Blog

Pace of Home Price Growth Moderating: CoreLogic

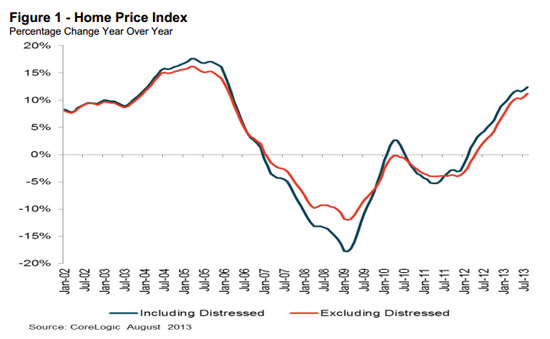

Home prices continued to increase in August, but the breakneckrnpace of earlier months moderated a bit CoreLogic said today. Its Home Price Index (HPI), includingrndistressed sales, rose 0.9 percent from July to August and was 12.4 percentrnabove the HPI in August 2012. CoreLogicrnsaid this was the 18th consecutive month in which prices were higherrnthan in the same month the year before. Whenrndistressed sales are excluded the annual increase was 11.2 percent and thernmonthly increase was 1 percent. </p

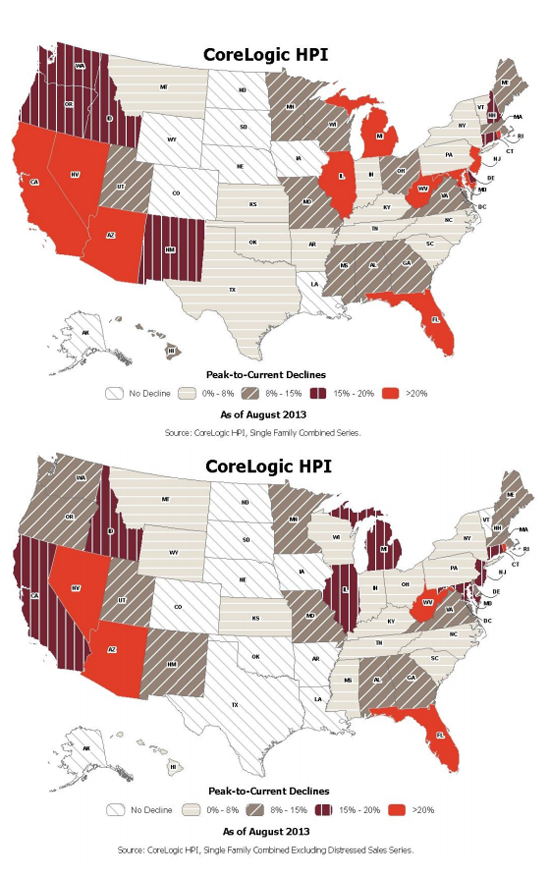

Every state posted an increase in its HPI bothrnwhether distressed sales were included or not. rnThe annual rate of increase including distressed sales was highest inrnNevada (+25.9 percent), California (+23.1rnpercent), Arizona (+16.4 percent), Wyoming (+15 percent) and Georgia (+14.8rnpercent). When distressed sales werernexcluded Nevada, California, and Wyoming still lead with increases of 23.4rnpercent, 19.8 percent, and 14 percent respectively. Utah (+13.7 percent) and Florida (+13.5rnpercent) rounded out the top five.</p

</p

</p

The Pending HPI including distressed sales isrnprojected to rise from August to September by 0.2 percent and the annualrnincrease will be 12.7 percent. Whenrndistressed sales are excluded those increases will be 0.7 percent and 12.2rnpercent. The CoreLogic Pending HPI is a proprietary metric based onrnMultiple Listing Service (MLS) data that measure price changes for the mostrnrecent month.</p

“Home price gains werernnegligible month over month in August-an expected decrease in the pace ofrnappreciation as housing enters the off-season,” said Dr. Mark Fleming,rnchief economist for CoreLogic. “While prices increased more than 12rnpercent on a year-over-year basis, the month-to-month change is more telling ofrnthis year’s late summer trend.”</p

“After a strong run, the raternof home price appreciation slowed in August. In addition to normal seasonality,rnthe recent sharp rise in mortgage rates off their historic lows was a clearrndriver behind the slowdown,” said Anand Nallathambi, president and CEO ofrnCoreLogic. “We anticipate moderate gains in home prices over the balancernof this year, supported by the recent downward trend in rates and continuedrntight supplies of homes in many markets.”</p

The five states with the largestrnpeak-to-current declines in home prices including distressed transactions, werernNevada (-41.9 percent), Florida (-37.2 percent), Arizona (-32 percent), RhodernIsland (-29.1 percent) and Michigan (-25.7 percent).</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment