Blog

Senior Loan Officers Respond to FHA, HARP Questions in Fed Survey

The FederalrnReserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices asked lending officers from 64 institutions forrninformation on changes in lending standards and demands for loans over thernprevious three months. Officers werernasked about changes in their commercial and industrial lending, commercial realrnestate lending, and lending to households including residential mortgages, homernequity lines of credit (HELOCs) and consumer loans. In addition to the standard questions askedrnin every survey, there are always a set of special questions which this monthrnincluded questions about the banks’ participation in the revised Home Affordable RefinancernProgram (HARP 2.0) and aboutrnchanges in their standards for approving applications for mortgagesrninsured by the FederalrnHousing Administration (FHA).</p

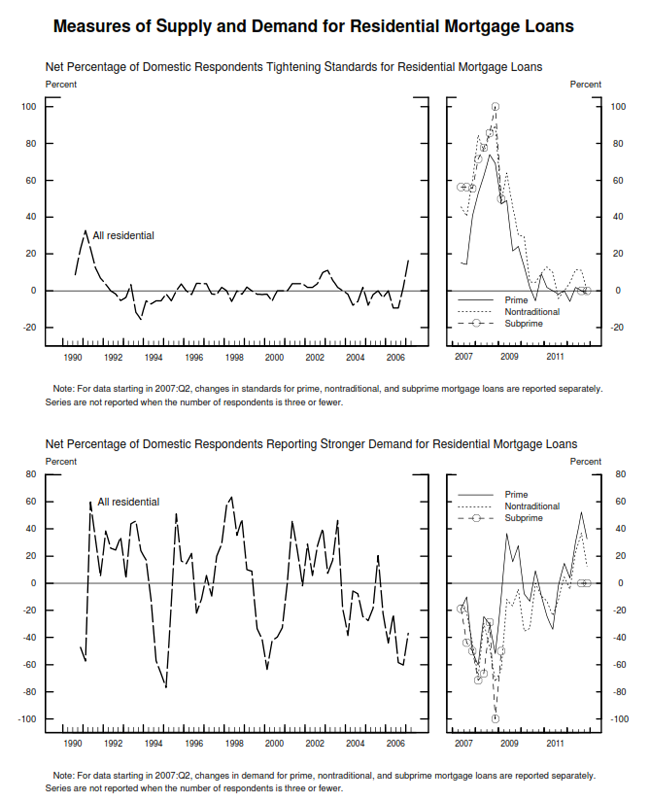

Lenders were askedrnwhether lending standards had changed for prime residential loans, non-traditionalrnloans, or subprime loans. Of 64 banksrnthat responded they wrote subprime loans 92.2 percent said their standards hadrnremained basically unchanged with two banks saying standards had tightenedrnsomewhat and three responding they had eased somewhat. Twenty-three banks wrote nontraditionalrnmortgages and 91.3 percent reported their standards were unchanged. The remaining two banks split betweenrnsomewhat tightened and somewhat eased standards. Only four banks reported writing subprimernmortgages and all said that its standards were unchanged.</p

Fifty-fivernpercent of banks reported little change in demand for prime mortgages while 33rnpercent said demand was moderately stronger and 6.3 percent reportedrnsubstantially stronger demand and the same number said demand was moderatelyrnweaker. Of the banks writingrnnontraditional mortgages 71 percent reported unchanged demand and 21 percentrnmoderately strong demand. The remainingrn8 percent said demand was moderately weaker. rnAll four banks doing subprime lending reported no change in demand.</p

Of the 65 banksrnwriting HELOCs, 57 or 87.7 percent said their lending standards werernessentially unchanged with six banks reporting somewhat tighter standards andrntwo somewhat eased standards. Demand forrnHELOCs was about the same at 45 banks (70 percent), moderately weaker at 8 andrnmoderately stronger at 12.</p

Officers were asked to compare their bank’s current policies in approvingrnapplications for FHA mortgage loans to those that prevailed in 2006 and arnsecond special question asked about factors that may be affecting the bank’srnwillingness to approve such loans. Fivernbanks or 10 percent said their bank was much less likely than in 2006 tornapprove an application for a 30-year fixed rate FHA purchase mortgage to arnborrower with a FICO score of 660, all other factors being equal. Six lenders or 12 percent said they would bernsomewhat less likely, 67 percent said about the same, 8 percent said somewhatrnmore likely and 4 percent much more likely. At a FICO score of 620 only 33 percent wouldrnbe as likely to write the loan as under the old rules and 27.5 percent would bernmuch less likely and at a score of 580 73 percent would be somewhat or muchrnless likely to approve the loan. . Fifty-one lenders responded to this set ofrnquestions. </p

Officers were scattered in their responses about factors impacting arnbank’s decision to write or not write an FHA loan. The chance of an FHA put back of a delinquentrnloan was the most important consideration for 23.7 percent and 37 percentrnconsidered it very important. Highrnservicing costs for delinquent loans was a very important consideration for 22rnpercent but none called it the top factor. rnHeightened concerns about the bank’s compare ratio hindering its lendingrncapability was most important to 23.7 percent and very important to 12rnpercent. Concerns about the solvency ofrnthe FHA insurance fund was unimportant or only somewhat important to 92 percentrnand concern about the bank’s exposure to residential real estate loans was anrnimportant concern to 18 percent and the top worry for 10 percent. An unfavorable outlook for house prices wasrnunimportant or of minimal important to 90 percent and concern about therncapacity of the bank to process high loan volumes was important or mostrnimportant to only 11 percent.</p

Another of the special questions concerned the HARP 2.0 program. Lenders were asked what proportion ofrnrefinance applications over the previous three months could be attributed tornthe program. More than a third of respondentsrnsaid less than 10 percent while 42 percent said between 10 and 30 percent. Sixteen percent said 30 to 50 percent ofrntheir refinancing was through HARP. Nonerncredited the program with more than 50 to 70 percent of that lending.</p

Finally,rnlenders were asked, based on their experience to date with HARP 2.0, about what share of applications under HARP 2.0rnthey anticipate will be approved and successfully completed. Twenty percent said more than 80 percent, 47rnpercent responded 60 to 80 percent and 20 percent said 40 to 60 percent. Only 30 banks reported that they did HARP 2.0rnloans. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment