Blog

Residential Construction Spending Declines in June. Federal Outlays Increase

The Census Bureau today released Construction Spending for June 2010.</p

Residential construction spending includes remodeling, additions, and major replacements to owner occupied properties subsequent to completionrn of original building. It includes construction of additional housing units in existing residential structures, finishing of basements and attics, modernization of kitchens, bathrooms, etc. Also included are improvements outside of residential structures, such as the addition of swimming pools and garages, and replacement of major equipment items such as water heaters, furnaces and central air-conditioners. Maintenance and repair work is not included. </p

This report covers a broad spectrum of residential construction spending but does not provide countable data on how much new home building occured in the previous month. Furthermore, Constructionrn Spending data is one of the last backward looking economic indicators to be released on arn monthly basis. This means the market has already been given multiple opportunities to react to more timely information.</p

For example, ahead of this release we had already learned that New Home Sales Rebounded from Revised Record Low in June, we had already heard that Existing Home Inventory Moved Higher, and we already knew Housing Starts Went Stagnate. On top of that, Home Builders Were Less Confident in June. These headlines are not the building blocks for a strong structural recovery in housing. So it was no surprise when the Census Department today told us private residential construction declined further in June…</p

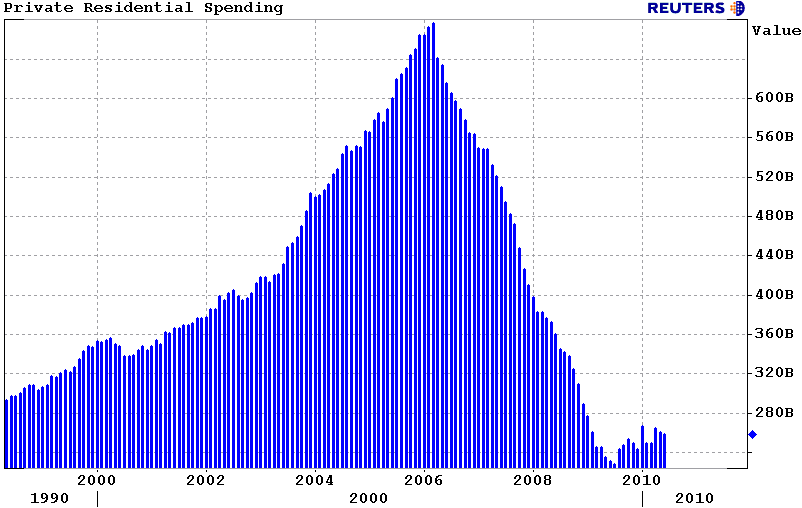

Residential construction was at a seasonally adjusted annual rate of $258.3 billion, 0.8% below the revised May estimate of $260.3 billion. Private Residential Construction continues to hover near a record low level….same old story!</p

</p

</p

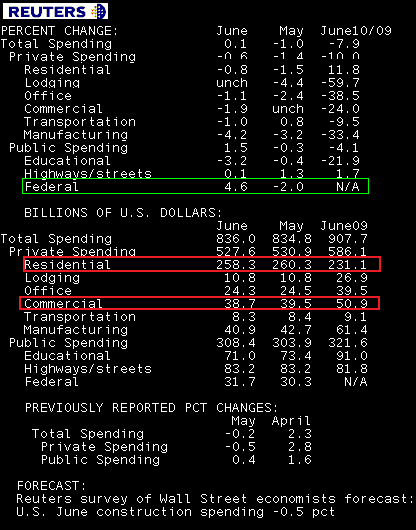

Below is a recap of the entire report. Overall construction spending, which includes private and public spending, rose 0.1% thanks to a 4.6% increase in Federal spending. The private sector declined across the board, not including an unchanged month over month read in Lodging. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment