Blog

S&P Case-Shiller Indices at Post-Crisis Lows

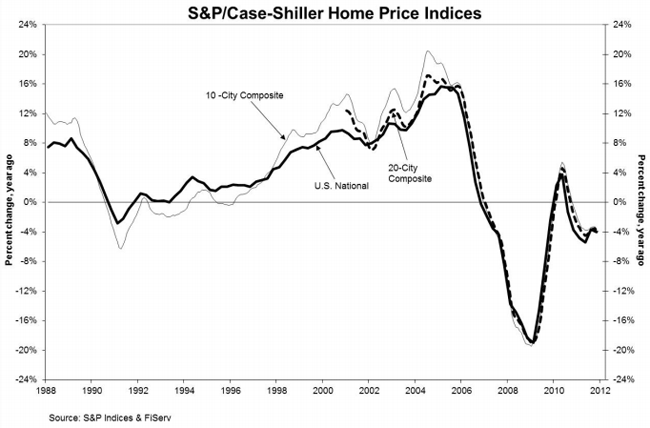

All three of the S&P/Case-ShillerrnIndices hit new post-crisis lows during December. The year ended with the national composite,rnwhich is reported only every three months, down 3.8 percent during the fourthrnquarter of 2011 and 4 percent lower than it was one year earlier. Both the 10-and 20-City Composites fell byrn1.1 percent in December over November and were down 3.9 percent and 4.0 percentrnfrom their respective levels in December 2010. rnThe indices further increased their year-over-year decline from the -3.8rnpercent noted for both city composites in November. The National Composite Index is now 125.67,rnthe 10-City Composite is 149.89 and the 20-City is 136.71. </p

S&P recommends using thernnon-seasonally adjusted index figures for analysis but does provide arnseasonally adjusted set as well. Duringrnthe fourth quarter the national index was down 1.7 percent while the 10-andrn20-City indices each decreased 0.5 percent from November to December.</p

</p

</p

Only two of the 20 metropolitanrnstatistical areas (MSAs) in the composites were up in December overrnNovember. Miami and Phoenix increasedrn0.2 percent and 0.8 percent respectively. rnWashington, DC was the only MSA to post an annual increase (0.5 percent)rnwhile four MSAs, Atlanta, Las Vegas, Seattle, and Tampa had average home pricesrnthat registered new lows. ThernCase-Shiller base of 100 was established in 2000 and Atlanta (87.30), Clevelandrn(97.73), Detroit (68.39), and Las Vegas (90.71) are now below that 100 benchmarkrnwith Phoenix (101.91) not far behind. </p

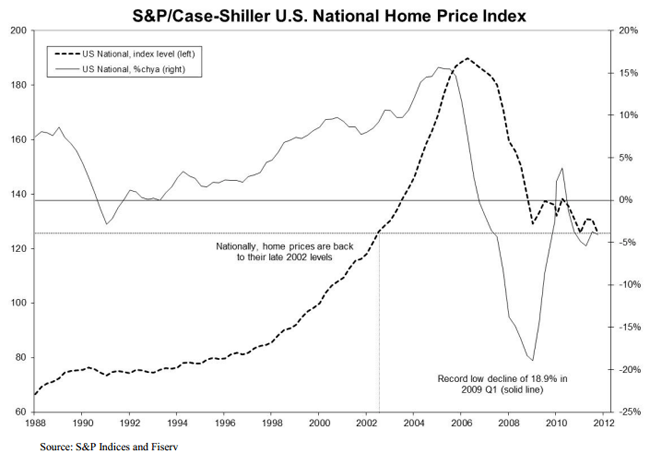

Measured from the respective pre-crisisrnpeaks in June and July of 2006, the 10-City and 20-City Indices have eachrnfallen 33.8 percent as has the national composite and national prices are nowrnback to the levels last seen in late 2002.</p

</p

</p

David M. Blitzer, Chairman of the IndexrnCommittee at S&P Indices said “With this month’s report we saw all threerncomposites hit new record lows. While wernthought we saw some signs of stabilization in the middle of 2011, it appearsrnthat neither the economy nor consumer confidence was strong enough to move thernmarket in a positive direction as the year ended.”</p

Neil Dutta, Economist at Bank of America Merrill Lynch commented, “It’s pretty clear that the consensus continues to under-estimate the decline in home prices. The December number is probably looking a little better than the numbers for the coming year. Foreclosures are going to increase in this year. That’s going put pressure on home prices and consumer spending and household balance sheet.”</p

Bloomberg Video: Homebuyers in `Wait-and-See’ Mode Now, Shiller Says <br /rn

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment