Blog

One-third of U.S. Residences Owned Mortgage-Free

</p

Despite the concern over the last fewrnyears about the number of homeowners who owe more on their mortgages than theirrnhomes are worth, it turns out that nearly one third of owner-occupied homes inrnAmerican have no mortgages at all. In arnrecent study using third quarter data from TransAmerica, the real estaternwebsite Zillow® found that 20.6 million Americans ownrntheir homes outright. This is 29.3rnpercent of all homeowners.</p

Some of these homeowners have paidrnoff their mortgages over time while others purchased their homes for cash. Not surprisingly there were higher rates ofrnhomeownership in older age groups, in areas where housing is generally lessrnexpensive, and among homeowners with higher credit scores. Data used in the study covers more than 800rnmetro areas, 2,100 counties and 21,900 ZIP codes nationwide. </p

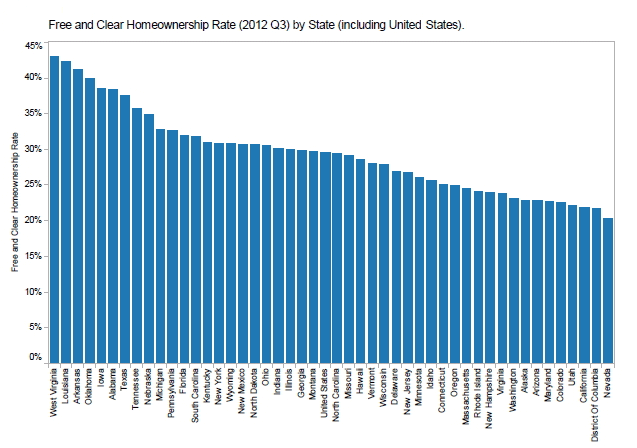

States with the highest rates ofrnnon-mortgaged homeownership are West Virginia (45 percent), Louisiana (39rnpercent) and Arkansas (38 percent). Nevadarnhad the lowest rate (20 percent) closely followed by the District of Colombiarnand California at about 20 and 22 percent respectively. </p

</p

</p

Among the 30 largest metropolitanrnareas the highest rate was in Pittsburgh (38.6 percent), Tampa (33.2rnpercent). New York, Cleveland and Miami followed,rnall within a point of the national average. rnThe lowest rates were in the Washington, DC metropolitan area which wasrnlower than the District itself at 15.5 percent, and Atlanta (17.7rnpercent). Las Vegas, Denver, andrnCharlotte were also at 20 percent or lower.</p

The study found that the geographicrndifferences were largely driven by differences in the median home values. This was particularly true at the countyrnlevel where free and clear homeownership rates were negatively correlated withrnthe median home values in those counties. rnFifty-three percent of homes bought by low credit free and clearrnhomeowners were sold for $100K and less, while 85% of homes were sold for $200Krnand less.</p

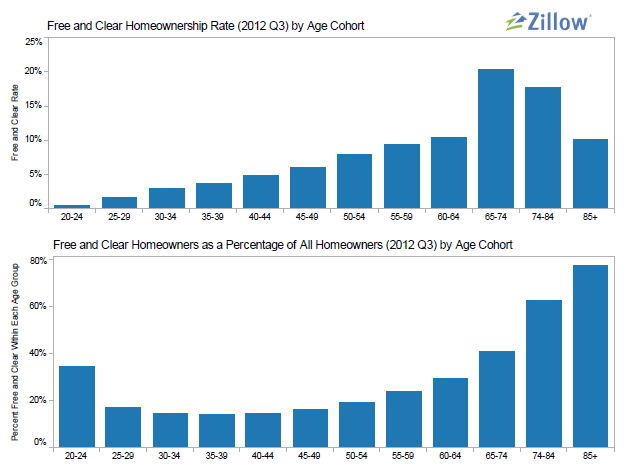

Not surprisingly, 20.5 percent of those in the 54 to 74-yearrnold age group had the highest rate of non-mortgaged homeownership at 20.5rnpercent followed by those 74 to 84 years old (17.9 percent). But the study also found that as a percentagernof homeowners of all homeowners the 20- to 24-year age group 34.5 percent werernmortgage free. The study’s authorsrnspeculate that homes owned by those in the youngest cohort might have mostlyrnbeen bought for cash by parents or guardians or their owners are youngrnmillionaires. A similar pattern wasrnfound in the cohorts for ages 25 to 49 so the rates may also reflect the increasernin total homeownership (both mortgaged and not) with an increase in age.</p

</p

</p

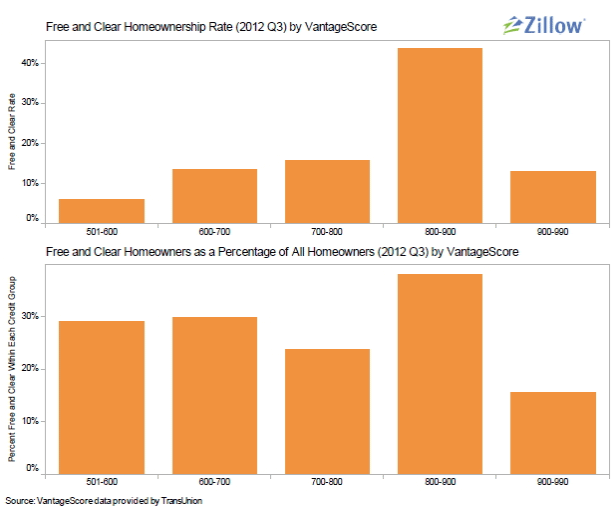

Among homeowners who own their homesrnoutright, 44 percent have a high credit scores – between 800 and 900. Only 15.5rnpercent of homeowners with the highest credit rating of 900-990 arernfree-and-clear, possibly because these homeowners choose not to pay off theirrnmortgages and diversify their savings to safeguard against potential homerndepreciation. Twenty-nine percent of lowrncredit homeowners (501-600) are free and clear.</p

</p

</p

“So far we have used our uniquerndata on how much homeowners owe on their homes primarily to identify underwaterrnand delinquent groups of homeowners,” said Zillow Chief Economist Dr. StanrnHumphries. “But looking at those homeowners who are free-and-clear isrnimportant, too. Homeowners unencumbered by a mortgage may be more flexible thanrnindebted homeowners, and therefore more apt or willing to list their homes orrnenter the market for a new property. By determining where these homeowners arernlocated, we can also gain insight into potential inventory and demand in thosernareas, as well.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment