Blog

Zombies Rise as Foreclosure Pipelines Clear

Asrnmight be expected, as the number of foreclosures has dwindled, so has the numberrnof so-called zombies. However RealtyTracrnsaid on Friday their share of all foreclosures has continued to grow. Zombie foreclosures are those in which the delinquentrnhomeowner has moved from the home before the actual foreclosure or sheriff’srnsale takes place. Vacant properties arernat risk for deterioration or vandalism, creating a liability for both lenders andrncommunities. </p

Inrnits quarterly Zombie Foreclosure Report</iRealtyTrac says that at the end of January 2015 there were 142,462 homes in thernU.S. that were in the process of foreclosure but had already been vacated byrnthe owner, down 6 percent from a year earlier. rnHowever that number represented one-quarter of all homes in the pre-salernforeclosure inventory compared to 21 percent in the first quarter of 2014. </p

Daren Blomquist, RealtyTrac vicernpresident said, “While the number of vacated zombie foreclosures is down from arnyear ago, they represent an increasing share of all foreclosures because theyrntend to be the problem cases still stuck in the pipeline. Additionally, thernstates where overall foreclosure activity has been increasing over the pastrnyear – counter to the national trend – tend to be states with a longerrnforeclosure process more susceptible to the zombie problem.”</p

Blomquist said that in those statesrnwith what he called a bloated foreclosure process the increase in zombiernforeclosures is positive, signaling that banks and courts are finally movingrnforward to clear the backlog of properties that may have been in legal limbornfor years “In many markets there is plenty of demandrnfrom buyers and investors to snatch up these distressed properties as soon asrnthey become available to purchase,” he added.</p

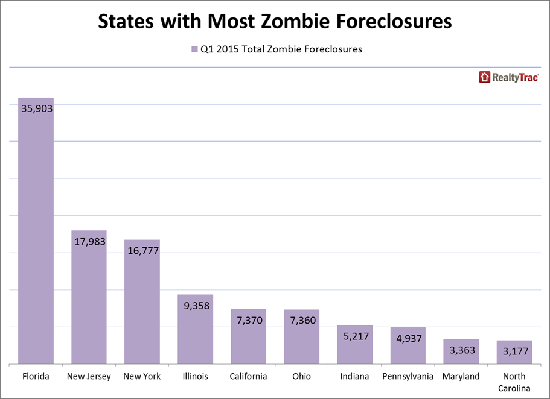

The percentage of vacant homes in thernforeclosure inventory soared in two states which have among the longestrnforeclosure timelines, stretching at times to near five years. Compared to a year earlier zombiernforeclosures increased 109 percent in New Jersey to 17,983 and 54 percent torn16,777 in New York, the second and third largest totals in the country. The numbers represented 23 percent and 19rnpercent respectively of the states’ foreclosures. </p

However, despite decreasing 35 percentrnsince the first quarter of 2013, Florida still topped the list of states in itsrnnumber of zombies, 35,903, down from 54,908 a year earlier. This was twice the number of second place NewrnJersey and 26 percent of all foreclosures in the state.</p

</p

</p

Illinois had 9,358 zombie foreclosuresrnat the end of January, down 40 percent from a year ago but still the fourthrnhighest state total, while California had 7,370 zombie foreclosures at the endrnof January, up 24 percent from a year ago and the fifth highest staterntotal. </p

</p

</p

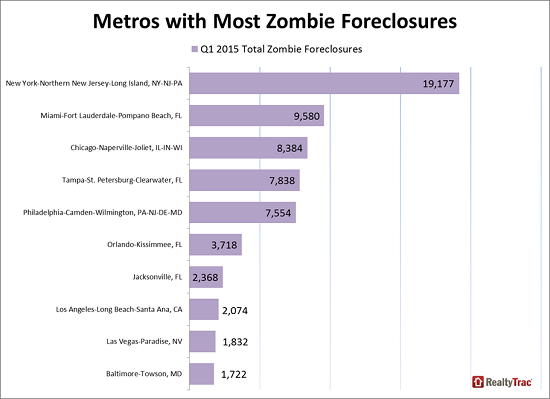

Among metro areas the greatest numberrnwere in the greater New York area with 19,177, 17 percent of properties in thernforeclosure inventory and a 73 percent increase from a year earlier. The number of zombies decreased from a yearrnago in the next three cities on the list, Miami, Chicago, and Tampa. Miami was down 34 percent, Chicago 35rnpercent, and Tampa 25 percent, but the three metros still posted the second,rnthird and fourth highest number of zombie foreclosures among metro areasrnnationwide: Philadelphia, in fifth place, had a 53 percent increase in zombiesrnfrom a year earlier and they now represent 27 percent of all foreclosures inrnthat city.</p

Among large metro areas with significantrnnumbers of zombie foreclosures in the first quarter the highest share were in St.rnLouis (51 percent), Portland (40 percent) and Las Vegas (36 percent). Metros with the largest increases in the pastrnyear were Atlantic City, New Jersey (+133 percent), Trenton-Ewing, New Jerseyrn(+110 percent), and New York (+73 percent).

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment