Blog

Multi-Family Sector Bucks Commercial Lending Trend

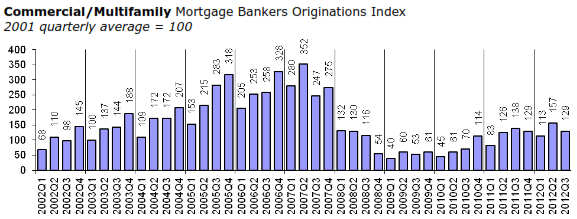

Despiternrecord low interest rates, the Mortgage Bankers Association’s (MBA) Commercialrnand Multifamily Originations Index fell during the third quarter of 2012. MBA reports that volume was down sevenrnpercent from one year earlier and 17 percent below that in the second quarterrnof 2012. Year-to-date originationsrnhowever are running 15 percent ahead of the same period in 2011. The Index has improved three-fold sincernhitting bottom in the first quarter of 2009 but remains at less half the levelrnof most quarters between the second quarter of 2005 and the end of 2007. </p

</p

</p

Thernmulti-family component of the index was one of two to increase during the thirdrnquarter. Lending increased by 7 percentrnfrom Quarter Two and 30 percent year-over-year. rnOriginations for most other types of property covered by the MBA surveyrnwere down from the previous quarter, (Retail -43 percent; Office -29 percent;rnHealth Care, -25 percent; Hotel -25 percent), industrial lending was the onlyrnother sector to improve, increasing by 8 percent. </p

Mostrnsectors fared better on a year-over-year basis with retail and officernproperties again having the largest downside, decreases of 35 and 24 percentrnrespectively. The remainder showed annual increases; 4 percent for hotel properties, and a 19 percentrnincrease for both industrial and health care properties. The multi-family lending market, with its 30rnpercent increase may have been assisted by decliningrnrental vacancy rates and lower homeownership reported by the Census Bureau.</p

“Commercialrnand multifamily mortgagernborrowing slowed in the third quarter,”rnsaid Jamie Woodwell, MBA’s Vice Presidentrnof Commercial Real Estate Research. “Evenrnthough low interest rates continue to make borrowing extremely attractive, a moderate pace of commercial property salesrntransactions and a continued drop in the volume of commercial mortgages maturingrnlimited the overallrnamount of commercialrnmortgage loans originated.”</p

Amongrninvestor types, between the second and third quarters of 2012, loans forrnconduits for CMBS saw a decrease in volume of 55 percent, loans for liferninsurance companies dropped 37 percent, originations for commercial bankrnportfolios increased six percent and loans for GSEs increased by 14 percent.</p

Onrnan annual basis, therndollar volume of loans acquired by life insurance companies dropped 32 percentrnfrom a year earlier. There was an 8rnpercent increase for commercial bank portfolios and 30 percent for the governmentrnsponsored enterprises Fannie Mae and Freddie Mac. The volume of loans originated for CMBS conduitsrnwas unchanged.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment