Blog

Shadow Inventory, Moving not Falling

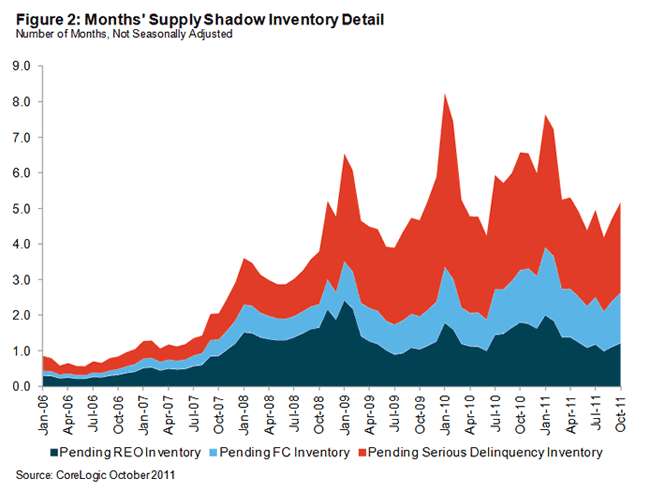

According to data reported on Wednesdayrnby CoreLogic, the residential shadow inventory as of October stood at 1.6rnmillion housing units, a supply of 5 months. rnThis was relatively unchanged from figures in July. In October 2010 the inventory was anrnestimated 1.9 million units, a 7 months’ supply. CoreLogic said that the flow of new seriously delinquent loans into the shadow inventoryrnhas been offset by the roughly equal sales flow of real estate owned and shortrnsales. Some 3 million distressed homesrnhave sold since January 2009, the point at which prices were falling thernfastest, yet the shadow inventory is at essentially the same level as in thatrninitial month.</p

</p

</p

Shadowrninventory includes homes that are seriously delinquent (90 days or more), inrnforeclosure or already owned by lenders (REO) but are not currently listed byrnlocal multiple listing services. Thisrnformulation does not include the homes that are typically included in officialrncounts of unsold inventory.</p

Thern1.6 million units in the shadow inventory represent half of the 3 millionrnproperties that are currently seriously delinquent, in foreclosure, or inrnREO. The shadow inventory includesrn770,000 units that are seriously delinquent (2.5 months supply), 430,000 are inrnsome stage of foreclosure (1.4 months supply) and 370,000 are already in REOrn(1.2 months supply.)</p

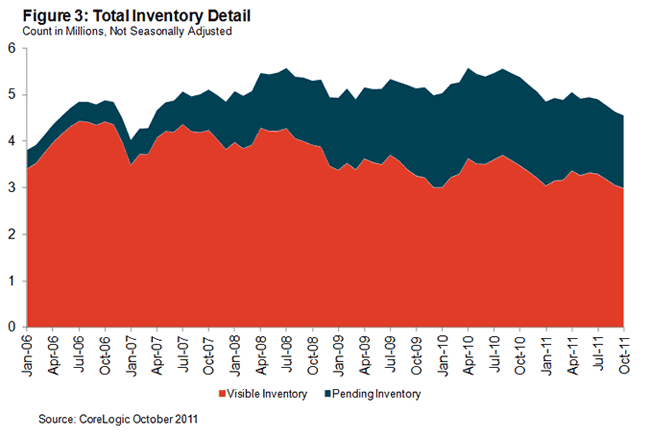

Based on current estimates of thernvisible inventory (both distressed and non-distressed), the shadow inventory isrnapproximately half of all visible inventory listings. For every two homesrnavailable for sale, there is one home in the “shadows”</p

</p

</p

Therninventory is approximately four times as large as at its low point (380,000rnproperties) at the peak of the housing bubble in mid 2006. According to CoreLogic, a healthy housingrnmarket should have less than one-months supply of shadow inventory. This level could be easily absorbed withoutrnimpacting house prices unless the inventory was geographically concentrated. </p

Therninventory, however, is concentrated to a large extent. Florida, California and Illinois account forrnmore than a third of the shadow inventory. The top six states, which would alsorninclude New York, Texas and New Jersey, account for half of the shadowrninventory. In addition, the shadowrninventory is often located in suburban and exurban submarkets where thosernproperties compete with new home sales. rnThis may be one reason why new homes are currently running at 7 percentrnof all sales rather than a more typical 12 percent.</p

“Thernshadow inventory overhang is a large impediment to the improvement in thernhousing market because it puts downward pressure on home prices, which hurtsrnhome sales and building activity while encouraging strategic defaults,”rnsaid Mark Fleming, chief economist for CoreLogic.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment