Blog

New Home Sales Mixed Regionally. Still Near Record Lows

The Census Bureau and the Department of Housing and Urban Development have released New Residential Home Sales data for August 2010. </p

Excerpts from the Release…</p

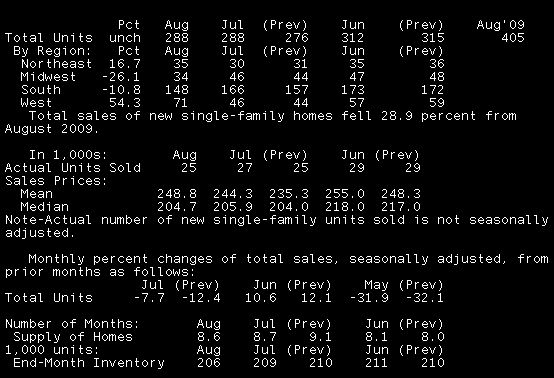

Sales of new single-family houses in August 2010 were at a seasonally adjusted annual rate of 288,000. This is unchanged (±16.7%) from the revised July rate of 288,000 and is 28.9 percent (±11.0%) below the August 2009 estimate of 405,000.</p

The median sales price of new houses sold in August 2010 was $204,700; the average sales price was $248,800. </p

The seasonally adjusted estimate of new houses for sale at the end of August was 206,000. This represents a supply of 8.6 months at the current sales rate. </p

————–</p

Here is a recap from Reuters….</p

RTRS-US AUG SINGLE-FAMILY HOME SALES 288,000 UNIT ANN. RATE (CONS 290,000) VS JULY 288,000 (PREV 276,000)

RTRS-US AUG SINGLE-FAMILY HOME SALES UNCH VS JULY -7.7 PCT (PREV -12.4 PCT)

RTRS-US AUG HOME SALES NORTHEAST +16.7 PCT, MIDWEST -26.1 PCT, SOUTH -10.8 PCT, WEST +54.3 PCT

RTRS-US AUG NEW HOME SUPPLY 8.6 MONTHS’ WORTH AT CURRENT PACE VS JULY 8.7 MONTHS

RTRS-US AUG MEDIAN SALE PRICE $204,700, -1.2 PCT FROM AUG 2009 ($207,100)

RTRS-US HOMES FOR SALE AT END OF AUG 206,000 UNITS, LOWEST SINCE AUG 1968, VS JULY 209,000 UNITS

RTRS-US AUG MEDIAN SALE PRICE LOWEST SINCE DEC 2003</p

</p

</p

CHARTS TO BE ADDED</p

These are mixed results. The West recorded a pretty hefty uptick in absolute and relative terms while the Northeast managed to bounce back to the level of sales seen in June. The largest region, the South, experienced the most sizable contraction in absolute terms with an 18,000 unit decline while the Mid-West reported the biggest decline in relative terms with a 26.1% move lower. </p

Regardless, New Home Sales and Existing Home Sales are still hovering around record low levels. THE HOUSING MARKET IS STAGNANT

This should come as no surprise to folks working in the industry. Uncertainty is abundant in all sectors of the economy and prospective (qualified) homeowners are too worried about further home price declines and the status of their jobs to buy a house right now. When investing outlooks are unusually cloudy and the market’s strategic perspective is stuck in the “here and now”, a brutal negative feedback loop can arise. Some may refer to this phenomenon as a “downward spiral”, where negative data leads to more negative data. Here’s to hoping that a negative feedback loop isn’t already in progress. If it is, the Obama Adminstration may be forced to come up with yet another unconventional strategy to spark some activity in the labor and housing markets.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment