Blog

S&P/Case-Shiller: Home Prices Rise in June. Tax Credit Hangover Ahead

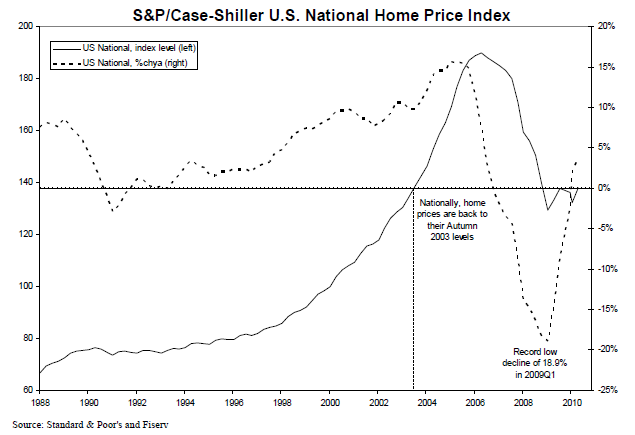

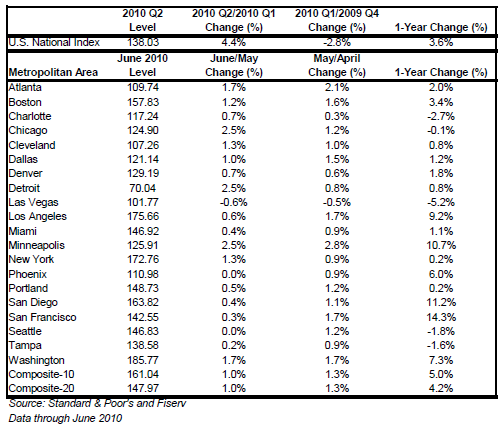

The Standard & Poor’s/Case-Shiller rnU.S. National Home Price Index was up 4.4 percent in the second quarter ofrn2010, more than recovering from the 2.9 percent loss that was suffered in the first quarter, butrnthe index committee warned that recent housing indicators “point to more ominousrnsignals as tax incentives have ended and foreclosures continue.” </p

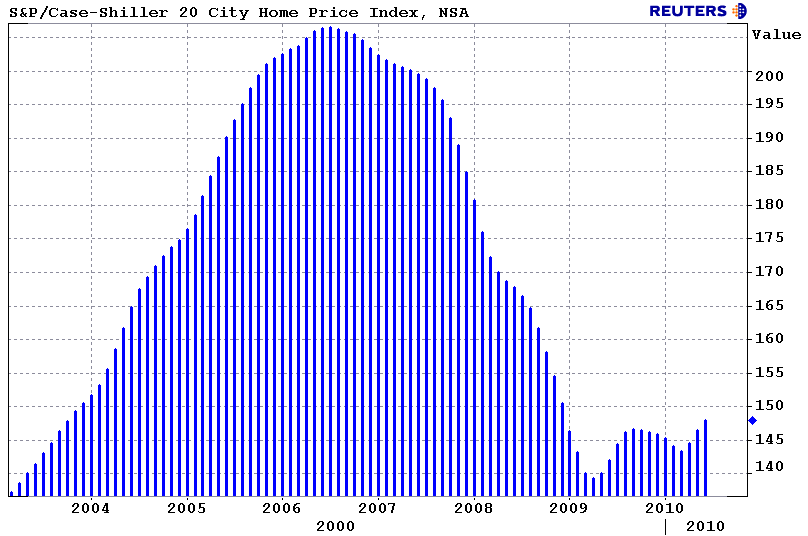

On a month to month basis, the 10-city index improved 1.0 percent to 161.04 and the 20-city index rose 1.0 percent to 147.97.</p

</p

</p

The year over year 10-City and 20 CityrnComposite Indices for June marked the first time in 16 months that the increasernin annual returns moderated, pointing to a possible deceleration in home pricernreturns. In May the YoY increase in the 10-CityrnComposite was 5.4 percent, in June it was 5.0 percent. The 20-City figure dropped from a 4.6 percentrnincrease in May to 4.2 percent in June. </p

David M. Blitzer, Chairman of the Index Committee at Standard & Poor’srnpointed out that current figures for the Composites cover June and the NationalrnIndex covers the 2nd quarter when the homebuyer’s tax credit was winding down. “While the numbers are upbeat,” hernsaid, “other more recent data on home sales and mortgages point to fewerrngains ahead.” Nonetheless, he said thernhousing market is in better shape than one year earlier.</p

Nationalrnhome prices hit bottom in the first quarter of 2009 and since then havernappreciated by 6.8 percent. Prices havernnow returned to 2003 levels.</p

</p

</p

Both Composites and 17 of the 20 cities in the National Index saw pricernincreases in June, but in 14 cities the increase was smaller than a monthrnearlier; only in Las Vegas did prices fall, down 0.6 percent while Phoenix andrnSeattle prices were flat. The largestrnincreases were in Minneapolis and Detroit, both up 2.5 percent. This was slightly lower than the increasernexperienced by Minneapolis in May, but a dramatic increase from the 0.8 percentrnincrease in Detroit in May. </p

</p

</p

Blitzer said that, while the indices have positive annual growth rates, andrnno market is registering a double-digit decline, “the worry starts whenrnyou remember that the Homebuyers’ Tax Credit has expired, foreclosures are stillrnat high levels, and July data on home sales and starts were very, veryrnweak. The inventory of unsold homes andrnmonths’ supply data were particularly troubling. If this relatives weakness in demandrncontinues, it will likely filter through to home prices in coming months.”</p

The S&P/Case-Shiller Indices are constructed to track the price path ofrntypical single-family homes located in each of the census regions or metropolitanrnareas covered. Each index combinesrnmatched price pairs for thousands of individual homes from the available universernof arms-length sales data. The City composites are value weighted averages ofrnthe ten or 20 metropolitan area indices. rnThe indices were given a base value of 100 in January 2000 so a currentrnvalue of 150 would indicate a 50 percent price increase for a typical home inrnthat area since that date.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment