Blog

OCC Reports on Quarterly Delinquencies, Home Retention Actions

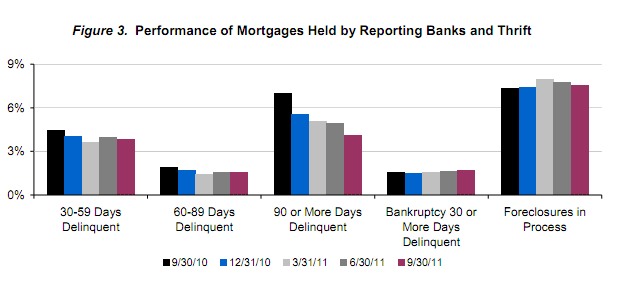

The Office of Comptroller of thernCurrency released its Quarterly Mortgage Metrics Report on Wednesday showingrnthat delinquencies among mortgages serviced by the large financial institutionsrnit supervises were stable but still elevated during the third quarter.</p

While delinquencies have declinedrnfrom one year earlier, the number of new foreclosures increased by 21.1 percentrnduring the quarter as alternatives for loan modifications and other efforts tornmitigate delinquencies were exhausted and some of the voluntary moratoria thatrnwere implemented in the fall of 2010 in the wake of the robo-signingrncontroversy were lifted. The increasernin new foreclosures along with the increasing amount of time each takes tornprocess has brought the number of loans in foreclosure to 1.33 million or 4.1rnpercent of the overall portfolio.</p

At the end of the quarter 88 percentrnof the 32.4 million mortgages in the portfolio were current and performing,rnabout the same as in Q2, and the percentages of loans that were 30-59 daysrndelinquent and over 60 days delinquent were also unchanged quarter overrnquarter. Both categories of delinquenciesrnare down, however, from a year earlier.</p

</p

</p

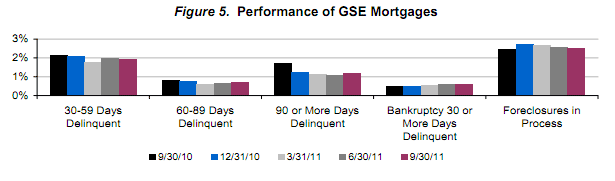

Mortgages belonging to Freddie Macrnand Fannie Mae (the GSEs) performed better than the overall portfolio becausernof the higher percentage of prime loans. rnThe percentage of these loans that were current and performing was 93.1rnpercent, unchanged from the previous quarter and up from 92.3 percent a yearrnearlier. Of the GSE mortgages, 58rnpercent were serviced for Fannie Mae and 42 percent for Freddie Mac.</p

</p

</p

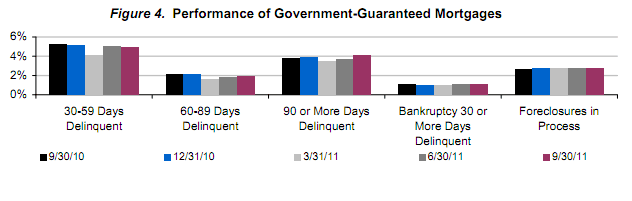

The performance of government guaranteedrnmortgages declined in the third quarter with current and performing loansrndropping to 85.2 percent of the portfolio from 85.7 percent in the secondrnquarter but improving from 85.7 percent in Q3 of 2010. The percentage in the process of foreclosurernincreased to 2.8 percent from 2.7 percent in the second quarter. Government-guaranteed mortgages represent morernthan 21 percent of the portfolio compared with 19 percent a year earlier.</p

</p

</p

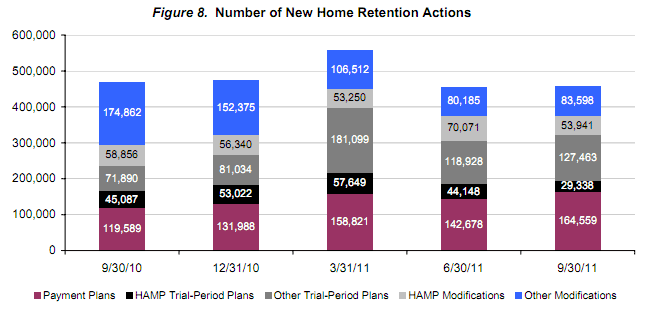

Servicers implemented 458,899 newrnhome retention actions during the quarter, a slight increase from Quarter 2 butrndown by 2.4 percent from a year earlier. rn Servicers implemented 137,549rnloan modifications, down 8.5 percent from the previous quarter and new HAMPrnmodifications decreased by 23 percent to 53,941. This was partially offset by the 4.3 increasernin other modifications. During the pastrnfive quarters more than 2.4 million home retention actions have beenrnimplemented.</p

</p

</p

On average, the modificationsrnimplemented in the third quarter of 2011 reduced borrowers’ monthly principalrnand interest payments by 24.4 percent, or $382. Modifications made under HAMPrnreduced payments by 35.1 percent on average, or $567.</p

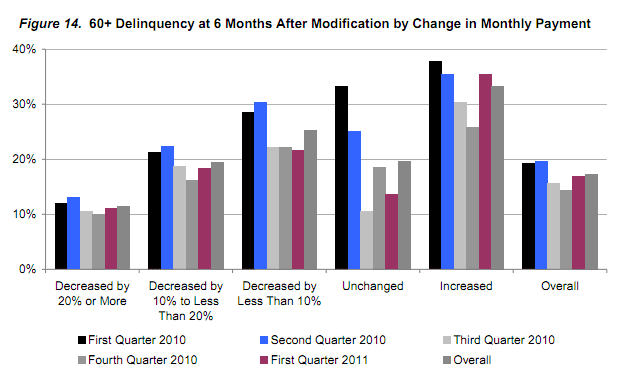

Those modifications that reducedrnpayments by at least 10 percent performed better than those that reducedrnpayments by less. At the end of thernthird quarter 58.8 percent of modifications made since the beginning of 2008rnwith a 10+ percent reduction were current and performing compared with 36.4rnpercent of the modifications made in the same period with a less than 10rnpercent payment reduction. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment