Blog

Private Residential Outlays Lead Construction Spending Higher in April

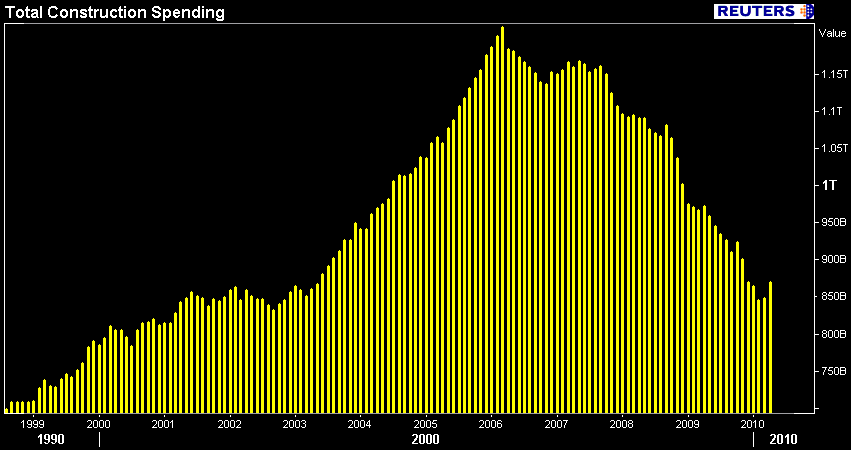

Total construction spending rose for the second straight month in April and recorded the best monthly improvement seen since August 2000, according to April 2010Construction Spending data released by the Commerce Department today.

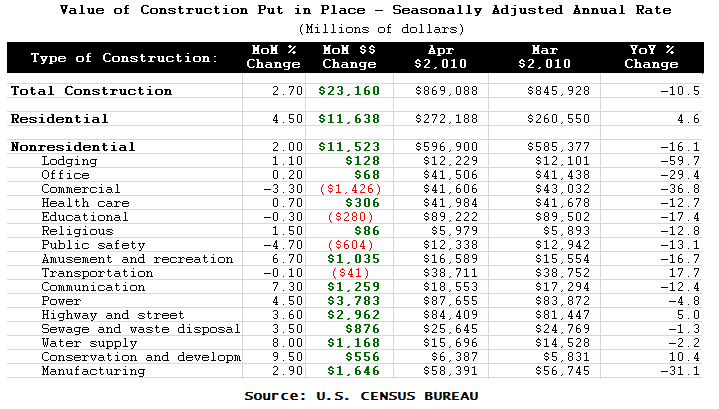

Overall construction spending, which includes public and private outlays, increased by the 2.7 percent to a seasonally adjusted annualized rate of $869.1 billion. This follows a revised for the better 0.4 percent uptick in March, whichrn was originally reported as a 0.4 percent rise.

The improvement was broad based with only a few exceptions. Commercial construction was the largest laggard in dollar terms while public safety construction outlays were the biggest percentage decliner. The expansion in public/private residential construction spending was a major upside contributor in both absolute and relative terms.

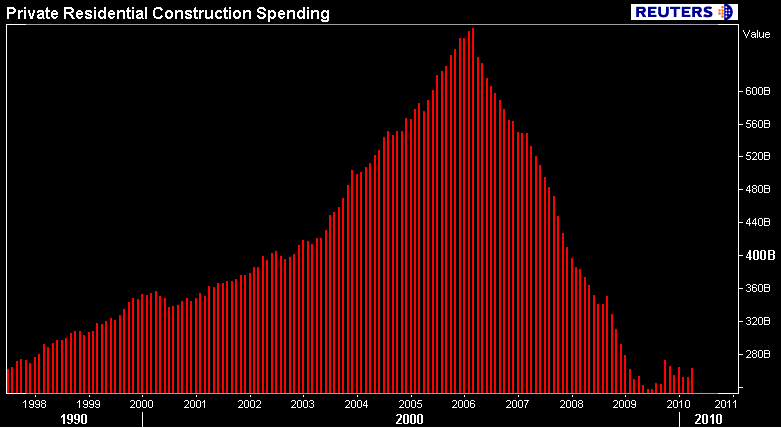

Private residential construction grew 4.4 percent at a seasonally adjusted annual rate of $263.0 billion in April.

Residential construction spending includes remodeling, additions, andrnmajor replacements to owner occupied properties subsequent to completionrn of original building. It includes construction of additional housingunits in existing residential structures, finishing of basements andattics, modernization of kitchens, bathrooms, etc. Also included areimprovements outside of residential structures, such as the addition ofswimming pools and garages, and replacement of major equipment itemssuch as water heaters, furnaces and central air-conditioners.Maintenance and repair work is not included.

Plain andrn Simple: this reportcovers a broad spectrum of residential construction spending but doesnot provide countable evidence of how much NEW home building took placein the previous month.

As you can see from the chart below, private residential spending is still at anemic levels.

Construction Spending data is one of the last economic indicators to be released on a monthly basis. This means the market has already been given multiple opportunities to react to more timely information.

Ahead of this release we already knew single family housing starts rose 10.2 percent in April . We already learned that New Home Sales, which report on new home sales contracts signed, surpassed expectations as the tax credit expired. And on top of that we've already been able to digest news that covered May, which indicated home builders were feeling more confident about activity in the next six months.

Basically this backward looking dataset is old news. It is no suprise to anyone that residential construction spending expanded before the homebuyer tax credit expired. Did we learn anything new today? Nope. The fate of housing is still up in the air. READ MORE ABOUT THE HEALTH OF HOUSING</a

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment