Blog

Metrics of HAMP Continue to Improve

The Departments of Treasury and Housingrnand Urban Development have released their joint October 2011 HousingrnScorecard. The report is essentially arnsummary of data on housing and housing finance released by public and privaternsources over the previous month and/or quarter. rnMost of the data such as new and existing home sales, permits andrnstarts, mortgage originations, and various house price evaluations have beenrnpreviously covered by MND. </p

The scorecard incorporates by referencernthe monthly report of the Making Home Affordable Program (HAMP). HAMP reports that 25,974 homeowners havernentered into HAMP loan modification trials since its last report inrnSeptember. This brings the cumulativernnumber of trials begun since the program was initiated in April 2009 torn1,714,012. Of these trials, 766,203 wererncancelled in the trial stage, 90,835 remain in trial status, and 856,974 trialrnmodifications have been converted to permanent status, 40,141 of these in thernlast month. A total of 720,612rnpermanent modifications are still active.</p

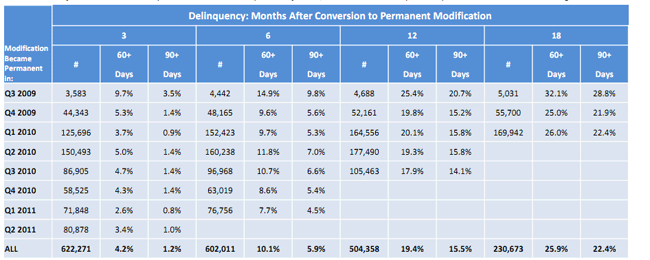

The program now has data on 622,271rnpermanent modifications that have been in force long enough to collect at leastrnsome information on recidivism and, as HAMP has previously stated, therndelinquency rate continues to improvernwith each generation of modifications. As can be seen from the table below, there hasrnbeen a definite downward trend in delinquency for most loans over those in earlierrnvintages after the same period of seasoning. rn </p

</p

</p

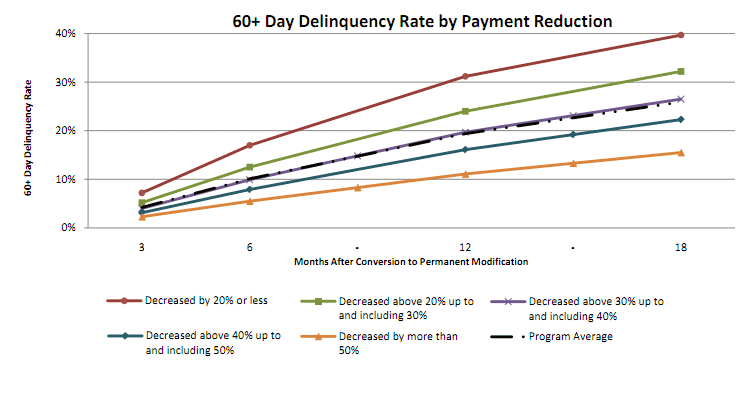

Not surprisingly, there has been arnstrong correlation between reduced payment and success of thernmodification. For example, loans thatrnreceived a 20 – 30 percent reduction in payment have a serious delinquency ratern(90+) of 28.1 percent after 18 months; a modification resulting in a 50 percentrnor greater payment reduction has a rate of 12.9 percent. The table below compares various loanrnreductions against a 60+ delinquency.</p

</p

</p

The program continues to improve itsrnnumbers in terms of shortening the length of what are supposed to be threernmonth modification trials but which, in the earlier days of the program, oftenrndragged on for many times that length. Thernaverage duration of the trial period for those converted to a permanent HAMPrnmodification has decreased from 5.3 months for trials started prior to June 1,rn2010, to 3.5 months for trials started after June 1, 2010 when substantialrnchanges were made to the HAMP guidelines. rnAll servicers but Chase, which is averaging 4.6 months, are actually belowrnthat 3.5 month average. </p

In September the number of active trialsrnthat had lasted for more than six months was down from 27,345 in August torn19,793. In September 2010 there werern76,500 trials that had been in existence for six months or more. Bank of American and Chase are noteworthy inrnthis category. While the two servicesrntogether were responsible for 40.5 percent of all trials initiated over the lifernof the program, they hold 61.57 percent of the extended trials. Nine of the 12 largest servicers have reachedrnthe 80 percent benchmark in converting to permanent status those trials startedrnafter June 30, 2010. SPS has the bestrnrecord at 90 percent, Chase the worst at 72 percent. </p

HAMP is responsible for several smallerrnforeclosure avoidance programs. Servicersrnhave started 32,078 agreements under the Home Affordable ForeclosurernAlternatives (HAFA) program and completed 18,557. Just over 500 of the completed transactionsrnwere deeds-in-lieu of foreclosure, the remainder were short sales.</p

The Second Lien Modification Program (MP2)rnhas started 45,705 modifications of junior liens and has extinguished 6,332 andrnmodified 38,658.</p

HUD says ofrnHAMP, “Even as new delinquencies continue to fall, eligible homeowners enteringrnHAMP have a high likelihood of earning a permanent modification and realizingrnlong-term success.rnEighty percent of eligible homeowners entering a HAMP trial modification since June 1, 2010rnreceived a permanent modification, with an average trial period of 3.5 months.rnAfter six months in the program, more than 94 percent of homeowners remain inrntheir HAMP permanent modification. Homeowners in HAMP permanent modificationsrnhave saved an estimated $8.8 billion to date.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment