Blog

Study Shows Apparent Disparities in Lending to Women

Arnnew study has revealed some apparent differences in the success rate of female andrnmale mortgage applicants. rnThe Woodstock Institute, a non-profit research organization, conducted arnstudy based on Home Mortgage Disclosure Act (HMDA) data in the six county Chicagornregion and found that applications for either purchasing or refinancing a homernwere less likely to be approved if submitted by a female. The same was true of applications submittedrnby a female with a male cosigner when compared to applications from a malernapplicant with a female cosigner. </p

“Wernwould expect to see no significant difference in the origination rates forrnmale-headed joint applications and female-headed joint applications, since thernbackgrounds of both borrowers on joint applications are considered by mortgagernlenders,” said Spencer Cowan, vice president of research at WoodstockrnInstitute. “The fact that there are such large disparities raises troublingrnquestions about potentially discriminatory underwriting.”</p

ThernInstitute says that the wealth gap between men and women is well documented;rnone study showed that single women between the ages of 18 and 64 have a medianrnwealth that is 49 percent of that for single men and 12 percent of the medianrnfor couples. The differences for womenrnof color are even greater. That samernstudy suggests that the wealth gap would persist even if the gap in incomernbetween men and women and between whites and persons of color did not exist. </p

Sincernhomeownership is the most common means of wealth creation, women arerndisadvantaged here as well. They arernthree times as likely to be custodial parents with greater expenses and lessrnopportunity to save. That and theirrnlower income means they are less likely to have a significant down payment,rnincome to qualify for more valuable properties (and thus greater appreciation)rnand more likely to have received subprime loans during the housing bubble, andrnthis made sustainable homeownership more difficult and, by increasing the costrnof homeownership, reduced the wealth-building effects. </p

Thernstudy examines women’s access to mortgages following the housing collapse tornsee if they now have substantially equal access to mortgages in the absence ofrnthe subprime products that had been disproportionately marketed to them. The Institute examined data on applications bothrnthose originated and denied for conventional, FHA and VA loans between $20,000rnand $800,000 intended as first liens on one-to-four family units. Applicants had incomes between $20,000 andrn$999,000. The study included 58,870rnapplications for home purchases and 198,522 applications for refinancing.</p

Controllingrnfor loan-to-value ratio, the Institute found that female mortgage applicantsrnwere about 8 percent less likely overall tornhave home purchase mortgagesrnoriginated than were malernapplicants. Those disparities, however, may reflect the influence of demographic characteristics which vary systematically betweenrnfemale and male applicants. For example, 77 percent of female applicants forrnpurchase mortgages had no co-applicant versus only 52rnpercent of male applicants; 71 percent of femalernapplicantsrnfor refinance mortgages had no co-applicant versusrn32 percent for malernapplicants. rnThe more likely presence of children in single-women headed households may also put female applicants with nornco-applicants in a significantly different family and financial situationrnthanrnarernmale applicants with no co-applicants.</p

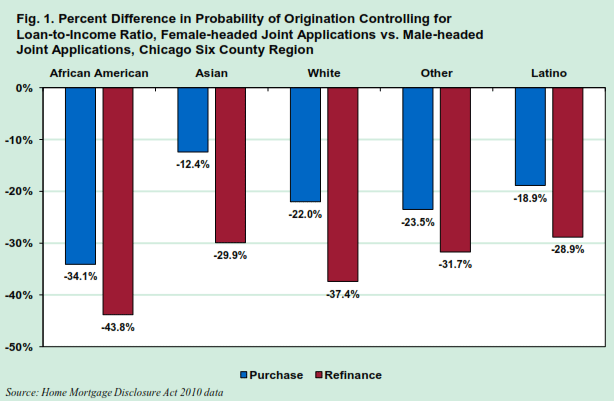

To control for those potentially confounding demographic factors, thernstudy ran an analysis on a subset of the datarnconsisting of joint applications with a male applicant with a female co-applicant or a femalernapplicant with a malernco-applicant.rnIn this subset, there werern21,432 purchase applicationsrnand 111,304 refinancernapplications. Female-headedrnjoint applicationsrnoverall were 24rnpercent less likely to havernpurchase mortgages originated, and 39rnpercent less likely tornhave refinance mortgages originated, than were male-headed joint applications. Therndisparities applied across all racial categories with the largest found in African American female- headedrnjoint applications which werern34 percent lessrnlikely tornbe originated than were African American male-headed joint applications forrnpurchase and 44 percent lessrnlikely for refinancing. Latino female-headedrnjoint applicationsrnwere 19 percent lessrnlikely tornhave purchase mortgagesrnoriginated and 29rnpercent lessrnlikely tornhave refinance mortgagesrnoriginatedrnthan werernLatinornmale-headedrnjoint applications.</p

</p

</p

The Instituternreferences a Department of Housing and Urban Development disparate impact analysis which found that female applicants for mortgages,rnbothrnpurchase and refinance, are significantly less likely tornhave loans originated than are male applicants. Even whenrnthernanalysis is limited tornapplicationsrnwith either a femalernapplicantrnand male co-applicant or male applicant with arnfemale co-applicant, reducing the probability that the applicant isrna single parent, the disparity remains and appliances among all racial andrnethnic categories. rnThe Institute says such a consistent set of findingsrnshowing a significant disparity in women’srnaccess to mortgagerncredit is troubling andrnwarrants further investigation.</p

The Woodstock Institute study admits arnflaw in that the HMDA data does not contain key categories of information suchrnas credit scores, overall debt-to-income ratio or appraised values and saysrnwithout those data points, it is not possiblernto determinernwhether female-headed joint applicationsrnare denied while male-headed joint applications withrnsimilar qualifications are approved. Itrnurges the Consumer FinancialrnProtection Bureaurn(CFPB) to expeditiously finalize enhancements it is permitted under Dodd-Frank to make to thernHMDA data to include at a minimum the applicant’s credit score,rndebt-to-income ratio, and the appraised value of the property. rnThat additional data could show morernclearly whether there was disparate impact or some legally defensible justification for the disparities shown in itsrnstudy. “If disparities for women persist with those additional data, additional fairrnlending training,rnsupervisionrnand enforcement will be needed,”rnthe study concludes.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment