Blog

RPX: Investors Amassing Billions to Invest in Distressed Properties

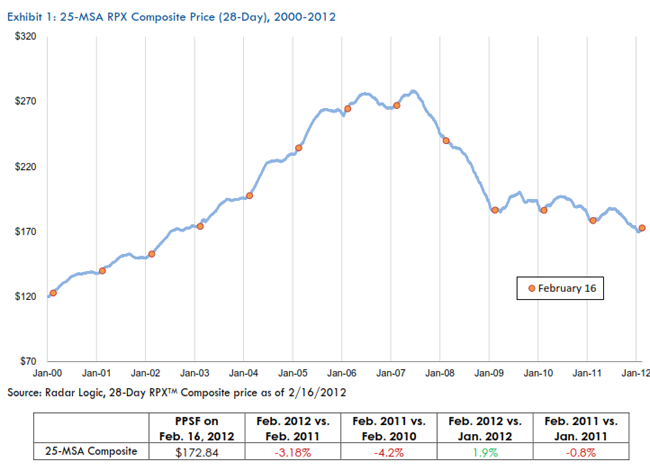

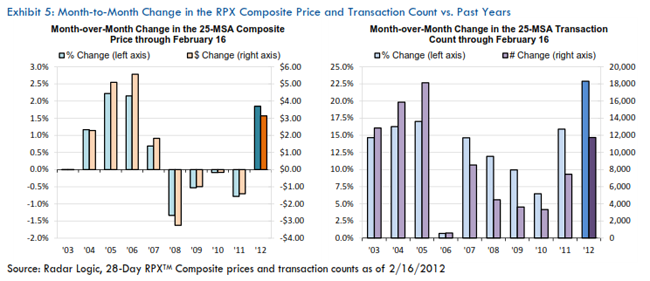

The RPX Monthly Housing Market Report says that both home sales and home prices increased strongly in the month ended February 16. The RPX Composite Price which tracks home prices in 25 major metropolitan areas was up 1.9 percent over the previous month, a change which RPX called large relative to changes of the same period in recent years. There was also a strong increase in home sale transactions in those metropolitan areas.</p

The RPX composite ended the period at $172.84 per square foot compared to $169.75 per square foot in January. It is only fair to mention that January set the lowest price for the Composite since July 2002. February’s Composite price is still 3.18 percent lower than it was in February 2011.</p

</p

</p

</p

</p

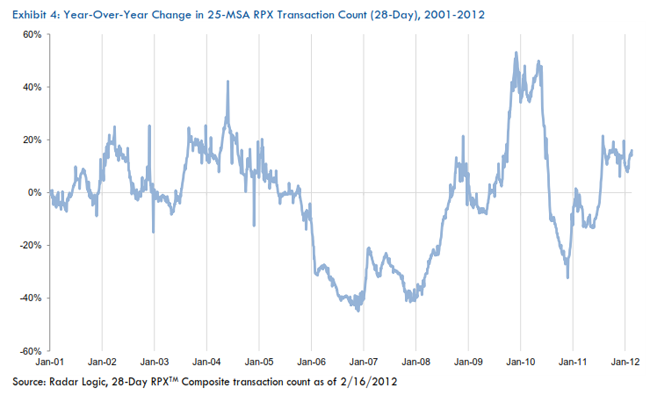

Transactions in the 25 MSAs increased 22.9 percent on a month over month basis through February 16. RPX says that February is typically a strong month but the increase this time was particularly robust. Transactions are up 16 percent over those one year earlier.</p

</p

</p

RPX credits two factors for the strong sales. One, the warm weather, may have merely moved the market forward in time so February’s strength may be compensated by weakness later in the buying season.</p

The second factor is of greater import. The report notes that since 2009 there has been a rapid increase in home sales to corporate investors especially in markets hard-hit by the housing crisis. In Miami purchases by corporate investors increased 714 percent compared to an 184 percent increase in total sales. In Las Vegas the increase was 1,300 percent compared to an overall increase of 264 percent. Corporate purchases were up in other cities as well: New York was up126 percent against 69 percent; Los Angeles 421 percent v 36 percent. </p

The impact of this corporate presence has been mixed. Because investors tend to buy properties at a discount from lenders this has had an initial negative impact on prices which is then carried forward by depressing the comps used for market sales. On the other hand, investor purchases have helped put a floor under housing prices, particularly at the low end of the market. Over the last year RPX motivated sale prices which track sales of lender owned real estate have declined 0.7 percent while all prices are down 5.2 percent. One could argue that investors have stabilized the distressed sale market. </p

RPX says that now, with home prices at such low levels and rents rapidly approaching all time high levels, large institutional investors are raising funds with which to purchase thousands of mostly distressed properties to convert to rentals, something which the government is facilitating as a matter of policy. “These large investors are amassing hundreds of millions to billions of dollars to deploy in the rapid acquisition of thousands of residential properties.” RPX said some buying has begun but most of the capital is yet to be deployed and, when it is it will have to be done quickly so ‘these investors are likely to be less price sensitive than traditional buyers.”</p

This is likely to have a positive impact on seller psychology and could help, RPX says, to strengthen aggregate home prices to a greater extent than the actual contribution of the investors to the market would suggest. Sellers, when they see investors buying, may decide to hold or raise prices.</p

This effect however could be short lived, as once the capital in spent or prices have risen to a point that investors have less incentive to buy the market could return to prior levels. Investors will not drive a lasting recovery in home prices.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment