Blog

No "Psychological" Bottom Yet in Housing Prices

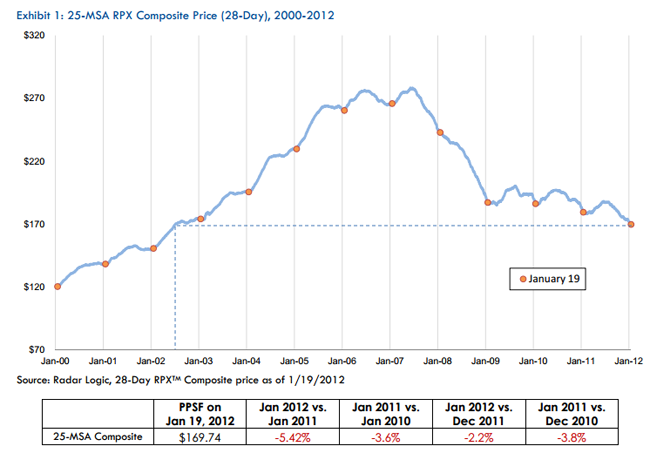

The rate of decline in housing prices has slowed recently accordingrnto the RPX Composite Index released today by RadarLogic, but the bottom forrnprices may still be a ways off. The RPXrnComposite price, which tracks 25 major metropolitan areas, declined to $169.75rnper square foot in January, the lowest price for the Composite since July 2002. </p

</p

</p

The year-over-year rate of decline has been increasing sincernmid-2010 and reached the most rapid growth in several years in Decemberrn2011. The rate of decline then began tornslow. On December 19 the rate was 7rnpercent and on January 19 it was 5.42 percent. </p

The decline from December to January was 2.2 percent, thernlowest since 2007. RadarLogic discountedrnthe seasonality of the decrease by pointing out the declines in January for thernyears 2008 to 2010 averaged 3.6 percent.</p

RadarLogic said that while the slowing rate of decline isrnpromising it is still too early to say that prices are nearing the bottom. The company referenced a similar slowing inrnthe rate of decline in 2009 only to see acceleration again in 2010.</p

</p

</p

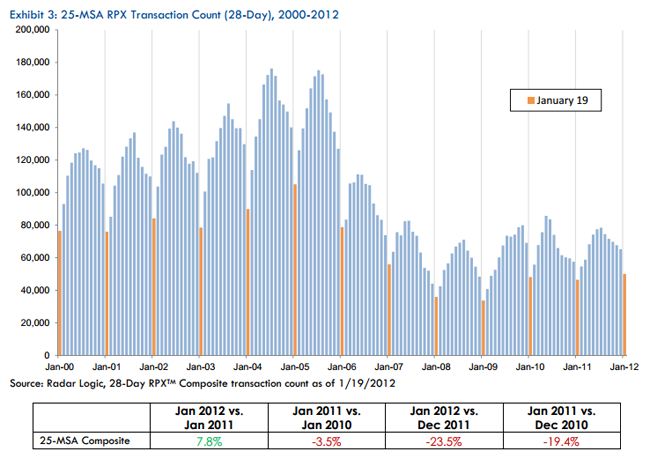

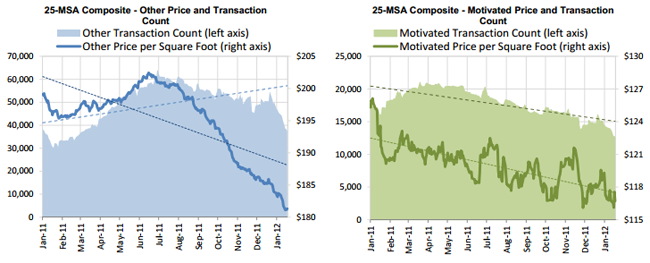

The RPX transaction count for the 25 metropolitan areas increasedrn7.7 percent year-over-year to the highest January level since 2007. The increase was driven by a 23.4 percentrnincrease in non-distressed or “other” sales. rnAt the same time the composite price for these sales dropped 7.7 percentrnwhich the company suggestions may indicate that sellers are dropping theirrnprices to move the properties.</p

Motivated sales, defined as sales at foreclosure auction andrnliquidation sales by lenders declined by 21.8 percent year over year and thosernprices also declined.</p

On a monthly basis counts of “other” sales declined 25.9rnpercent while motivated sales were down 15 percent over the same periodrnresulting in motivated sales comprising a larger percentage of total sales; thernpercentage increased from 22.6 percent in the month ending on December 19 torn25.1 percent for the following month. “Thisrnrelative increase in motivated sales put downward pressure on the overallrn25-MSA RPX Composite price, exacerbating its month-over-month decline.”</p

</p

</p

RPX says that the existing home sales figures released thisrnweek and continued signs of weakness in mortgage application numbers suggestrnthat the country has yet to find the “psychological” bottom in the housingrnmarket. “Until buyers, of whom wernsuspect there are many, believe the imbalance of supply and demand isrncorrecting, they will continue to push prices down by bidding below askingrnprices. It would seem that home buildersrnagree with this sentiment as starts and permits for single family homes arernweak. Most new builder activity appearsrnto be in apartment structures.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment