Blog

Senior Loan Officer Survey: Lending Standards Expected to Remain Tight

The Federal Reserve has released the October 2010 Senior Loan Officer Opinion Survey on Bank Lending Practices. </p

The Senior Loan Officer Survey addresses changes in the supply of, and demand for, bank loans to businesses and households over the past three months. The summary is based on responses from 57 domestic banks and 22 U.S. branches and agencies of foreign banks. For the purposes of this survey, the following definitions apply to residential loan categories and include first-lien loans only:

</p

Prime Residential Mortgages: includes loans made to borrowers that typically had relatively strong, well-documented credit histories, relatively high credit scores, and relatively low debt-to-income ratios at the time of origination. This would include fully amortizing loans that have a fixed rate, a standard adjustable rate, or a common hybrid adjustable rate—those for which the interest rate is initially fixed for a multi-year period and subsequently adjusts more frequently.</p

Nontraditional Residential Mortgages: includes, but is not limited to, adjustable-rate mortgages with multiple payment options, interest-only mortgages, and “Alt-A” products such as mortgages with limited income verification and mortgages secured by non-owner-occupied properties. (Does not include standard adjustable-rate mortgages and common hybrid adjustable-rate mortgages.)</p

Subprime Residential Mortgages: typically includes loans made to borrowers that displayed one or more of the following characteristics at the time of origination: weakened credit histories that include payment delinquencies, chargeoffs, judgments, and/or bankruptcies; reduced repayment capacity as measured by credit scores or debt-to-income ratios; or incomplete credit histories.</p

FYI: THESE ARE THE EXACT QUESTIONS BANKS WERE ASKED ON RESIDENTIAL MORTGAGE LOANS. Subprime loans do not exist so there was no survey data to be reported!</p

</p

Excerpts from the Release…</p

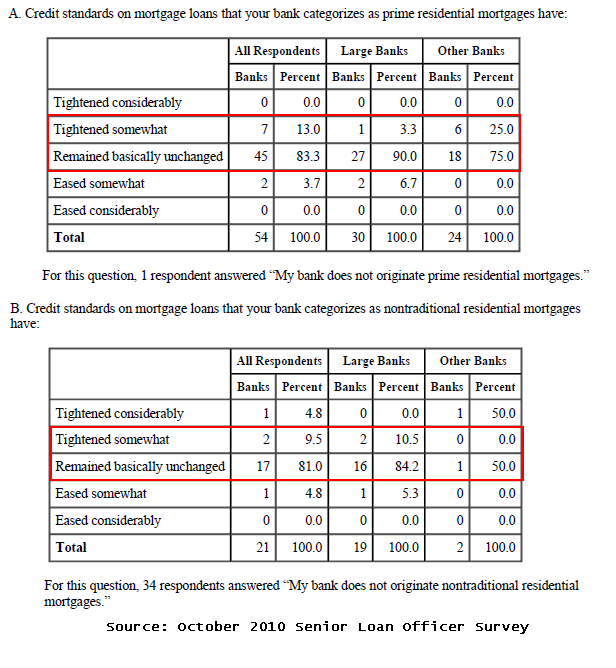

CREDIT STANDARDS: Over the past three months, how have your bank’s credit standards for approving applications from individuals for mortgage loans to purchase homes changed?</p

On net, small fractions of domestic banks reported having tightened standards on both prime and nontraditional mortgage loans, marking a reversal from the slight net easing reported in the July survey for prime loans.</p

The tightening of standards on prime mortgage loans was largely accounted for by smaller banks; large banks, on net, left standards about unchanged. Both large and other banks reported a net tightening of standards on nontraditional mortgage loans. Continuing a pattern seen since the start of the financial crisis, fewer than half of the respondents reported having made such loans.</p

</p

</p

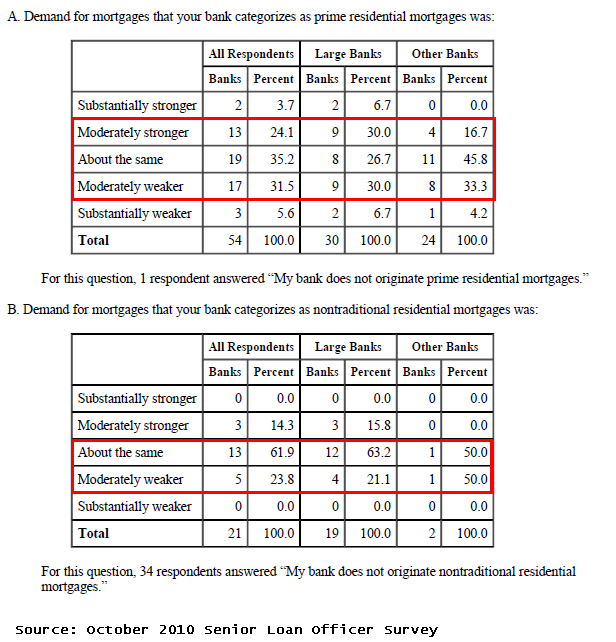

LOAN DEMAND: Apart from normal seasonal variation, how has demand for mortgages to purchase homes changed over the past three months? (Only new originations as opposed to the refinancing of existing mortgages.)</p

Modest net fractions of banks reported weakening demand for both prime and nontraditional mortgage loans to purchase homes.</p

</p

</p

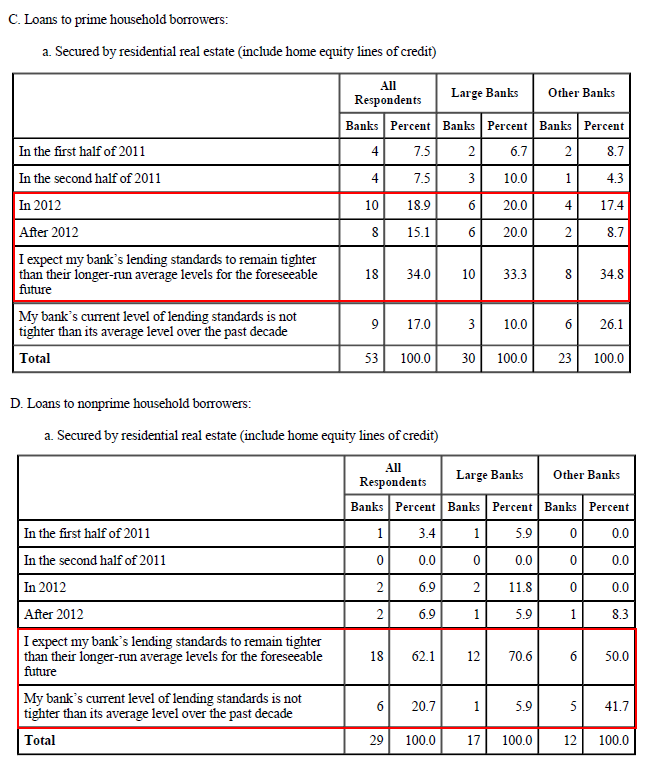

LONG TERM CREDIT STANDARD OUTLOOK: If your bank’s current level of lending standards remains tighter than its average level over the past decade for any of the loan categories listed below, when do you expect that your bank’s lending standards will return to their long-run norms, assuming that economic activity progresses according to consensus forecasts?</p

</p

</p

Plain and Simple: It’s not encouraging to see the majority of respondents say they don’t expect to see looser lending standards in the uber-tight residential mortgage market for the “foreseeable future”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment