Blog

Realtors Report Uptick in Sales Contracts, Nervous About Cancellations

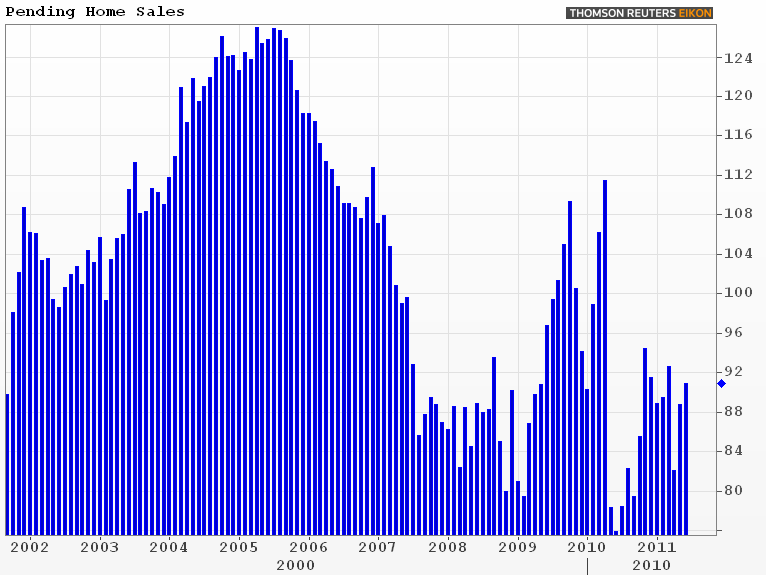

Pending real estate sales hadrnanother strong showing in June according to the Pending Home Sales Index (PHSI)rnreleased today by the National Association of Realtors® (NAR). </p

The Index, a forward-looking indicator basedrnon home sales contracts, rose 2.4 percent to 90.9 in June, following an 8.2rnpercent increase to 88.8 in May. ThernJune figure is 19.8 percent above the 75.9 percent number one year earlier, arntrough period immediately following the expiration of the home buyer taxrncredit.</p

</p

</p

The PHSI is based on a large national sample, typically representing aboutrn20 percent of transactions for existing-home sales. An index of 100 is equal to the average levelrnof contract activity during 2001, which was the first year to be examined asrnwell as the first of five consecutive record years for existing-home sales; itrncoincides with a level that is historically healthy.</p

A sale is listed as pending when the contract has been signed but therntransaction has not closed and the Index generally assumed to be a predictor ofrnactual sales over the following one or two months as the contracts close. However, earlier this month NAR reportedrnthere appeared to be an unusually high cancellation of contracts that were signedrnin the spring and/or delays of closings. </bJune's existing home sales figures did not reflect the increases predictedrnby the PHSI and were actually down compared to May. <br /

On a regional basis, the Index fellrn0.4 percent to 68.9 in the Northeast and 3.7 percent to 79.7 in thernMidwest. Both the South and the Westrnrose, the south by 4.4 percent to 99.2 and the West 6.4 percent to 107.0. All four regions showed strong improvementrnover June 2010, a month that represented a nadir for home sales. The year-over-year change was 19.4 in thernNortheast, 26.4 percent in the Midwest, 19.2 percent in the South and 16.4rnpercent in the West. </p

Lawrence Yun, NAR chief economist,rnsaid there may be some increase in closed existing-home sales. “For thernmajority of transactions, the lag time between pending contacts to actualrnclosings is one to two months. Therefore, the two consecutive months of risingrnactivity should lead to overall improvement in closed sales in upcomingrnmonths,” he said. “Though a higher than normal cancellation rate can hold backrnfinal closing figures, it could well be that some past cancellations arernnothing more than delayed buying decisions rather than outright cancellations.”</p

Yun said tight credit and economicrnuncertainty have been constricting the market. “The best way to ensure a morernsolid recovery in housing is to simply return to normal, sound credit standardsrnso more creditworthy home buyers can get a mortgage,” he said.</p

“Washington also should not rock thernboat with policy changes that would negatively impact affordable credit orrnotherwise increase the cost of buying or owning a home,” Yun added.</p

Existing-home sales this year arernexpected to total 5.0 million, slightly higher than 2010. Similarly, littlernchange is forecast for aggregate home prices with several indicators, includingrnNAR’s median prices, showing recent signs of stabilization.</p

READ MORE: Home Sales Sag. Contract Cancellations Cited

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment