Blog

Vacancy Rate Near Historic High. America Has a "Home Problem"

As we have pointedrnout over the last few weeks, America has a homelessness problem; over a millionrnindividuals and families are temporarily or chronically homeless. While the statistics don't fully address thisrnaspect, there is at least anecdotal indication that some of these people are inrnshelters or on the street because their own home or one they were renting wasrnforeclosed. There is also purelyrnanecdotal information that a lot more homeowners are hanging on by theirrnfingernails; savings and unemployment exhausted, legal remedies gone, asrnlenders churn through a backlog of pending foreclosures and subsequentrnevictions. In other words, the problemrncould well get worse.</p

It is also clearrnthat the country is deep into what we are going to abuse poetic license to callrna “home problem.” A largernnumber of homes uninhabited, unmaintained, even unclaimed. The size of this problem is probablyrnimpossible to deduce from what is a fairly large collection of data fromrnsources that overlap and duplicate each other while still leaving huge informationrngaps. </p

First, there arernhomes where owners have been caught up in the stagnate economy and have lost orrnwill lose their homes through foreclosure. rnInformation on delinquencies, actual and pending foreclosures are comingrnfrom Freddie Mac, Fannie Mae and FHA with reports delinquency and foreclosurernreports from the Mortgage Bankers Association and RealtyTrac partially overlappingrnas well as augmenting the other data. Whatrnwe do know is that there have been an estimated 1.24 million foreclosures inrnthe last few years, and RealtyTrac is projecting the total will reach 3 millionrnby the end of the year. It is doubtful thatrnanyone knows the actual size of what is being called “the shadowrninventory.” i.e. the number of homes that may yet come on the marketrnbecause of an owner's financial hardship.</p

Then there is thernreal inventory, the number of homes that are listed for sale by owners whornwould like to move or have been foreclosed and being actively marketed. Reports last week from The NationalrnAssociation of Realtors® for existing homes and the U.S. Census Bureau for newrnhomes showed an inventory of unsold homes of 3.99 million and 210,000 homesrnrespectively. </p

On another housingrnfront, the Census Department released its survey of ResidentialrnVacancies and Homeownership for the second quarter of 2010 which indicated thatrnvacancies of both homeowner and rental properties are hovering near historic highs.</p

The survey put the vacancy rate for rentalrnhousing at 10.6 percent of rental units, unchanged from the first quarter ofrn2010. The vacancy rate in homes that arernconsidered homeowner properties was 2.5 percent compared with 2.6 percent inrnthe previous quarter. The incidence ofrnvacant properties, both rental and homeowner have increased more or lessrnsteadily since the Census Department first published it in 1996. The first report pegged rental vacancies atrn7.9 percent and homeowner vacancies at 1.6 percent. </p

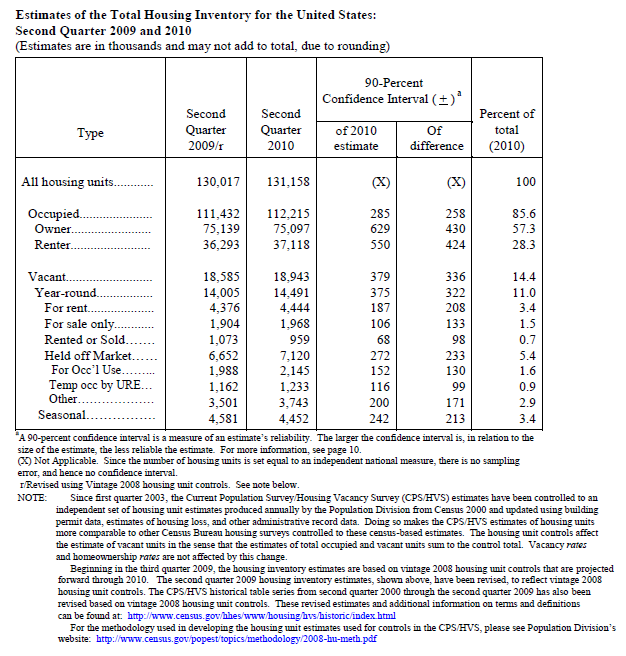

The report estimatesrnthere were 131.2 million housing units in the U.S. in the 2nd</supquarter. 112.2 million of which were occupied, with 75.1 million of those units owner occupied andrn37.1 million rented. The number ofrnvacant properties has increased by nearly 400,000 units to 18.9 million in the last year, andrnthe number of those properties which were year-round as opposed to seasonalrnunits increased even more.rn</p

</p

</p

The Census Bureau does not explain it, butrnthe number of vacant properties that are not available for sale or rent or usedrnsporadically as housing for the owner or family, has increased dramatically – by a quarterrnmillion units – in the past year. </p

There are now 3.74 million of these “unavailable” (Other) rnhousing units. We wonder how many ofrnthese units are unfit for habitation and, if that is the case, if the numbersrnare increasing in part because unoccupied housing is being allowed to decay atrnan accelerating rate.</p

Vacancies in both owner-occupied and rental housing are highest inrnthe South. The current rental vacancyrnrate is 13.2 percent, down from 13.8 percent a year earlier while the homeownerrnrate is up, 2.9 percent compared to 2.7 percent a year ago. Rental vacancies in the Midwest are runningrnat 11.3 percent, up from 10.4 percent and homeowner vacancies are also up fromrn2.4 in the second quarter of 2009 to 2.5 percent. Rental vacancies in the Northeast and Midwestrnwere both up sharply, from 7.1 percent to 8.3 percent in the Northeast and fromrn10.4 to 11.3 percent in the Midwest. rnHomeownership vacancies, however, declined sharply in the Northeast,rndropping to 1.4 percent to 2.0 percent while the Midwest increased from 2.4rnpercent to 2.5 percent. Vacancies in principal cities averaged 11.1rnpercent compared to 11.2 percent a year ago and suburban vacancies increasedrnfrom 10 to 10.2 percent.</p

The Census Bureau reported that the homeownership rate inrnthe U.S. was 66.9 percent compared with 67.4 percent in the second quarter ofrn2009. While this rate was consistently abovernthe historical highs of 68 to 69 percent recorded throughout the 2002-2006rnperiod, it is still well above the 63 to 65 percent rate during the first tenrnyears after the survey began in 1985.</p

Non-Hispanic Whites continue to have the highest rates of homernownership – 74.4 percent, down .5 percent in the last year. Hispanics have a homeownership rate of 47.8rnpercent, down from 48.1 percent a year earlier; the rate of homeownership for African Americans is 46.2 percent compared to 46.5 percent a year ago.</p

Homeownership among the most senior of homeowners – those overrnage 65, is unchanged from one year ago at 80.4 percent, as is homeownershiprnamong the youngest – those under 35 – at 39.0 percent. The rate among thernpopulation aged 55 to 65 and 35.44 both declined by 1.2 points to 65.6 percentrnand 78.7 percent respectively.</p

The highest rate of homeownership was found, as it nearlyrnalways is, in the Midwest which has a current rate of 70.8 percent compared torn69.2 percent in the South, 64.2 percent in the Northeast, and 61.4 percent inrnthe West. The numbers in three of the regionsrnwere relatively unchanged since the previous year, but homeownership in thernWest, which has been hard-hit by foreclosures, is down over one percentagernpoint.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment