Blog

Vacancy Rates and Homeownership both Down in Census Survey

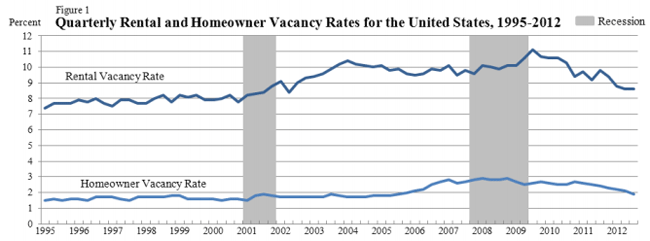

Vacancy rates in the third quarterrndeclined from one year earlier for both homeowner properties and those held asrnrentals according to the U.S. Census Bureau, but rates were little changed fromrnthe second quarter of this year. ThernBureau said that homeownership rates also declined on a year over year basis.</p

The Census Bureau reported that therernwere 132.8 million housing units in the U.S. in the third quarter, 114.70rnmillion of which were occupied or 86.3 percent. rnOf the occupied units 75.1 million were owner occupied (56.3 percent) andrn29.6 million or 29.8 percent were renter occupied. </p

Of the 18.15 million vacant housing units,rn13.59 million were classified as year round properties (10.3 percent of allrnunits) and 4.56 million were seasonal. rnOf year-round properties, 3.81 million were for rent, a decline ofrn430,000 from the third quarter of 2011 and 1.48 million were for sale only,rn386,000 less than a year earlier.</p

The vacancy rate for rental properties</bwas at 8.6 percent in the third quarter of 2012, unchanged from the secondrnquarter but down from 9.8 percent a year earlier. Rental vacancies most recently peaked at 11.1rnpercent in the third quarter of 2009. </p

Homeowner vacancies stood at 1.9 percentrnin the third quarter compared to 2.1 percent in the second and 2.4 percent inrnthe third quarter of 2011. That rate hitrna recent high in 2008 when it varied between 2.8 and 2.9 percent through allrnfour quarters of the year.</p

</p

</p

The rental vacancy rate inside ofrnprincipal cities was 8.8 percent, 8.1 percent in the suburbs, and 9.7rnpercent. All three rates were down fromrna year earlier.</p

The rental vacancy rate in the Southrndeclined from 12.2 percent in the third quarter of 2011 to 10.5 percent while homeownerrnvacancies were down from 2.5 percent to 2.1 percent. In the West rental vacancies fell from 7.3rnpercent to 6.5 percent and homeowner vacancy rates fell 6 basis points to 1.7rnpercent. In the Northeast the rentalrnvacancy was 7.1 percent compared to 8.0 percent a year earlier and homeowner vacanciesrnwent from 2.2 percent to 1.9 percent. rnThe greatest changes were in the Midwest where rental vacancies fellrnfrom 10.5 to 9.4 percent and homeowner vacancies from 2.4 percent to 1.8.</p

The rate of homeownership in the thirdrnquarter of 2012 was 65.5 percent, unchanged from the second quarter but downrnfrom 66.3 percent in the third quarter of 2011. rnThe most recent peak in home ownership, 69.0 percent, occurred in thernthird quarter of 2006.</p

Homeownership was highest in the Midwestrnat 69.6 percent and lowest in the West at 60.1 percent. The third quarter rate was up slightly in thernWest and the Northeast compared to the second quarter, down in the South, andrnunchanged in the Midwest. The rate ofrnhomeownership declined in every age cohort except among those 45 to 54 years ofrnage where it increased six basis points quarter-over-quarter and lower than onernyear earlier for all groups except those over age 65. </p

Annual homeowner rates fell slightly forrnall racial groups except White non-Hispanics and that group’s rate at 73.6 percentrnremains far higher than any other group except All Other Races, the only otherrnclassification to break 50 percent.</p

Homeownership in both family incomernclassifications declined slightly on an annual basis. Households with family income greater than orrnequal to the median income declined from 81.3 percent in the third quarter ofrn2011 to 80.3 percent and in those with family income less than the median thernrate was down from 51.3 percent to 50.6 percent.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment