Blog

Who Will Pick up Fed's MBS Buying Slack?

The Federal Reserve has completed itsrnlatest round of Quantitative Easing, the government sponsored enterprisesrn(GSEs) Freddie Mac and Fannie Mae are under orders to continue shrinking theirrninvestment portfolios and significant constraints exist to keep privaterninvestors from purchasing agency mortgage-backed securities (MBS). So who, the Mortgage Bankers Associationrn(MBA) asks, is going to pick up the slack?</p

A white paper written by MBA’s vice presidentrnand senior economist Michael Fratantoni, lays out the conundrum facing the MBSrnmarket. Fratantoni says both policyrnmakers and the housing industry have a common interest in bringing privaterncapital into the mortgage markets but the key question is how and in what formrnthat private capital can best reenter the system. MBA has advocated for private capital to haverna larger role in covering credit risk within the government guaranteed,rnconforming portion of the market but we need to consider how to draw it to therninterest-rate risk of the conforming market and how to reengage it for lendingrnoutside of the government guaranteed system. rn</p

For years, the GSEs’ ability to issue long-termrnfixed-rate debt appeared to be a stabilizing factor for the U.S. housing financernsystem. Long-term, fixed-rate debtrnissued by the GSEs was a better match for funding long-term fixed-rate MBS thanrnother funding instruments but the GSEs’ purchase of fixed-rate MBS with minimalrncapital turned out instead to be destabilizing because they did not have enoughrnskin-in the game. </p

The GSE’s investment portfolios which oncerntopped more the $1.5 trillion have been reduced under their post-crashrnagreement with Treasury, to less than $1 trillion. Fratantoni said he is not arguing with that policyrnchoice but those portfolios did historically serve to channel global capitalrninto the U.S. mortgage market absent bearing the uncertain cash flows fromrndirectly owning mortgages or MBS. Now itrnhas to be asked how the market can be structured to attract stable privaterncapital over time without GSE investment portfolios playing that role. </p

Confronting this issue has been delayed,rnfirst by the Federal Reserve’s purchase of more than $1.7 trillion of agencyrnMBS over a five year period; in many months this accounted for the vast preponderancernof issuance. But in October the Fed stopped growing its portfolio although itrnis likely to continue replenishing it until the first increase in the Fed’s targetrnshort-term rate. Then, likely at some pointrnin the middle of 2015, this major investor will be leaving the MBS market, according to Fratantoni. </p

Second, modest supply has required little demand.rnMBA estimates that origination volume in 2014 will be the lowest in 14 years withrncorrespondingly less MBS issuance. Reduced supply has kept spreads relatively tight,rneven as the GSEs have been net sellers and the Fed has tapered its purchases.</p

Third, demand from banks has been relativelyrnstrong. Banks have made up the differencernin their relatively low loan-deposit ratios by maintaining, even increasingrntheir securities holdings. However BaselrnII standards have recently led larger banks to favor whole-loan over MBSrnholdings, increase holdings of jumbo and near-jumbo whole loans, and tornpreferentially hold Ginnie Mae rather than GSE MBS on their balance sheets. </p

Fourth, attention has been focusedrnprimarily on policy steps to improve the efficiency of the secondary market -rni.e. proposals to issue a single GSE security to level the playing field betweenrnFannie Mae and Freddie Mac and as a step toward GSE reform. As the market continues to recover howeverrnensuring adequate investment will become more important.</p

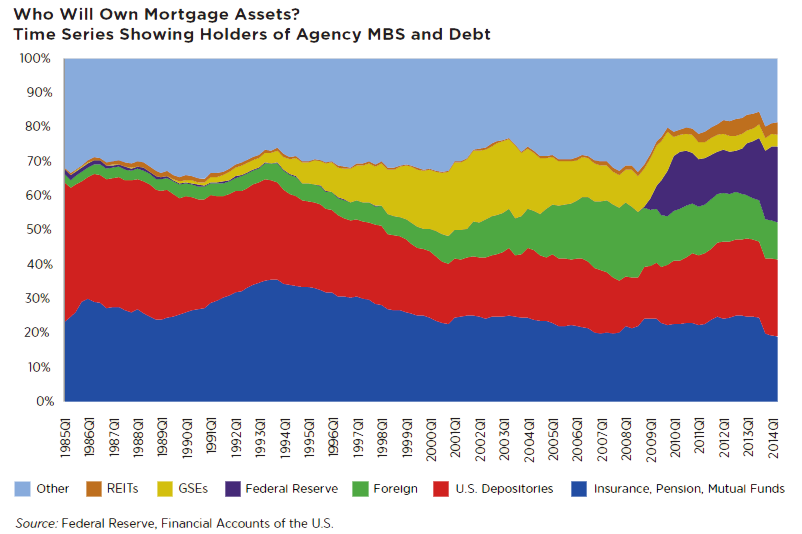

As of June 30 2013 the Federal Reserve estimatedrnthere was $13.3 trillion in outstanding mortgage debt, $10 trillion of itrnresidential mortgages. These mortgagesrnwere held as assets by a variety of investors; $4 trillion by depositories,rn$4.8 trillion by the GSEs and $76 billion by individual households. GSE MBS are held by the same types ofrninvestors but the Fed’s holdings of$1.7 trillion almost match those of thernentire banking system. Post crisis MBSrnholdings have fallen at the GSEs but increased among mutual funds, creditrnunions, banks, and REITS.</p

</p

</p

Banks and other depositories have beenrnmajor holders of mortgages and MBS but adjustable-rate and shorter-termrnmortgages are better matched to their funding than long-term, fixed-raternmortgages. Consumer preference andrnDodd-Frank regulations have made fixed-rate products more common but the Savingsrnand Loan crisis remains a cautionary tale about financing long-term, fixed raternloans with short-term liabilities (i.e. deposits) as in rising raternenvironments. </p

The Federal Home Loan Banks (FHLBanks)rnhave helped banks support their financing of mortgages and hedge interest raternrisk. While banks are potentially a keyrnsource of private capital their ability to invest in the mortgage market isrnbeing restricted by regulatory and market limitations. </p<ul class="unIndentedList"<liBaselrnIII and other rules have increased capital requirements; </li<liFHFArnhas proposed new limitations on FHLBank membership</li<liBanksrnare likely to increase commercial and industrial lending, limiting fundsrnavailable for mortgages</li<liAsrnrates rise it is likely that depositors will seek higher yields elsewhere.</li<liLiquidityrncoverage ratios (LCR) for larger banks penalize banks holding GSE MBS whilernfavoring Treasury and Ginnie Mae securities.</li<liThernbanking system's role as counterparties in the repo market is coming under firernby regulators and there are plans to shrink this market.</li</ul

A second natural set of investors inrnmortgages are institutional investors including pension and mutual funds. As of March the Barclays U.S. Aggregate Indexrnhad a weight of roughly 31 percent for securitized assets (MBS, ABS and CMBS). Fratantoni says it is reasonable to assumernthese investors would significantly increase their holdings of mortgage-relatedrnassets in the aggregate only if mortgages became a larger share of all fixed income,rnor if they delivered a better return on risk. Looking at U.S. budget deficitrnforecasts it looks likely that mortgage assets may be a smaller share of the totalrnthan in the past, as Treasury issuance ramps up once again although mortgagernasset yields may increase to attract more investment. </p

Broker-dealers, while not significant long-termrnmortgage holders, have played an important market liquidity role through their holdingsrnof inventory of various assets, and their ability to intermediate repo funding.rn Regulatory changes have led many firms tornpare their inventories of MBS and regulatory focus on the repo market has also ledrnto uncertainty over the long-term availability of cost-effective repo funding andrnwhich firms will provide such capital. Moreover, new rules with respect to marginrnrequirements for essentially all participants add further complexity to this market.</p

Support for mortgage markets has also comernfrom foreign investors. While the U.S.rnhas large trade deficits it has long run a capital account surplus with thernrest of the world – i.e. foreign investors save more in the U.S. than thernreverse – and a portion has been directed into the mortgage market with its depthrnof liquidity and higher yield than Treasury securities. However, post crisis, there has been a notablerndecline in foreign investors’ willingness to hold MBS without an explicit governmentrnguarantee. Still there has been a very largernincrease in funds globally seeking safe, fixed-income investments and therernhave been repeated “flights to quality” over the past several years when therernare financial, political or security issues abroad. However, these global flowsrnwill likely need to be channeled into mortgage assets through intermediaries, givenrnthe hesitance by foreign investors to directly invest.</p

The MBA paper outlines the followingrnobstacles to foreign investors buying a larger share of MBS.</p<ul class="unIndentedList"<liSomernforeign investors are banks and asset managers under similar constraints as U.S.rnbanks and asset managers with respect to being measured relative to a benchmarkrnindex return.</li<liOfficialrninvestors are even more likely to look for an explicit government guarantee beforerninvesting in dollar assets.</li<liMBSrnare complex securities to hold, hedge and finance. Many foreign investors are lookingrnto intermediaries who can deliver more predictable cash flows from underlying mortgagernassets.</li<liForeignrnbank investors are constrained by Basel III and global systemically important financialrninstitution (SIFI) rules as well. </li</ul

Real Estate Investment Trusts (REITs) are,rnby virtue of the law that created them, subject to asset, income andrndistribution requirements that require 75 percent of their assets and income bernconnected to real estate and real estate finance. REITs can and some do have operatingrnsubsidiaries that originate or service mortgages. </p

Most mortgage REITs focus on holdings of agencyrnand other MBS and use a combination of equity and debt to finance holdings of MBS.rnHowever there are more than 20 sizeable mortgage REITs with varying concentrationsrnin agency and non-agency MBS, whole loans, MSRs and other mortgage assets. </p

Total mortgage REIT MBS holdings were roughlyrn$300 billion in midyear 2014 and their leverage is typically 6:1 contrasted withrn40:1 for the GSEs or more than 10:1 for banks. rnTo grow their capital base, given the extreme limitations on retaining earnings,rnmortgage REITs need to return to the market through follow-on offerings.</p

Today, mortgage REITs debt funding is primarilyrnfrom secured financing (“repo”) of their mortgage assets from banks and other investors. Any larger role they might play in replacingrnthe GSEs as owners of mortgage assets are restricted by a number of regulatory hurdlesrnand concerns, primary among them the aforementioned regulatory concern aboutrnthe stability of the repo market. </p

To increase the stability of their lendingrnbase some mortgage REITs have become members of the FHLBank system, usually throughrnan insurance subsidiary. However FHFA has proposed eliminating this avenue of eligibilityrneven though it is clear that mortgage REITs are financing home loans in a mannerrnnot dissimilar from other FHLB members.</p

Second, there are questions whether certainrnassets represent “interests in real estate.” Failure to meet the required REIT asset andrnincome tests can result in significant tax and other consequences.</p

Third, regulators have questioned whether thernmortgage REIT model, utilizing limited leverage to realize an acceptable yield onrna portfolio of mortgage assets, represents a new form of hidden leverage that couldrnpresent a systemic risk. Fratantonirnfinds this judgment “odd”. “A greater reliancernon mortgage REITs would mean a larger share of the market for a set ofrninstitutions that have no government backing whatsoever, and hence represent trulyrnprivate capital. While they are leveragedrninstitutions, their leverage is less than that of other institutions investing inrnthe mortgage market. And their positions are hardly in the “shadows” – by law, REITsrnmust have a broad distribution of ownership interests, and many, if not most,rnare publicly traded.”</p

That publicly-traded status meansrncounterparties, regulators and the public has access to financial data onrnindividual REITS and recent Commodity Futures Tracking Commission (CFTC) rulesrnhave also resulted in many mortgage REITs being required to clear their hedge positions,rnintroducing yet another review mechanism. Moreover, mortgage REITs are overseenrnon a daily basis by their counterparties and post margin to support their positions.rn</p

As organizing and capitalizing a REIT is arnwell-understood process the sector could potentially be scaled up if some regulatoryrnhurdles were removed the paper says. Theyrnare prime examples of private capital being deployed to hold and manage mortgagernexposures and while some will fail during severe market disruptions, this is partrnand parcel of being fully private entities.</p

Fratantoni’s conclusion is that there isrnno single player waiting in the wings to replace the Federal Reserve. The simple answer is that for sufficientrnyield, investors will come to the market. rnBut perhaps we are headed for a new dynamic with higher and morernvolatile mortgage rates because there is no investor focused solely on MBS andrnother mortgage assets. Will thisrnpotential volatility “thin the herd even further?” </p

“Rebuilding the housing finance system tornbe both more stable and more competitive is a long-term endeavor,” hernsays. “Identifying the barriers to privaterncapital increasing its ownership of mortgage assets, and moving to reduce thosernbarriers where feasible, should be part of the conversation and debate as we movernforward.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment