkmann said. “Only when we see arnconsistent increase in employment will we see an increase in sales and starts,rnand a sustained improvement in the delinquency numbers. Until we see thernincrease in the number of households that comes with an increase in the numberrnof paychecks, all measures of the health of the housing industry will continuernto be weak.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment