Blog

OCC/OTS Report: Delinquencies Decrease. Foreclosures Rise. Loan Mods Re-Defaulting

For the first time in at least 21 months, the delinquencyrnrates for all categories of mortgages – prime, Alt-A, and subprime – decreased,rnaccording to the June Mortgage Metrics Reports for the first quarter of 2010rnreleased today by the Offices of Thrift Supervision (OTS) and Comptroller ofrnthe Currency (OCC.) </p

At the same time, the number of foreclosures,rnincluding new foreclosures, foreclosures in process, and completed foreclosuresrnincreased substantially. Loanrnmodifications also increased and there were indications that servicers are picking up the pace of converting HAMP trial modifications tornpermanent status. READ MORE </p

The overall delinquency rate for the portfolio stood at 6.5rnpercent for the quarter compared to 7.1 percent in the fourth quarter ofrn2009. This is a decline of 7.7 percentrnfrom the previous quarter but an increase of 36.8 percent year-over-year. </p

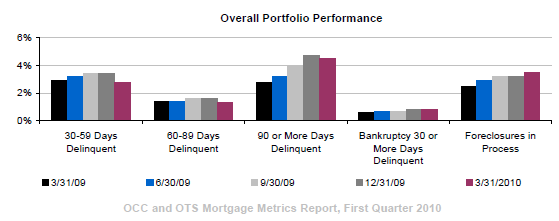

A breakdown by delinquency “bucket”rnshows the same pattern as has been evident in other recent studies – a decreasernin delinquencies that is most pronounced in the early stages while the most severelyrndelinquent numbers are much less fluid. </p

Mortgages that were 30 to 59 daysrndelinquent represented 2.8 percent of the total portfolio compared to 3.4rnpercent in the last quarter of 2009. rnThis is a drop of 17.7 percent in the quarter and a -3.6 percent changernfrom figures in the first quarter of 2009. </p<pLoans that were 60 to 89 days in arrears dropped 19.3 percent from thernprevious quarter, to a 1.3 percent delinquency rate, a year-over-year decreasernof 7.3 percent. </p

The most severely delinquentrn(over 90 days) bucket did decline by 7.7 percent from the previous quarter, butrnwas still up nearly 37 percent from a year earlier. When borrowers in bankruptcy, a number thatrnhas remained relatively stable, are removed from the most seriously delinquentrngroup, the year over year increase rises to 60.3 percent. </p

Compared to the previous quarter, new foreclosures increasedrn18.6 percent, while foreclosures in process were up 8.5 percent, and completed foreclosuresrnrose 18.5 percent. Over 1.2 millionrnmortgages were involved in some type of foreclosure during the quarter, anrnincrease of 37 percent over one year earlier.</p

</p

</p

While the Metric Report did not explain the decliningrndelinquency rate as an indication that the worst is over as others have donernwith their own data, they did, as others have, account for the increasedrnforeclosure rates as a result of servicers exhausting other options andrnbeginning to move the large inventory of potential foreclosures through thernsystem. READ MORE</p

Short sales are an increasing option to foreclosure, morernthan doubling from one year ago to 41,033 sales. This is an increase of 9.2 percent from thernfourth quarter.</p

The number of modifications and other home retention actionsrnincreased to 629,678, an increase of 5.4 percent from the previous quarter andrn61.4 percent from Q1 2009. The HomernAffordable Modification Program (HAMP) accounted for 288,000 of thernmodifications with 188,000 borrowers entering the trial modification period. Just short of 100,000 borrowers convertedrnfrom trial to permanent modifications, a whopping 385 percent increase over thernfourth quarter, perhaps as a result of actions by HAMP administrators to morerncarefully monitor servicers, streamline documentation requirements, andrnrecalibrate servicer incentives. 87rnpercent of all loan modifications reduced borrower payments and 55 percent ofrnborrowers saw their payments reduced by at least 20 percent.</p

</p

</p

Modified loans still, however, have a poor prognosis. One year following modification more thanrnhalf of the modified mortgages are 60 or more days delinquent. This, however, appears to be improving. Over half a million mortgages were modifiedrnin 2009 and nearly 52 percent of those were current at the end of the firstrnquarter of 2010 compared to 27 percent of those that were modified duringrn2008. READ MORE</p

</p

</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment