Blog

Over Half-Million Underwater Mortgages Turned Positive in Q2

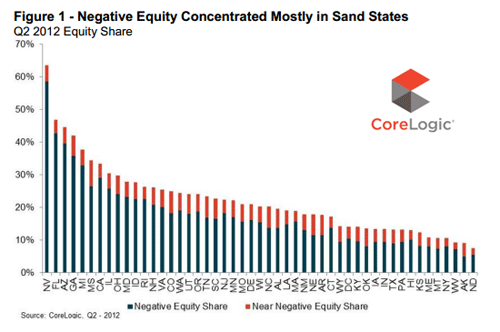

The proportion of homeowners withrnnegative or near equity in their homes declined in the second quarter of thernyear with 600,000 borrowers reaching a state of positive equity during thernquarter making a total of 1.3 million so far this year. Negative equity refers to a mortgage with arnbalance greater than the value of the home. </p

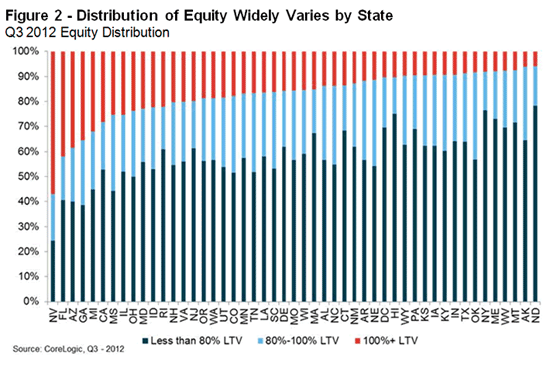

CoreLogic released a report Wednesdayrnmorning showing that 10.8 million homeowners, or 22.3 percent of those with arnmortgage, were underwater at the end of the quarter, down from 11.4 million orrn23.7 percent at the end of the first quarter. rnAn additional 2.3 borrowers* were classed as near-negative with lessrnthan 5 percent equity in their home. Twenty-sevenrnpercent of all mortgaged homes nationwide had negative and near-negative equityrnmortgages at the end of the second quarter compared to 28.5 percent a quarterrnearlier. </p

</p

</p

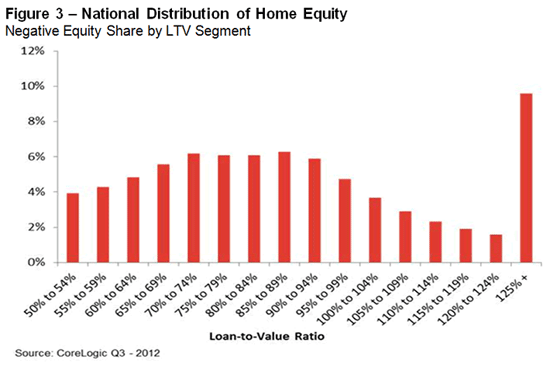

The dollar value of negative balances was $689 billion at the end ofrnthe quarter, down $2 billion from Q1. rnCoreLogic attributed the decline largely to improving house prices. Despite their negative equity position 84.9rnpercent of these homeowners continue to pay their mortgages, a slight increasernfrom 84.8 percent in the previous period. rnIn a report earlier this week, LPS noted that negative equity is,rnhowever a leading indicator of mortgage delinquencies. The CoreLogic chart below reinforces that correlation.</p

</p

</p

“The level of negative equityrncontinues to improve with more than 1.3 million households regaining a positivernequity position since the beginning of the year,” said Mark Fleming, chiefrneconomist for CoreLogic. “Surging home prices this spring and summer,rnlower levels of inventory, and declining REO sale shares are all contributingrnto the nascent housing recovery and declining negative equity.”</p

“Nearly 2 million morernborrowers in negative equity would be above water if house prices nationallyrnincreased by 5 percent,” said Anand Nallathambi, president and CEO ofrnCoreLogic. “We currently expect home prices to continue to trend up in August.rnWere this trend to be sustained we could see significant reductions in thernnumber of borrowers in negative equity by next year.”</p

CoreLogic said that 6.6 millionrnunderwater borrowers hold only a single mortgage compared to 4.2 million whornhold both first and second mortgage liens. rnThe average homeowner in the first group has average underwater equityrnof $51,000 and account for $689 billion in aggregate negative equity; those inrnthe second group are upside down by $84,000 for a total of $353 billion. </p

The bulk of negative equity isrnconcentrated in the low end of the housing market. For example, for low-to-midrnvalue homes (less than $200,000), the negative equity share is 32 percent,rnalmost twice the 17 percent for borrowers with home values greater thanrn$200,000.</p

At the end of the second quarter,rnjust over 17 million borrowers had LTVs between 80 and 125 percent which wouldrnqualify them for refinancing through the Home Affordable Refinance Programrn(HARP) under the original requirements first introduced in March 2009. Thernlifting of the 125 percent LTV cap via HARP 2.0 opens the door to another 5rnmillion borrowers. </p

</p

</p

Nevada had the highest percentage ofrnmortgaged properties in negative equity at 59 percent, followed by Florida (43rnpercent), Arizona (40 percent), Georgia (36 percent) and Michigan (33 percent).rnThese top five states combined account for 34.1 percent of the total amount ofrnnegative equity in the U.S.</p

*Elsewhere in the report CoreLogicrnstates, “As of Q2 2012, there were 1.8rnmillion borrowers who were only 5 percent underwater. If home prices continuernincreasing over the next year, these borrowers could move out of a negativernequity position” This number appears to be reflected in Nallathambi’s quote.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment