Blog

Realtors See Broad Based Stabilization in Housing Demand

The National Association of Realtors today released Existing Home Sales data for March 2010.

From the release:

Buyers responding to the homebuyer tax credit and favorableaffordability conditions boosted existing-home sales in March, markingthe beginning of an expected spring surge, according to the NationalAssociation of Realtors.

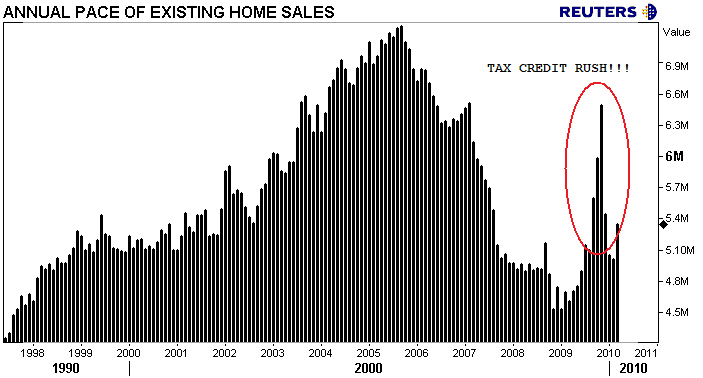

Existing-home sales, which are completed transactions that includesingle-family, townhomes, condominiums and co-ops, rose 6.8 percent to arn seasonally adjusted annual rate of 5.35 million units in March from5.01 million in February, and are 16.1 percent above the 4.61million-unit level in March 2009.

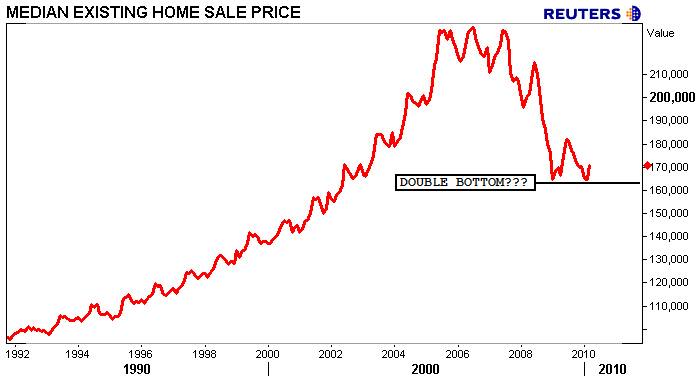

Single-family home sales rose 7.3 percent to a seasonally adjustedannual rate of 4.68 million in March from a level of 4.36 million inFebruary, and are 13.3 percent above the 4.13 million level a year ago.The median existing single-family home price was $170,700 in March, up0.6 percent from March 2009.

Existingrn condominium and co-op sales increased 3.1 percent to a seasonallyadjusted annual rate of 670,000 in March from 650,000 in February, andare 39.3 percent higher than the 481,000-unit level in March 2009. Themedian existing condo price5 was $170,600 in March, which is 0.7 percentrn below a year ago.

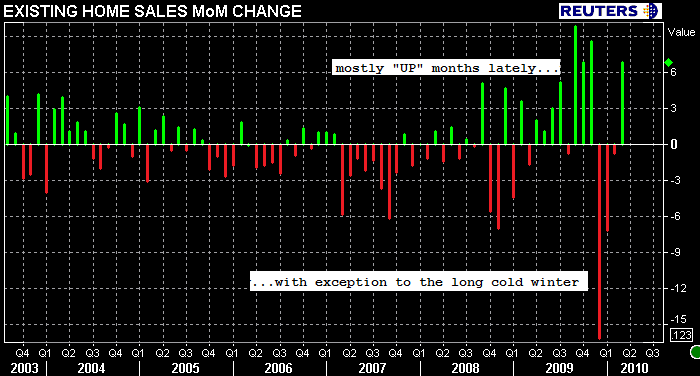

The chart below illustrates a pick up in home buyer demand during the spring/summer/early fall months of 2009, which happens to coincide with the expiration of the original first time homebuyer tax credit, followed by a drastic decline in the winter months all the way into spring 2010.

Single-family median prices rose in14 out of 20 metropolitan statistical areas reported in March incomparison with a year earlier. Five metro areas experienceddouble-digit increases, including San Diego, St. Louis and Boston.

Regionally, existing-home sales in the Northeast increased 6.0 percent to an annual level of 890,000 in Marchand are 25.4 percent higher than a year ago. The median price in theNortheast was $249,800, up 8.9 percent from March 2009.

Existing-homern sales in the Midwest rose 7.2 percent in March to a pace of 1.19million and are 15.5 percent above March 2009. The median price in theMidwest was $139,300, up 0.2 percent from a year ago.

In theSouth, existing-home sales increased 7.1 percent to an annual level of1.97 million in March and are 13.9 percent higher than a year ago. Themedian price in the South was $154,800, up 5.2 percent from March 2009.

Existing-homern sales in the West rose 6.6 percent to an annual rate of 1.30 million inrn March and are 14.0 percent above March 2009. The median price in theWest was $209,400, down 7.9 percent from a year ago.

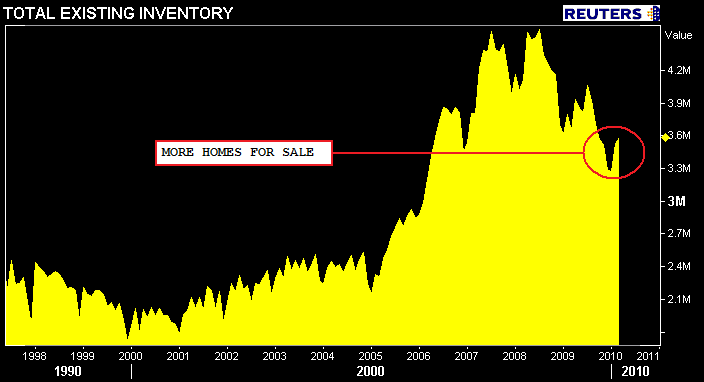

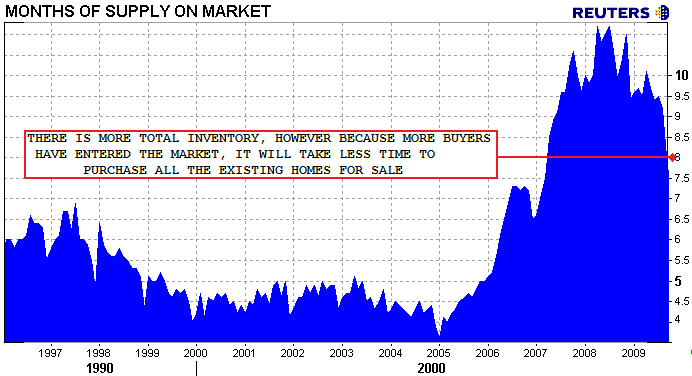

Total housing inventory at the end of March rose 1.5 percent to 3.58million existing homes available for sale. Raw unsold inventory is 1.8 percent below a year ago, and is21.7 percent below the record of 4.58 million in July 2008.

This represents an 8.0-monthrn supply at the current sales pace, down from an 8.5-month supply inFebruary.

REMEMBER: The annual rate for a particular month represents what the total number of actual sales for a year would be if the relative pace for that month were maintained for 12 consecutive months. See comments on chart….

Lawrence Yun, NAR chief economist, said it is encouraging to see a broadrn home sales recovery in nearly every part of the country, with twoimportant underlying trends. “Sales have been above year-ago levels fornine straight months, and inventory has trended down from year-agolevels for 20 months running,” he said.

“The home buyer tax credit hasbeen a resounding success as these underlying trends point to a broadstabilization in home prices. This is preserving perhaps $1 trillion inlargely middle class housing wealth that may have been wiped out withoutrn the housing stimulus measure.”

“Foreclosures have been feeding into the inventory pipeline at a fairly steady pace and are being absorbed manageably,” Yun said. “In fact, foreclosures are selling quickly, especially in the lower price ranges that are attractive to first-time home buyers.”

“With home values stabilizing, a revival in home buying confidence will likely help the housing market get back on its feet even as the tax credit impact disappears,” Yun said.

————————————-

WOW. The data seems to speak for itself. Plus the NAR is really excited!!! Or maybe the spike in “demand” was really just delayed closings hitting all at once in March?

PLEASE TELL US IF YOU HAVE SIMILIAR SENTIMENTS AS THE NAR

RE: the status of “home buying confidence” and the inventory pipeline

That is largely dependent on what banks do with REO (READ MORE) and whether or not there are SHADOW BUYERS out there.

I also discuss the idea that the MBA is missing out on mortgage applications. READ MORE

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment