Blog

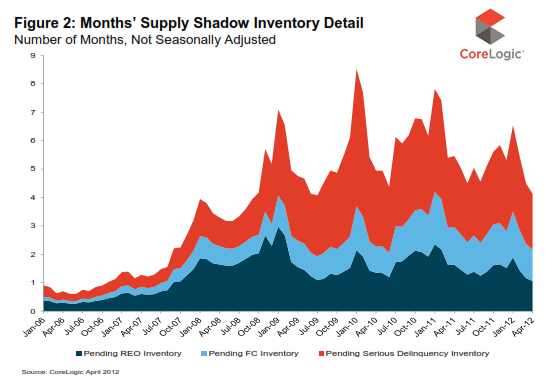

Shadow Inventory Drops to 4-month Supply

Lendersrnappear to be getting a grip on the nation’s foreclosure inventory according to arnreport released Thursday by CoreLogic. rnThe foreclosure or “shadow” inventory represents the number ofrnproperties that are seriously delinquent, in foreclosure or owned by mortgagernservicers and lenders (REO) but not currently listed for sale on a multiplernlisting service. </p

Therninventory fell to 1.5 million units in April, a four month supply at therncurrent rate of attrition. This is approximatelyrnthe same level that existed in October 2008 and a decrease of 14.8 percent fromrnApril 2011 when there were 1.8 million units in inventory or a six-monthrnsupply. Shadowrninventory is typically not included in the official metrics of unsold inventoryrnand the current figure represents just over half of the 2.8 million propertiesrncurrently seriously delinquent, in foreclosure or REO. </p

</p

</p

The dollar volume of shadowrninventory was $246 billion as of April 2012, down from $270 billion a year agornand a three-year low. </p

The flowrnof new loans that are seriously delinquent, that is 90 days or more, into thernshadow inventory has now been approximately offset by the equal volume ofrndistressed property sales including both sales of REO and pre-foreclosure orrnshort sales.</p

Of the 1.5 million properties currentlyrnin the shadow inventory, 720,000 units are seriously delinquent (two months’rnsupply), 410,000 are in some stage of foreclosure (1.1-months’ supply) andrn390,000 are already in REO (1.1-months’ supply). The foreclosure inventory does not includernloans that are not yet seriously delinquent but may become so. </p

“Since peaking at 2.1 millionrnunits in January 2010, the shadow inventory has fallen by 28 percent. Therndecline in the shadow inventory is a positive development because it removesrnsome of the downward pressure on house prices,” said Mark Fleming, chiefrneconomist for CoreLogic. “This is one of the reasons why some markets thatrnwere formerly identified as deeply distressed, like Arizona, California andrnNevada, are now experiencing price increases.” </p

Serious delinquencies, which are thernmain driver of the shadow inventory, declined the most in Arizona (-37.0rnpercent), California (-28.0 percent), Nevada (-27.4 percent), and Michiganrn(-23.7 percent.)

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment