Blog

Recap and Charts: May Existing Home Sales

The National Association of Realtors today released Existing Home Sales data for May 2010.</p

Excerpts From The Release…</p

Existing-home sales remained at elevated levels in May on buyer response to the tax credit, characterized by stabilizing home prices and historically low mortgage interest rates, according to the National Association of Realtors®. </p

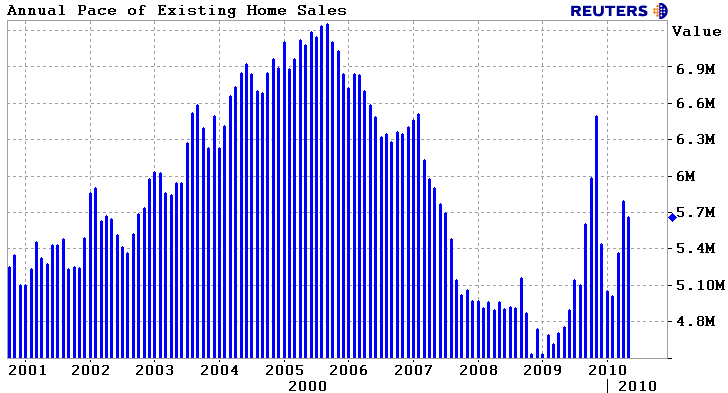

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, were at a seasonally adjusted annual rate of 5.66 million units in May, down 2.2 percent from an upwardly revised surge of 5.79 million units in April. </p

May 2010 closings are 19.2 percent above the 4.75 million-unit level in May 2009; April sales were revised to show an 8.0 percent monthly gain.</p

THIS NEWS DISAPPOINTED MARKETS</p

Single-family home sales declined 1.6 percent to a seasonally adjusted annual rate of 4.98 million in May from a pace of 5.06 million in April,rn but are 17.5 percent above the 4.24 million level in May 2009. </p

Existingrn condominium and co-op sales fell 6.8 percent to a seasonally adjusted annual rate of 680,000 in May from 730,000 in April, but are 32.6 percent above the 513,000-unit pace in May 2009.</p

A parallel NAR practitioner survey shows first-time buyers purchased 46 percent of homes in May, down from 49 percent in April. Investors accounted for 14 percent of transactions in May compared with 15 percent in April; the remaining sales were to repeat buyers. All-cashrn sales were at 25 percent in May, edging down from a 26 percent share inrn April.</p

</p

</p

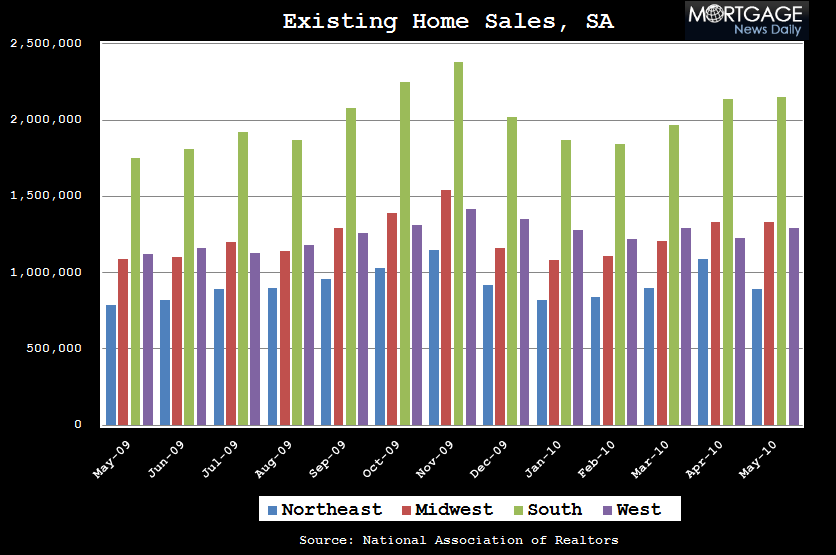

Regionally, existing-home sales in the Northeast fell 18.3 percent to anrn annual level of 890,000 in May from a surge in April, but are 12.7 percent higher than a year ago. The median price in the Northeast was $240,200, down 2.2 percent from May 2009.</p

Existing-home sales in the Midwest were unchanged in May at a pace of 1.33 million and are 22.0 percent above May 2009. The median price in the Midwest was $150,700, up 2.2 percent from a year ago.rn</p

In the South, existing-home sales increased 0.5 percent to an annual level of 2.15 million in May and are 22.9 percent above a year ago. The median price in the South was $159,000, up 1.0 percent from May 2009.</p

Existing-home sales in the West rose 4.9 percent to an annual rate ofrn 1.29 million in May and are 15.2 percent higher than May 2009. The median price in the West was $221,300, up 7.4 percent from a year ago.</p

</p

</p

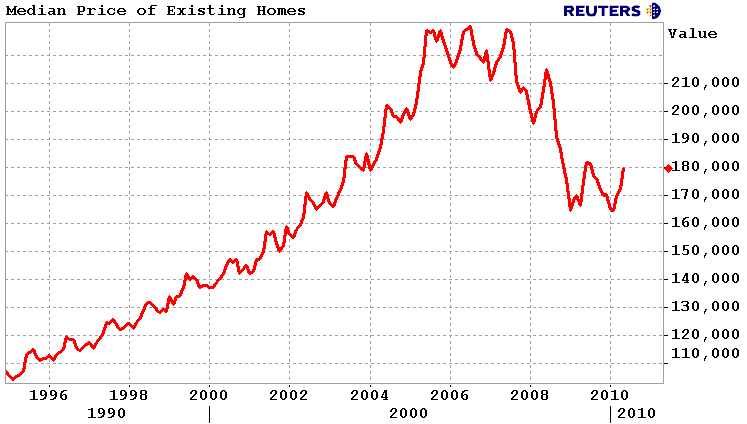

The national median existing-home price for all housing types was $179,600 in May, up 2.7 percent from May 2009. Distressed homes slipped to 31 percent of sales last month, compared with 33 percent in April; itrn was also 33 percent in May 2009.</p

</p

</p

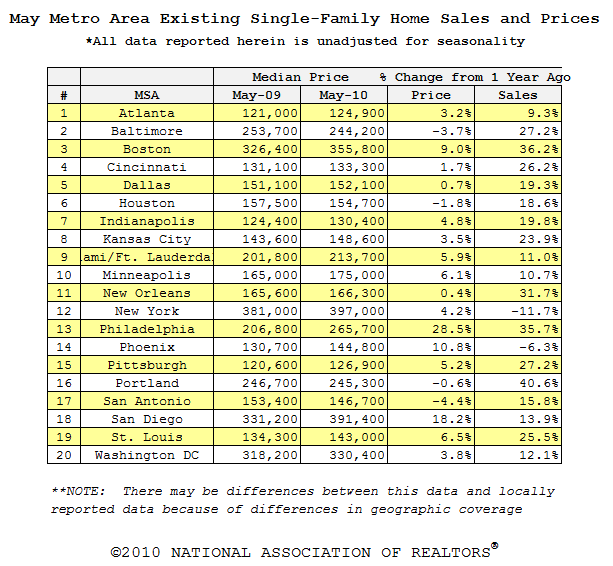

Single-family median existing-home prices were higher in 16 out of 20 metropolitan statistical areas reported in May from a year ago. In addition, existing single-family home sales rose in 18 of the 20 areas from May 2009. The median existing condo price was $181,300 in May, up 3.4 percent from a year ago.</p

</p

</p

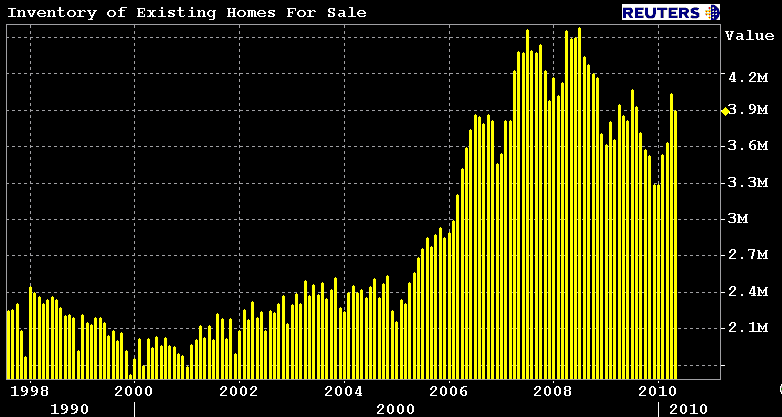

Total housing inventory at the end of May fell 3.4 percent to 3.89 million existing homes available for sale, which represents an 8.3-month supply at the current sales pace, compared withrn an 8.4-month supply in April. Raw unsold inventory is 1.1 percent abovern a year ago, but is still 14.9 percent below the record of 4.58 million in July 2008.</p

</p

</p

Lawrence Yun, NAR chief economist, said he expects one more month of elevated home sales:</p

“We are witnessing the ongoing effects of the home buyer tax credit, which we’ll also see in June real estate closings,” he said.</p

But he is worried that many borrowers won't make it to closing:</p

“However, approximately 180,000 home buyers who signed a contract in good faith to receive the tax credit may not be able to finalize by the end of June due to delays in the mortgage process, particularly for short sales…In addition, many potential sales are being delayed by an interruption in the National Flood Insurance Program. Florida and Louisiana, also impacted by the oil spill, have the highest percentage of homes that require flood insurance.”

NAR is frantically pushing Senate amendments to extend the home buyer tax credit closing deadline through September 30 for contracts written by April 30, and to renew the flood insurance program. STATUS CHECK

Pending home sales are expected to decline notably in May and June from the spring surge, but Yun added that job growth and a manageable level of foreclosures are keys to sales and price performance during the second half of the year.</p

Besides the horribly slow short sale process, THISrn IS WHY lenders are taking longer to process loan applications. Every “I” must be dotted and every “T” must be crossed.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment