Blog

The State of Mortgage Lending in America

ThernCenter for Responsible Lending (CRL) has released a report on the recentrnfinancial crisis and its impact on consumers. rnThe State of Lending in America and its Impact on U.S. Households</bassesses the impact of the financial crisis on American families and theirrnfinancial security and looks at a range of current lending practices and theirrnimpacts. </p

Thernreport, written by Debbie Bocian, Delvin Davis, Sonia Garrison, and BillrnSermons, looks at the financial products that American households use for everydayrntransactions, to acquire major assets, and build savings and wealth and thernways in which predatory lending has sometimes corrupted traditional financialrnproducts and undermined their worth. State of Lending is organized into threernseparate reports, the first two covering a spectrum of consumer loans, thernthird abusive debt collection, mortgage loan collection, and servicingrnpractices. </p

Wernwill summarize the extensive portion of the report that deals with mortgagernlending in two parts. The first reviews the role of various market playersrnand the changes that have been made to the traditional lending model. A subsequent article will summarize CRL’srnwords about the impact of the housing crisis on individuals, communities, andrnthe economy and on the challenges that must be met in the future.</p

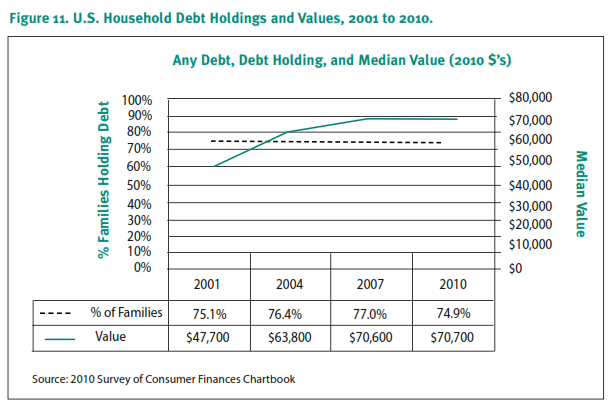

Thernauthors conclude there are two trends. rnFirst, families were already struggling financially even before therncrisis hit; managing the gap between stagnant family incomes and growingrnexpenses by increasing their debt which in turn left them with less spendablernincome and often with long-term financial distress, foreclosures and crushingrnstudent debt. </p

</p

</p

Somernare reaping benefits from the recovery and the rising stock market andrnimproving job opportunities but millions have lost their homes and millionsrnmore may yet do so; one-fifth of mortgaged homeowners are underwater. The impact was even greater on families ofrncolor who were three times more likely to be targeted with abusive subprimernloans as other borrowers with similar credit records.</p

Thernauthors say that, despite the housing crisis Americans put a high value onrnhomeownership, associating it with thernAmerican Dream and Americans’ idea of how to acquire wealth. Although not without risks, homeownershiprnprovides the opportunity to build equity both through appreciation of housingrnprices and paying down debt. Whenrntraditional mortgages are used, homeownership provides a “forced savings”rnmechanism for households. </p

Homeownership has long been a keyrnsource of economic mobility and financial security. Home equity can be tapped to start a newrnbusiness, pay for higher education, secure retirement and provide a financialrncushion against unexpected hardships and ownership bestows a host ofrnnon-financial benefits on individuals, families, and communities. </p

The federal government has longrnbeen involved in the mortgage markets. It worked to stem the tide ofrnforeclosures during the Great Depression, addressed discriminatory redlining inrnthe 1970s, and worked for decades to expand access to homeownership. Many agencies within the government deal withrnhousing and home ownership and government has long guaranteed mortgages forrnunderserved communities through FHA and VA loans and now through explicit GSErnloan guarantees.</p

Mortgages were once relativelyrnsimple transactions between lenders and borrowers. However, in recent decades,rnthe mortgage market has become larger and complex and involves morernparticipants. Today the main players are:</p<ul class="unIndentedList"

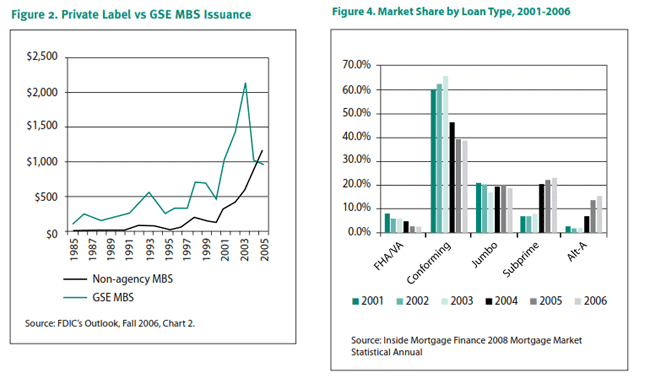

Under a “traditional” lendingrnmodel-where lenders both originated and held their mortgages-lenders had arnvested interest in ensuring that borrowers could repay their loans. In the morernrecent “originate-to-securitize” system, the compensation of brokers, lenders,rnand securitizers was based on transaction volume, not loan performance. This led to aggressive marketing andrnorigination, lax evaluation of the borrowers’ ability to repay, and to a newrnbreed of dangerous mortgages often made with scant underwriting and marketedrnwithout regard to their suitability for the borrowers. </p

The growth in private-labelrnsecuritization not only removed GSE standards from the equation but Wall Streetrnencouraged riskier loan products by paying a higher premium for non-conformingrnloans. Subprime lenders targeted many of the same borrowers who had traditionallyrnused the FHA and VA programs, saddling these borrowers with much riskier debtrnthan those government programs, for which many could have qualified. Then the agencies charged with rating thernquality of mortgage-backed investments were assigning high ratings tornsecurities backed by these dangerous and unsustainable loans leading investorsrnto believe those products were safe.</p

Not all communities were targetedrnequally by sub-prime lenders. Borrowers of color were 30% more likely tornreceive higher-rate subprime loans than similarly situated white borrowers andrnborrowers in non-white neighborhoods were more likely to receive higher-costrnloans with risky features such as prepayment penalties. In the early years of the subprime market,rnflipping was common in the subprime market. rnEach time refinancing occurred, fees and closing were rolled into thernloan, stripping equity. Loan terms wererncomplex and prevented easy comparison shopping and mandatory arbitrationrnclauses kept borrowers from pursuing legal remedies for illegal or abusivernterms. One of the early abuses in the subprime market was single-premium creditrninsurance, which charged a high up-front fee to insure mortgage payments if thernborrower couldn’t make them. </p

The abusive practices that led tornthe mortgage crisis were enabled by an out-of-date and fractured federalrnregulatory system. </p<ul class="unIndentedList"

Dodd-Frank Wall Street Reform andrnConsumer Protection Act of 2010 explicitly outlined new rules for mortgagernlending in order to prevent specific types of market abuses and it establishedrnthe CFPB as a new consumer protection agency. rnDodd-Frank mortgage provisions are designed to reorient the market backrnto well-underwritten, sensible mortgages and disfavors the loan terms common tornthe private-label securities market. </p

Among the most important aspectsrnof Dodd-Frank is the establishment of an “Ability-to-Repay” standard whichrnrequires originators to make a “reasonable and good faith determination basedrnon verified and documented information that the consumer has a reasonablernability to repay the loan and pay housing expenses. Dodd-Frank creates a preference against riskyrnloan terms through a category of safe loans called “Qualified Mortgages” (QMs)rngiving litigation protection to lenders who conform to the ability-to-repayrnprovision and a number of other QM requirements. Dodd-Frank also banned single-premium creditrninsurance and mandatory arbitration, required escrows of taxes and insurancernfor higher-priced mortgages; and documentation of borrowers’ income. </p

Importantly, Dodd-Frank createdrnthe CFPB as an independent consumer watchdog agency to ensure that financialrntransactions, including mortgages, are fair and transparent and empowered it tornenforce existing consumer protection laws and regulations and respond to newrnabuses as they emerge. The CFPB consolidates the functions of a number ofrnagencies and will be able to regulate the practices of all mortgage-marketrnparticipants, including banks, non-banks, brokers, and servicers. Also, by leaving funding outside thernappropriations process, Congress protected the agency from lobbying efforts tornweaken the resources available for supervision and enforcement. </p

A lot of blame for the recent crisis hasrnbeen laid on the Community Reinvestment Act (CRA) and the affordable housing goalsrnof the GSEs for encouraging loans to unqualified borrowers. The facts do not support these claims. CRA has been around for 30 years while thernproblem loans began within the last ten. rnOnly six percent of subprime loans were extended by CRA-obligated lendersrnto lower-income borrowers and those loans appear to have performed better thanrnother subprime loans. GSE could not purchase or securitize subprime mortgages directly. The share of subprime MBS purchased by thernGSEs as investments from Wall Street firms was a fraction of that of the privaternsector. Most of the GSEs losses, inrnfact, were from loans to higher income families, were tied to Alt-A rather thanrnsubprime loans, and did not count toward affordable housing targets. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment