Blog

Study Finds Substantial Misrepresentations in RMBS

Three researchers have looked at private label residential mortgage-backed securities sold to investors in 2007 and concluded there was substantial misrepresentation of collateral on two underwriting points. The study, Asset Quality Misrepresentation by Financial Intermediaries: Evidence from RMBS Market was undertaken by Tomasz Piskorski and James Witkin of the Colunbia University School of Business and Amit Seru, University of Chicago Booth School of Business.

The three looked at mortgage-back securities originated without government guarantees (non-agency RMBS) — representing a $2 trillion market in 2007. Rules and regulations requiring full and accurate disclosure of information on such financial products being play an important role in the functioning of capital markets, but over the past decade the numbers of intermediaries involved in these transactions has increased, potentially weakening safeguard ensuring transparency. In the aftermath of the crisis the authors say there has been a precipitous decline in the value of supposedly safe securities along with large investor losses.

The study looked at two types of misrepresentation; the occupancy status of the collateral property and undisclosed second liens. The authors compared what was disclosed to the investors in RMBS with the actual characteristics of those loans in credit bureau databases.

They found that one out of every ten loans had one of these misrepresentations. These, they say, “are not instances of the classic asymmetric information problem in which the buyers know less than the seller. Rather, we contend that they are instances where, in the process of contractual disclosure by the sellers, buyers received false information on the characteristics of assets.”

They looked at whether lenders and investors were aware of such behavior and assessed characteristics of intermediaries involved in the sale of assets, such as incentives for managers that could have moderated this behavior and claim they demonstrate the limits of existing market and regulatory arrangements in preventing such behavior in the capital market.

The propensity of intermediaries to sell misrepresented loans increased as the housing market boomed, peaking in 2006. These misrepresentations were costly for investors; delinquencies are more than 60% higher when compared with otherwise similar loans. Lenders seem to be partly aware of this risk, charging a higher interest rate on misrepresented loans relative to otherwise similar loans, but the interest rate markup on misrepresented loans does not fully reflect their higher default risk.

A significant degree of misrepresentation exists across all reputable intermediaries involved in sale of mortgages. The propensity to misrepresent seems to be unrelated to measures of incentives for top management, to quality of risk management inside these firms or to regulatory environment in a region. Misrepresentations on just these two relatively easy-to-quantify dimensions of asset quality could result in forced repurchases of mortgages by intermediaries in upwards of $160 billion.

The authors found that more than 6 percent of mortgage loans reported for owner-occupied properties were given to borrowers with a different primary residence, while more than 7% of loans (13.6% of loans using a broader definition) hid the presence of a junior lien. Stated differently, more than 27 percent of loans given to non-owner occupants did not state that fact and more than 15 percent of loans with a junior lien did not disclose that fact. Overall, more than 9 percent of loans in the sample had one of these misrepresentations and, had HELOCs been included when inferring misreported second liens it would be 12.2 percent.

Loans with misrepresented borrower occupancy status have about a 9.4 percent higher likelihood of default compared with loans with similar characteristics with correctly reported owner-occupancy. This implies a more than 60% higher default rate relative to the mean default rate of owner-occupants during our sample period. Similarly, loans with a misrepresented higher lien — likely to be fully documented loans — have about a 10.1% higher likelihood of default compared with loans with similar characteristics and no higher lien, again about 70%, relative to the mean default rate of loans without higher liens. Because of their substantially worse performance, misrepresented loans account for more than 15% of mortgages that defaulted in the study sample, a higher share than their proportion in the overall sample (about 10%).

Lenders did price for higher risk; those loans that misrepresented owner occupancy status were charged higher rates than similar loans where occupancy was correctly reported and the same was true of loans with misrepresented second liens when compared with loans with similar characteristics and no second lien. But the interest rate markups on the misrepresented loans are much smaller relative to loans where the true nature of occupancy and lien status were disclosed indicating that the rates did not fully reflect their higher default risk.

The authors also concluded that RMBS investors had to bear a higher risk than they might have perceived based on the contractual disclosure. As a result, investors could argue that the ex ante value of the securities with misrepresented assets that were sold to them was less than the price paid, and truthful disclosure of the characteristics of the assets could have prevented some of their losses. “Assuming that our estimates are broadly applicable to the entire stock of outstanding non-agency securitized loans just prior to the crisis, enforcement of contractual guarantees by investors in response to these violations could result in forced repurchases of mortgages in upwards of $160 billion.”

A significant degree of misrepresentation existed across all reputable intermediaries in the same and no relationship could be found between a tendency to misrepresent and incentives for top management, quality of a firm’s risk management, or the leniency of regulatory environment in a region.

While the data was limited, the authors concluded that part of the misrepresentation occurred at the financial institution level. “To the extent that practices in this subprime lender are representative, our findings suggest that misrepresentation concerning owner-occupancy status was made early in the origination process, possibly by the borrower or broker originating a loan on behalf of the lending institution. In contrast, the lender was aware of the presence of second liens, and hence their misreporting likely occurs later in the supply chain.”

The authors also conclude that current market arrangements may have been insufficient to prevent and eliminate widespread misrepresentations of asset quality in a large capital market. These findings suggest that a critical inspection of the protection of investors in other capital markets, especially those with more passive investors like the high- grade investment debt market, may be warranted.

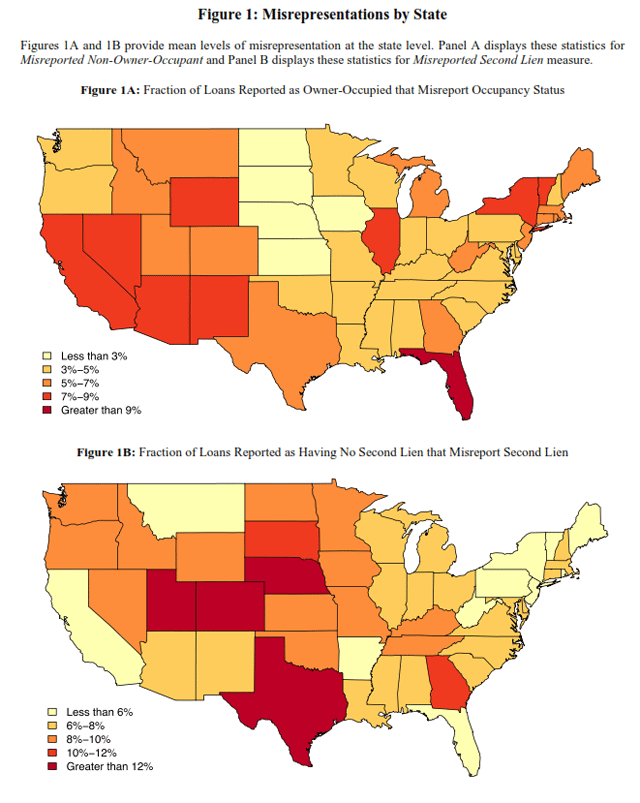

The authors also found that misrepresentations of owner- occupancy status were most pronounced in coastal and West Coast markets such as Florida, California, Arizona, and Nevada (with more than 7% of loans being misreported) and that a significant portion of the purchases made by non-owner-occupants in these regions was financed with mortgages that misrepresented their true purpose.

The geographical distribution of second lien misrepresentation is somewhat different. Texas and some of the Midwestern states show a more pronounced incidence of misreported second liens (more than 12% of loans erroneously report the absence of a second lien based on our measure).</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment