Blog

MBA: Commercial, Multi-Family Delinquencies Fell in First Quarter

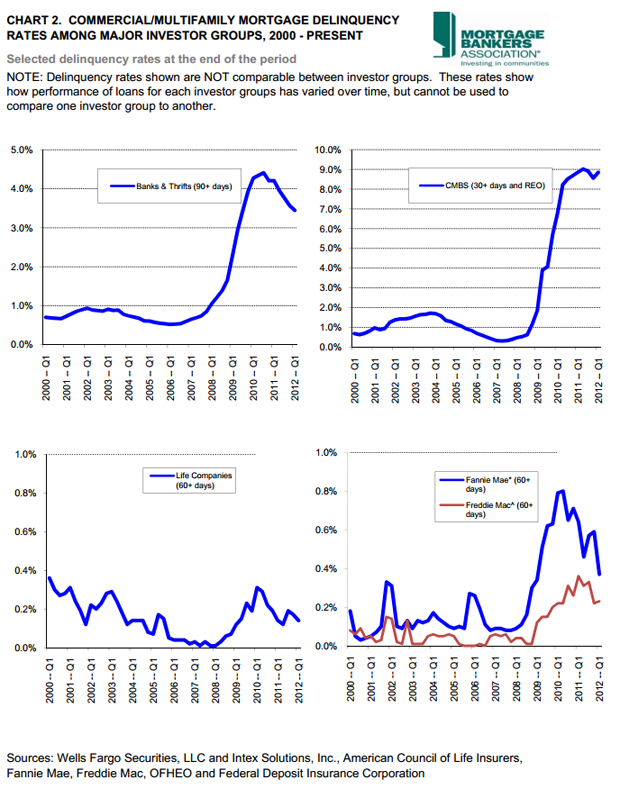

The Mortgage Bankers Association said today that commercialrnand multi-family delinquencies for most of the investor groups it tracksrndeclined during the first quarter of 2012 compared to both the previous quarterrnand the first quarter of 2011. The one exceptionrnwas commercial mortgage backed securities (CMBS) which had a rate, includingrnmortgages 30+ days late and real estate owned (REO) of 8.85 percent. The rate at the end of the previous quarterrnwas 8.56 percent. It had been one basisrnpoint higher, 8.86 percent, at the end of Q1 2011. </p

Banks and thrifts had a 90+ day rate of 3.22 percentrnin the first quarter compared to 3.57 percent in the fourth quarter of 2012 andrn4.21 percent in the first quarter of 2011. rnThe rate for life insurance mortgage holdings (60+ days) was 0.14rnpercent, unchanged from a year earlier but down from 0.17 percent in the lastrnquarter of 2012. Multi-family delinquenciesrnof more than 60+ days held by Fannie Mae dropped from 0.59 percent in thernfourth quarter to 0.37 percent. One yearrnearlier the rate was 0.64 percent. FreddiernMac’s multi-family delinquency rate, also based on 60+ days was 0.23 percent,rnone basis point higher than in the fourth quarter but substantially improvedrnfrom 0.36 percent one year earlier.</p

The fivernlargest investor-groups tracked by MBA together hold more than 80 percent of commercial/multifamilyrnmortgage debt currently outstanding.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment