Blog

Mortgage Credit: Loose, Tight, or Just Right?

Earlier this year the Mortgage BankersrnAssociation (MBA) began releasing its Mortgage Credit Availability Index, arnmeasure of how “loose” or “tight” mortgage credit is when compared to thernprevious month or year. In an article onrnCoreLogic’s Insights blog, titled “Goldilocks and the Three Credit Bears,”rnsenior economist Mark Fleming describes his company’s similar index.</p

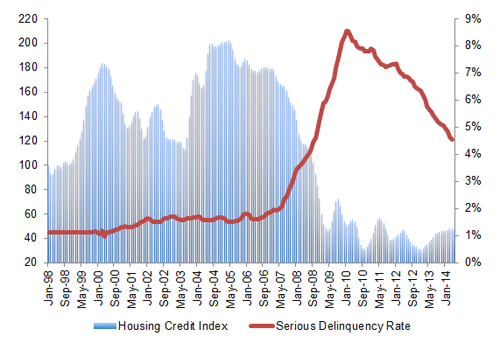

The Housing Credit Index (HCI) measuresrnthe range and variation of mortgage credit over time and over variousrnunderwriting criteria including credit scores, debt-to-income and loan-to-valuernratios and loan attributes such as whether the loan is a fixed or adjustablernrate, the amount of documentation, and the loan origination channel. CoreLogic then uses what Fleming calls “mathematicalrntechniques popularized in the economic inflation forecasting literature tornhandle multiple correlated attributes.”</p

The index, he says, can be thought of asrnmeasuring the size of the “credit box,” although “in this case the box is arnmultivariate correlated distribution.” rnLike the MBA index, a rising HCI indicates increasing availability orrnlooseness of credit and a declining index indicates it is tightening. CoreLogic’s index is benchmarked to Januaryrn1998, which Fleming calls the most recent period of relative normality in thernhousing market. Changes in the index canrnbe thought of a shares or percentages so an increase from 100 to 200 meansrncredit is twice as loose as in the base period. </p

Fleming explains that such an index isrnvaluable because lack of access to credit has been cited as a reason for thernslow pace of the housing recovery. Hernpoints to the Federal Reserve’s Senior Loan Officer Survey which is often citedrnas a source but is really only a superficial look at whether banks arerntightening or loosening their requirements and says little about the overallrnavailability of credit. Further he says,rnsaying that credit is tight or it is loose implies that somewhere there is,rnlike Goldilocks thought in another context, an amount of credit that is justrnright. </p

</p

</p

So where is credit on the too loose, toorntight, or just right spectrum? The chartrnshows the HCI from 1998 to early this year along the left axis and the seriousrndelinquency rates over that period on the right axis. When credit availability expanded in thernearly years of this century the delinquency rate rose from 1 to 1.25rnpercent. Credit access fell again thenrnrose in mid-decade to nearly double the normal (1998) level with disastrous results,rna delinquency rate that shot to nearly 9 percent. This was followed by a quick and dramaticrncontraction to its tightest point in the late 2010 at only one-third the “normal”rnlevel; Fleming says this was too tight. Sincernthen the HCI has eased in fits and starts with modification and refinancernprograms designed to help struggling homeowners. While the index has risen recently, credit remainsrntight by historic standards.</p

Fleming concludes that like Goldilocks testing every bed, “Over the last 15rnyears we have tried too loose and too tight credit with varying degrees ofrnsuccess. Consider lending standards in the late 1990s when the ‘credit box’ wasrntwice the current size and the serious delinquency rate was only 1 percent.rnThat bed feels just right.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment