Blog

Report Finds Fault with Freddie Mac, FHFA Handling of Servicer Complaint Process

Freddie Mac owned or guaranteed 10.6 million mortgagesrnthat were being serviced by third parties at the end of 2012. Servicer responsibilities include handing ofrnconsumer complaints but if these complaints become serious enough to fall intornthe category of “escalated cases” there are special procedures tornhandle them. According to the FederalrnHousing Finance Agency’s (FHFA) Servicing Alignment Initiative (SAI) servicers are required to report on the escalated casesrnthey receive and resolve those cases within 30 days. Additionally, FreddiernMac’s Servicing Guide specifically requires servicers to report monthly on thernescalated cases they receive. </p

During the 14 month period ended November 30, 2012rnFreddie Mac received 34,000 and FHFA received 565 consumer complaints about thernservicers that fell into the category of “escalated cases” involving:</p<ul class="unIndentedList"<liForeclosure actionsrninitiated or continued in violation of Fannie Mae or Freddie guidelines;</li<liAllegations of fraudulent servicing practices;</li<liComplaints that the borrower was not appropriately evaluated for or inappropriately denied a foreclosure alternative;</li<liThreats of litigation; or</li<liViolations of Fannie Mae or Freddie Mac policy timeframes for borrower outreach,rnevaluation, or response.</li</ul

Inrnaddition to the requirement that servicers must handle escalated cases withinrn30 days, servicers must also satisfy the following requirements when handingrnescalated cases:</p<ul class="unIndentedList"<liEnsure that staff resolving an escalated case are independent from the personnel that initially handledrnthe borrower's request forrnassistance;</li<liHave written procedures and sufficient, adequately trained staff to track and respond tornescalated cases;</li<liRegularly review and assess the adequacy of internal controls and procedures in connectionrnwith servicing activities; and</li<liTake remedial steps if any deficiencies are identified as a result of their review ofrninternal controls, and formally documentrnthe results and make them available to the enterprise upon request.</li</ul

According to the SAI, an escalated case is consideredrnresolved when the complaint has been resolved in accordance with thernguidelines, has been evaluated to require no change to the originalrndetermination or a proposed solution has been identified and the proposedrnsolution appropriately documented and the first action taken to implement thernresolution.</p

FHFA’srnOffice of Inspector General (OIG) recently undertook a performance audit to assessrnFreddie Mac’s controls over servicer handing of escalated cases. OIG found that most of Freddie Mac’srnservicers have not complied with escalated case reporting requirements. </p

Among Freddie Mac’s eight largest servicers-which serviced nearlyrn70% of Freddie Mac’s 10.6 million mortgages-four (Bank of America, CitiMortgage,rnProvident, and Wells Fargo Bank) did not report any escalated cases to Freddie Mac despite handling more than 20,000 such cases during the 14-month period between October 2011 and November 2012. </p

Further, Freddie Mac data on all of its servicers reveals that about 98% (1,179 of 1,207)rnincluding four of the largest did notrnreport any escalated cases as of December 2012. Although Freddie Mac officials told us thatrnreports are only required of servicers with escalated cases-and, thus, the lack of reporting mayrnindicate that there were no escalated cases to report-it is highly unlikely that 98% of its servicers had no escalated cases to report given the 6.6 millionrnloans that they manage. </p

Reasons for not reporting given by the four large non-reporting servicers includedrnbeing unaware of the requirement or that the information had not beenrnrequested. One servicer stated it had informed Freddie Mac of internal issues that were delaying thernservicer’s implementationrnof the SAI.</p

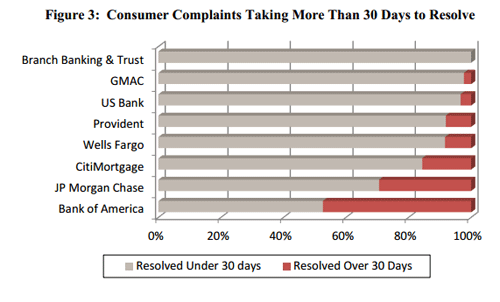

Freddie Mac’s eight largest servicers handled 26,196 escalatedrncases during the 14 monthrnperiod and resolved 25,528rnof them during this periodrnbut 21% of the resolved cases exceeded the 30-day time limit. rnIn addition, of the 668 unresolvedrncases as of November 30, 2012,rn398 (or 60%) had notrnbeen resolved within the required 30 days.</p

Among the eight largest servicers, only Branch Banking & Trust Corporation (BB&T) resolved all of its escalated cases within 30 days, but that bank had significantly fewer cases to process. The worst performing servicer, Bank of America, handled 4,404 escalated cases and resolvedrn3,950 of them. Bank of America took an average of 52 days to resolve its cases, and the longest casernrequired 392 days to resolve. </p

</p

</p

Servicers are required to report the resolution of escalated cases, using 13rnresolution categories</bthat include bankruptcy, initiation of some type of modification, or a final resolutionrnsuch as a short sale, completed foreclosure, or loan payoff. </p

OIG found notablerninstances of inconsistencies and inaccuracies among the categories used by thernlargest eight servicers to track the proposed resolutions in the servicingrnsystem. For example, instead of 13, one servicer used 61 different categories to identify the types of resolutions of itsrnescalated cases.rnInrnaddition, about 2,000 (or 8%) of the 25,528rncases resolved by Freddie Mac’s eight largest servicers between October 1, 2011, and November 30, 2012, lacked a resolution category, as required. </p

OIG also found that Freddie Mac’s oversight did notrnadequately address escalated cases. Outrnof 38 onsite operational reviews of the largest servicers Freddie Mac made onlyrnone finding regarding handling of escalated cases. </p

Whereas Fannie Mae has implemented testing proceduresrnwith respect to its servicers,rnFreddie Mac has not. Lack of testing procedures reduces the likelihood of finding servicerrnnoncompliance with escalated case requirements.rn</p

OIG also found that Freddie Mac’s Servicing Guide lackrnperformance-based incentives such as penalties related to escalated cases andrnthat Freddie Mac did not use the escalated case information it did receive tornidentify areas of elevated risk. </p

The report also finds that FHFA oversight had failed tornidentify noncompliance with consumer complaint requirements.</p

In August 2012, FHFA initiated its first examination of Freddie Mac’s implementation of the SAIrnwhich included, among other things,rnFreddie Mac’s monitoring of the servicers’ compliance with the SAI. OIG found in interviews with FHFA officials thatrntheir examination team was unaware that almost all of Freddie Mac’s servicers failed to report escalated cases to Freddie Mac. The examination team did not perform independent testing ofrnservicer compliance, but instead relied on internal reports produced by Freddie Mac related torntesting servicers’ compliance with implementation of the SAI. The examination team notedrnthat the enterprise’s reports did not identify any problems with servicers failing to report. As OIG had found, Freddie Macrnwas not testing servicers’ compliance withrnrequirements for handlingrnescalated cases, which explains why Freddie Mac’s reports- with one exception-did not contain instances of reportingrnviolations. FHFA’s failure to conductrnindependent testing of servicer compliance resulted in its reliance on incomplete data supplied by Freddie Macrnandrnfaulty conclusions about Freddie Mac’s implementation and oversight of the SAI.</p

Finally, FHFA did not publish guidance for examiningrnFreddie Mac’s implementation of FHFArndirectives, including the SAI. Specifically, FHFA’s Supervisory Guide, related advisory bulletins, and the Supervision Handbook do not contain guidance as to how to test enterprise compliance with FHFA directives. </p

OIG concluded that FHFA developed the SAI as part of an effort to keep homeowners in theirrnhomes; help servicers interact with delinquent borrowers in a timely, efficient, and fair way;rnand make enterprise lossrnmitigation programs more effective. These goals are at risk of not being achievedrnbecause none of the parties have adequately fulfilled their respective roles relative to addressing and resolving escalated consumer complaints in arntimely and consistent manner. </p

FHFA must take immediaternaction to improve servicer reporting which will in turn help the agency to ensurernthat escalated cases are resolved before homeowners and the enterprises unnecessarily suffer adverse consequences such as foreclosure.rn</p

OIG recommends that servicersrnbe required to report consumer complaint information, to include that nornescalated complaints have been received, onrna monthly basis and that escalated complains are resolved withinrn30 days. Servicers should also bernrequired to categorize informationrnin accordance with the resolution categories in the Servicing Guide.</p

To enhance Freddie Mac’s oversight of its servicers, FHFA shouldrnperform supervisory reviewrnandrnfollow-up to ensure that Freddie Mac included testing of servicers’ performance for handling and reporting escalated cases,rnidentifies and addresses servicer operational challenges with implementingrnthe escalated case requirements,rnand establishes penalties for servicers’ lackrnof reporting escalated cases. FHFA should also expand the servicer scorecard and servicer performance evaluations to include reporting of escalated cases and communicate information onrnescalated cases to its internal staff.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment