Blog

Sales Skewed Toward Higher Priced Homes

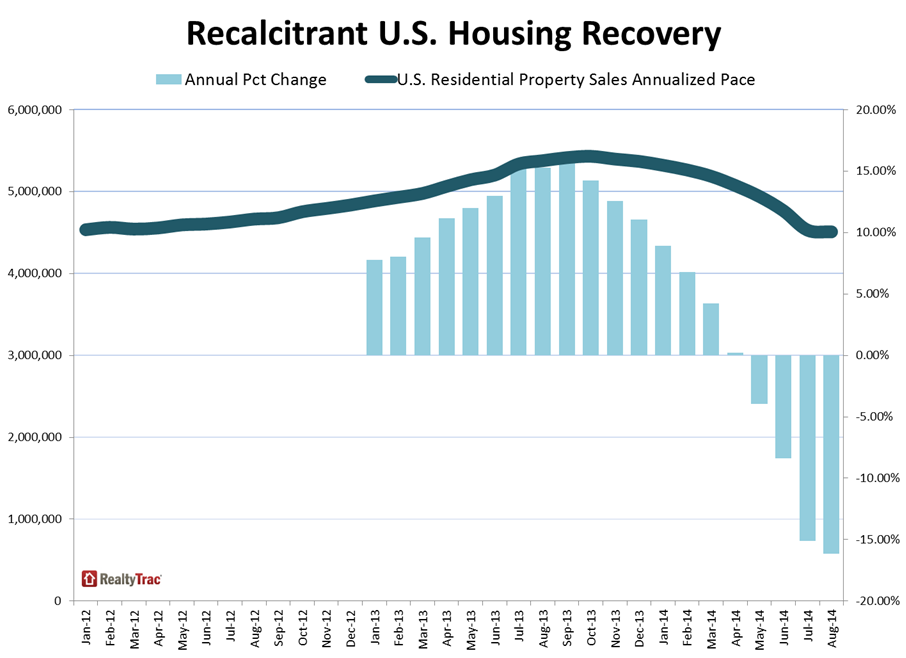

RealtyTrac estimated on Thursday thatrnsales of residential property including single family homes, condominiums, andrntownhomes set an annual pace of 4.51 million units in August. This is down .05 percent from July and is 16rnpercent below the pace one year earlier. rnThe California company said it was the fourth consecutive month whenrnannualized sales were lower than the same month the previous year. </p

</p

</p

There are many more estimates of homernprice trends each month than of home sales but the handful of private companiesrnand public agencies that provide sale data all use different data sets andrncriteria. The National Association ofrnRealtors (NAR) reports on sales of existing homes while the Census Bureaurncovers sales of newly constructed homes. rnThe Mortgage Bankers Association (MBA) also estimates new home salesrnbased on the applications its members receive for mortgages to finance suchrnpurchases. It is thus difficult to drawrnany conclusions about the accuracy of any of the estimates.</p

However, for comparison purposes, NAR thisrnweek put the pace of residential sales in August at 5.05 million, down 1.8rnpercent from July. The Census reported anrn18 percent monthly increase in the pace of new home sales to a six year high ofrn504,000 units while MBA estimated those sales at 424,000, a 9 percent drop fromrnJuly.</p

Pricesrncontinue to rise but the rate of increase is moderating. The median price of a property sold inrnAugust, both distressed and market rate, was $195,000, a 3 percent increasernfrom July and up 15 percent from a year earlier. The August median was a six-year high.</p

Distressed sales (short sales,rnbank-owned real estate or sales at foreclosure auction) accounted for 13.5rnpercent of properties sold in August, up from 10.7 percent in July but 8 basisrnpoints below distressed sales in August 2013. rnThe median price of distressed sales was $129,000, 15 percent higherrnthan a year earlier but well below the $205,000 median price of equity sales.</p

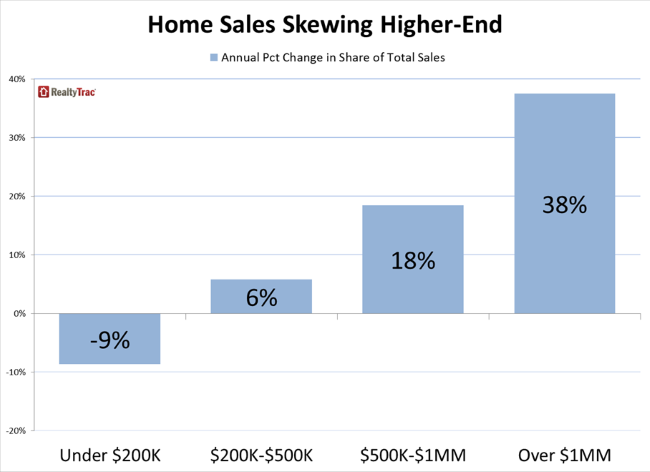

Thernhigher median price can be attributed in part to a skewing of the market towardrnhigher end properties, again in part to declining levels of distressedrnsales. Thernshare of sales in the $200,000-and-below price range was down 9 percent from arnyear ago, while the share of sales in the above-$200,000 price range increasedrn10 percent from a year ago. </p

</p

</p

A closer look at the $200,000 plusrnsegment shows that sales in the $500,000-to-$1 million price range increased 18rnpercent from a year ago while the share of sales in the over-$1 million pricernrange increased 38 percent. Combinedrnthis is an increase of 23 percent in the share of sales above $500,000.</p

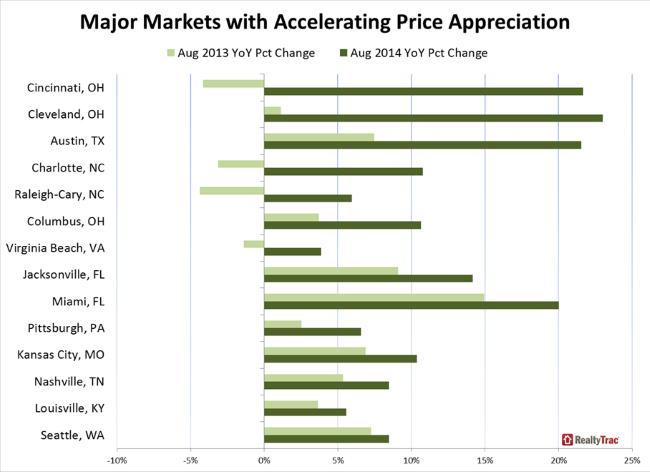

“Higher-end properties are taking uprna bigger share of a smaller home sales pie, boosting the median home pricernnationwide higher even as home price appreciation slows to single digits inrnmany of last year’s red-hot local housing markets,” said Daren Blomquist, vicernpresident at RealtyTrac. “On the other hand, markets where large institutionalrninvestors and other buyers have not picked clean lower-priced inventory arerncontinuing to see strong, double-digit increases in median home prices.”</p

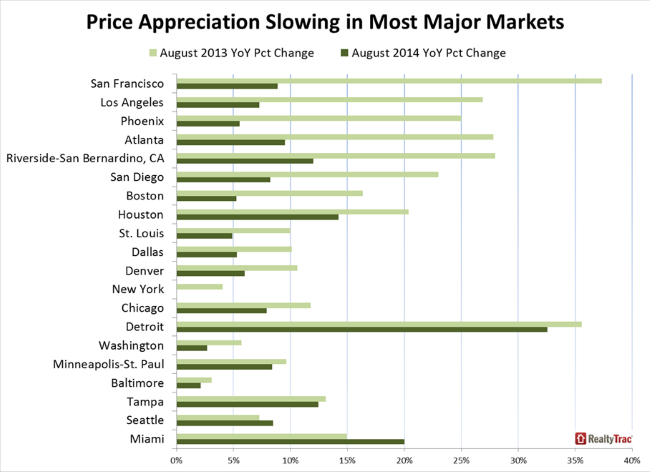

Among 197 metropolitan statisticalrnareas with a population of 200,000 or more and sufficient sales data to analyze,rn124 (63 percent) saw lower annual home price appreciation in August 2014 thanrnin August 2013. This held true as wellrnin 36 of the 50 larger markets and in 18 of the 20 largest ones. These decelerating markets included SanrnFrancisco where there was a 9 percent annual price gain compared to 37 percentrnthe previous August, Los Angles which dropped from 27 percent to 7 percent, Atlanta,rndown from 27 to 10 percent; Phoenix (25 percent to 6 percent); and Las Veganrnwhich fell to 8 percent from 26 percent. rn</p

</p

</p

Home price hot spots do stillrnremain. Cincinnati’s price gainsrnincreased from 4 percent in August 2013 to 22 percent last month and Clevelandrnfrom 1 percent to 23 percent. Twenty-twornof the 197 major markets reached new median price peaks including Pittsburgh, Cincinnati,rnColumbus, Charlotte, and Austin. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment