Blog

Optimism Grows Among US Lenders in FICO Survey

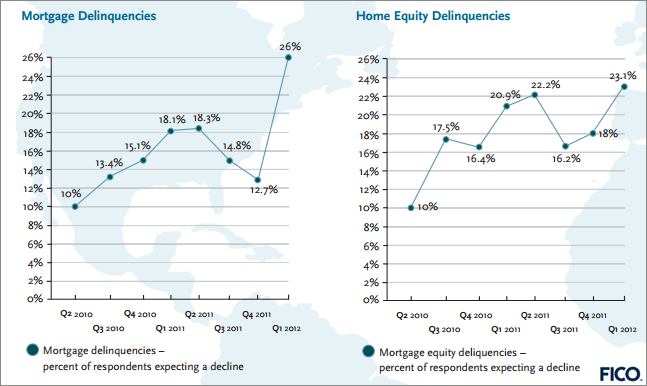

A recent survey of risk managers and other banking executives conducted by FICO indicates there is increasing optimism in the industry about the economic recovery. FICO said that only 35 percent of the 200 plus respondents in the first quarter survey conducted for FICO by the Professional Risk Managers’ International Association (PRMIA) expect mortgage delinquencies to increase over the next six months. When the same question was posed in the fourth quarter of 2011, 47 percent were expecting such increases. </p

</p

</p

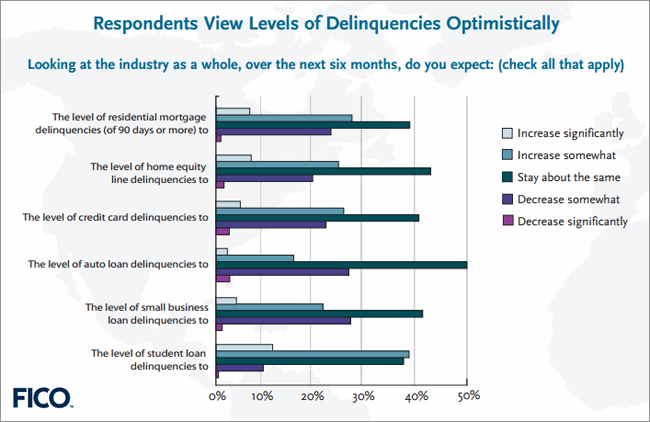

The bankers were similarly optimistic about other forms of credit with those expecting higher delinquencies on car loans dropping 13 percentage points to 20 percent. Thirty-two percent expected credit card delinquencies to increase, down from 39 percent in the fourth quarter. Delinquencies on small business loans were expected to increase by 28 percent of the risk officers compared to 39 percent in the earlier survey.</p

FICO said that not only were the survey results much more optimistic than those from last quarter, but fewer lenders expect delinquencies to rise than at any time since the survey was launched two years ago.</p

“As unemployment falls, even modestly, and four years of deleveraging begin to pay dividends, bankers are allowing themselves to feel some optimism,” said Dr. Andrew Jennings, chief analytics officer at FICO and head of FICO Labs. “Of course, we’re not out of the woods. Foreclosures continue to put pressure on home prices, and jobs are coming back slowly. But we seem to be headed in the right direction. If we can avoid major bumps in the road, such as a spillover effect from the Eurozone crisis, we should continue to see delinquencies drop.”</p

The one area of concern is student lending. Just over half of respondents expect those delinquencies to rise. This was down 16 percentage points from the 67 percent expecting increases in the last survey but remains the second highest level for this response in the eight quarters the survey has been conducted. </p

On a more granular level, however it can be seen that the banker’s optimism is of the cautious variety. The survey provided five levels of responses – delinquencies might stay the same, increase somewhat, increase significantly, decrease somewhat and decrease significantly. The plurality of respondents said they expect delinquencies to remain about the same but more respondents still expect an increase of some magnitude than expect a decrease. Still, the latter numbers are also up – 26 percent expect some decrease in mortgage delinquencies over the next six months compared to 12.7 percent in the last survey and 23.1 percent think delinquencies in home equity loans will decrease compared to 18.1 percent in Q 4.</p

</p

</p

Asked about credit availability, the respondents were also optimistic that the credit gap is closing. The majority expected the supply of credit to meet or exceed demand for all loan categories except residential mortgages. With lenders unsure about the real estate sector, 56 percent of respondents believed credit supply would not meet demand for residential mortgages. In contrast, supply was expected to meet demand for car loans by 77 percent, credit cards by 71 percent, 52 percent for small business loans, and 58 percent thought supply would meet or exceed demand for student loans.</p

In response to several “topical interest questions,” over half of the risk officers said they expected that the supply of mortgage credit over the near term would not be adequate to meet the demand and nearly half said they believe that the current generation of homeowners no longer considers their mortgage to be their most important credit obligation. The housing market will be stronger by the end of their year than it was at the beginning according to 53.1 percent of respondents but 45.5 percent said they expect more strategic defaults on mortgages in 2012 than in 2011.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment