Blog

MBA: Delinquency Rates Fall while Foreclosure Starts Rise

Seasonally adjusted mortgagerndelinquencies fell 45 basis points (bp) from the second to the third quarter ofrn2011 to a seasonally adjusted rate of 7.99 percent, the lowest level recordedrnby the Mortgage Bankers Association’s (MBA) National Delinquency Survey (NDS)rnsince the fourth quarter of 2008. Thernrate is 114 bp below the level at the end of the third quarter of 2010. The 3rd Quarter NDS released todayrnreported the non-seasonally adjusted delinquency rate was up 9 bp to 8.20rnpercent.</p

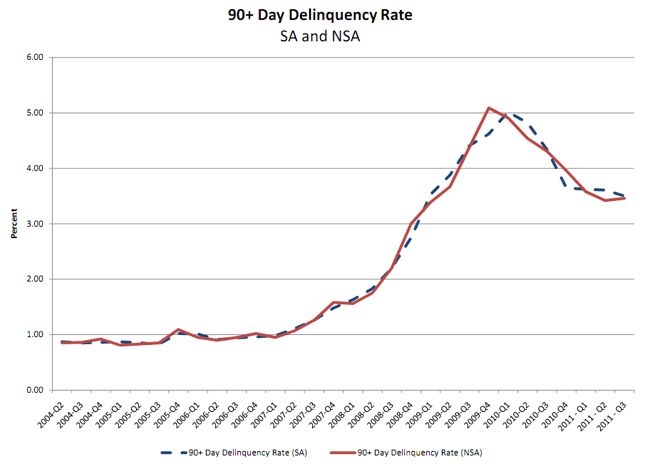

Early stage (30+ days) delinquenciesrndeclined 27 bp to 3.19 percent on a seasonally adjusted basis, the 60+ dayrnbucket was down 7 bp to 1.30 percent and 90+ day loans were down 11 bp to 3.50rnpercent.</p

</p

</p

Delinquency rates dropped across allrnloan types with Subprime loans showing the greatest improvement. Subprime fixed-rate mortgages (FRM) were downrn138 bp from Q2 to 21.21 percent and adjustable rate mortgages (ARM) fell 211 bprnto 25.07 percent. Prime FRM and ARMsrnwere down 42 bp to 4.32 percent and 103 bp to 10.73 percent respectively. FHArnand VA loans, while improving, did not fare as well. FHA loans are now at a 12.09 percentrndelinquency rate following a 53 bp drop and VA loans were down 47 bp to 6.58rnpercent.</p

The delinquency rate includes loans thatrnare at least one payment in arrears but does not include loans in the processrnof foreclosure. Taken together the tworncategories have a non-seasonally adjusted rate of 12.63 percent, up 9 bp fromrnQuarter Two but 115 bp lower than the third quarter of 2010.</p

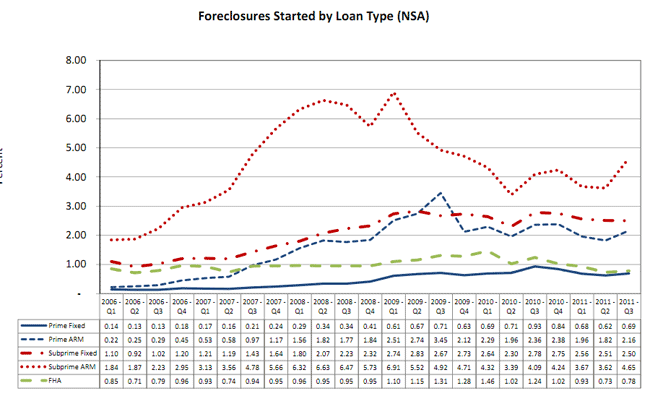

Seriously delinquent (90+ days) loansrndeclined by 11 bp as foreclosure starts rose 12 basis points indicating that somernservicers had begun picking up the pace of foreclosures as loans left thernloss-mitigation process and state foreclosure moratoria ended. Foreclosure starts were at a non-seasonallyrnadjusted rate of 1.08 percent compared to .96 percent in the second quarter andrn1.34 percent a year earlier. </p

</p

</p

Foreclosure starts, non-seasonallyrnadjusted, increased 7 bp for prime fixed loans to 0.69 percent, 34 bp for primernARM loans to 2.16 percent, 6 bp for subprime fixed to 2.50 percent, and 103 bprnto 4.65 percent for subprime ARMs. The foreclosurernstarts rate for FHA loans was up 5 bp to 0.78 percent for 1 bp for VA loans torn0.56 percent.</p

</p

</p

MBA states that it is difficult torninterpret the seasonal effects in data with quarter to quarter comparisons sornit is necessary to look at year-over-figures as well. Compared with the third quarter of 2010,rnnon-seasonally adjusted foreclosure starts decreased 24 bp for prime FRM, 20 bprnfor prime ARM, 28 bp for subprime fixed, 46 bp points for FHA loans, and 30 bprnfor VA loans. The rate increased 56 bprnfor subprime ARM loans.</p

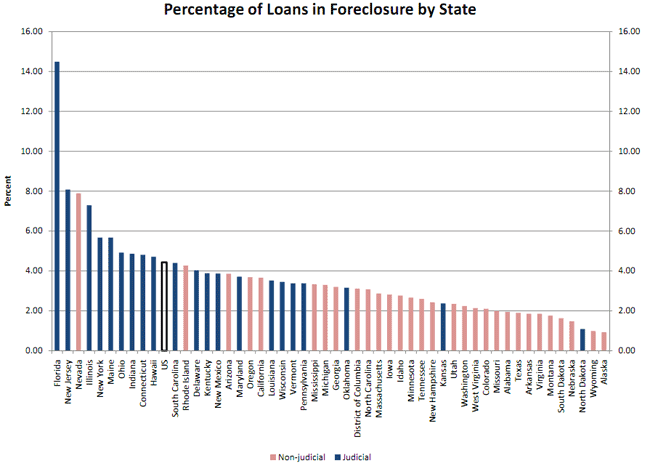

The foreclosure inventory stands at 4.43rnpercent, unchanged from the second quarter and up 4 bp from one year ago. Mike Fratantoni, MBA’s Vice President forrnResearch and Economics told a press conference accompanying the NDS releasernthat the flat inventory rate is actually obscuring two underlying trends. The inventory in states using a judicial formrnof foreclosure stands at 6.8 percent and is rising while the inventory inrnnon-judicial states is 2.9 percent and trending down. Of the ten states with arnhigher level of loans in foreclosure than the U.S. as a whole, nine of them arernjudicial foreclosure states. Fratantonirnsaid that foreclosure inventories in those states are a legal issue rather thanrnone of economics.</p

</p

</p

As can be seen from the chart above,rnFlorida is still having an enormous foreclosure problem. The current inventory in that state stands atrn14.49 percent, more than three times the national average of 4.43 percent andrnnearly double that of the next highest state, New Jersey. While the state has 7.5 percent of the loansrnserviced in the U.S. it has 24.5 percent of the foreclosure inventory. Florida along with four other states,rnCalifornia, Illinois, New York and New Jersey have 52.8 percent of foreclosuresrnbut only 32.2 percent of all loans serviced. rn</p

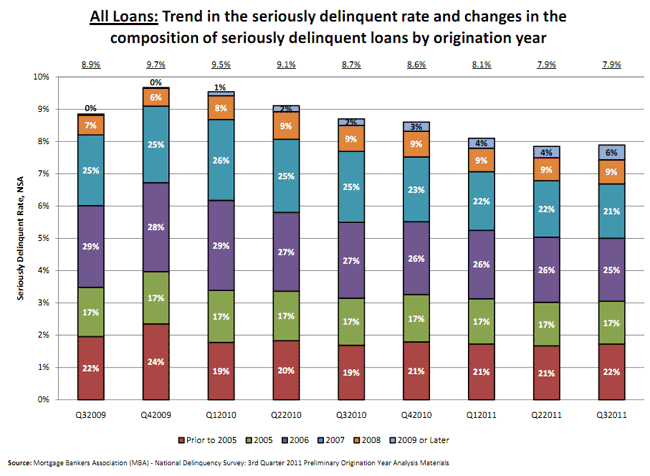

Fratantoni said that, even as overall delinquenciesrnhave decreased, the percentage across loan vintages has remained remarkablyrnconsistent. Loans originated before 2005rnconstituting less than a quarter of loans while the 2005-2007 vintages make uprnwell over half of the problem loans. Thern2008-2010 classes of loans are now entering what Fratantoni called the peakrndefault years – three to four years following origination – but so far appearrnto be performing well which, he said, portends well for gradually working outrnof the inventory.</p

Recent FHA loans, however, arernperforming less well. More than half ofrnthe delinquent FHA loans are loans originated in 2008 or later. In part this reflects the surge of loans thatrnFHA has written since credit tightened, at times financing nearly 50 percent ofrnall mortgages in the country. However,rnthese figures bear watching.</p

Fratantoni said that MBA does not expectrnmore than modest job growth over the next months but that even the current raternis enough to keep the delinquency rate moving down. He expects, however, that it will take threernto four years to return serious delinquency rates to the historic levels ofrnaround 1 percent.</p

The MBA surveys 120 servicing companiesrnfor the NDS. The survey covers about 88rnpercent of all loans serviced, approximately 43.5 million loans. The number of loans has declined 1.8 percentrnor 358,000 loans since the second quarter and 440,000 from one year ago. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment