Blog

MBA Delinquency Survey Shows Signs of Stabilization. Progress Depends on Labor Market

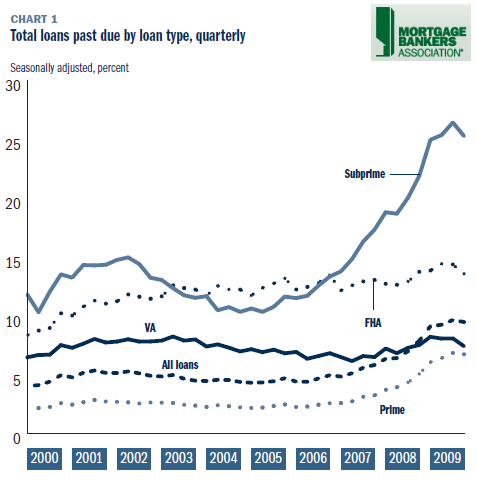

The Mortgage Bankers Association released the National Delinquency Survey for Q4 2009 today. Total mortgage delinquency rates, seasonally adjusted, were downrn17 basis points during the fourth quarter, but up year-over-year by 159 basis points.

9.47 percent of all mortgages on one- to four-family homes are now inrnsome state of delinquency.

While that was the headline onrnthe press release accompanying the results of the Mortgage BankersrnAssociation's National Delinquency Survey, the real news was the 16rnbasis point drop in new delinquencies recorded during the 4th quarter.

In a telephone press conference accompanying release of thernsurvey this morning, Jay Brinkmann, MBA's chief economist said thatrndelinquencies in the 30 day plus “bucket” traditionally represent thernlargest category of troubled loans as many people have short term problems, quicklyrnrecover and bring their loans current.

Inrnthe present scenario, that is not the case. The number of loans 90+ days in arrears is now the largest category ofrndelinquency and growing, the MBA believes the drop in new delinquencies may be a signrn”we are beginning to work our way out of the problem.”

The timing of this drop, Brinkman pointed out, isrnespecially significant as the fourth quarter usually sees an increase in thern30+ bucket because of seasonal factors such as the holiday season and the arrivalrnof the first heating bills. Only a fewrntimes since MBA has been keeping records has there been a 3rd to 4thrnquarter decline “and never as large as this one.” The 4thquarter number follows a 22 point decline in the 3rd quarter. Thisrnwas also a drop of 22 basis points from 4th quarter 2008 figures.

Loans in the 60+ day bucket were down 4 basis points, thernsecond consecutive quarter that category had shrunk.

Long term delinquencies were 71 basis points higher than inrnthe 3rd quarter and 209 basis points higher than the year before andrnnow represent 30 percent of all loans.

The drop in the 30 day bucket was consistent across allrnloans as was the growth in longer term arrearages. The latter, Brinkmann said, is paired with arndrop in foreclosure starts as many loans in the 90+ bucket are in some type ofrnmodification program such as HAMP. Concrete figures are not available, he said,rnbut it is clear that borrowers are staying in that bucket longer than hasrnhistorically happened. Not only are loans not moving as quickly intornforeclosure status because of these programs, but some people are probably alsornworking their way out of delinquency but haven't quite gotten current.

He pointed to a nearly identical parallel between new andrncontinued delinquencies and employment figures. rnPersons who have been out of work for more than 6 months represent 41rnpercent of all unemployed while new unemployment claims have been steadilyrndropping – they are now down about a third since their peak in March 2009. Long term and short term mortgage delinquenciesrnhave exactly mirrored this pattern.

“The pattern of mortgage delinquencies now very much follows thernpattern of unemployment. Just as short-term delinquencies have fallenrnduring the latter part of 2009, first-time claims for unemploymentrninsurance have declined by about a third since their peak in Marchrn2009. Just as long-term delinquencies now dominate total mortgagerndelinquencies, long-term unemployment now dominates the totalrnunemployment number. People who have been unemployed for six months orrnmore now constitute over 40 percent of the total unemployed, thernhighest share in the history of the unemployment survey. In addition,rnover the last several months we have seen a large number of peoplernsimply drop out of the work force, many who are discouraged about beingrnable to find work. Until the issue of this large segment of long-termrnunemployed is resolved, many of the longer-term mortgage delinquenciesrnwill remain a problem with a strong likelihood of turning intornforeclosures,” Brinkmann said.

Only a few states are really driving delinquency andrnforeclosure statistics. Nevada continues to have the highest overallrndelinquency rates at 14.92 percent followed by Mississippi (14.69 percent) andrnGeorgia (13.53 percent). Leading inrnforeclosure inventory are Florida (13.44 percent), Nevada (9.76) percent, andrnArizona (6.07 Percent.) The highestrnrates of foreclosure starts are found in Nevada (3.04 percent), Florida (2.41rnpercent) and Arizona (2.18 percent.)

Brinkmann was asked to comment on the possible effect of PresidentrnObama's newly announced program to pump $1.5 billion into housing agencies in fivernstates, California, Arizona, Nevada, Florida, and Michigan to fund programs forrnpeople who are unemployed or underwater with their mortgages. He said he hadrnnot had a chance to study the program but that the current problems are notrnstructural mortgage problems, they are employment related. READ MORE

Subprime adjustable rate mortgages had a 90+ day delinquencyrnrate compared to 16.10 in the third quarter and 11.60 percent one year earlier.rnSubprime fixed rate mortgages increased from 11.30 percent in the third quarterrnto 13.04 percent. One year earlier thatrn90 day rate was 7.43 percent. Prime ARMrnmortgages had a delinquency rate of 7.84 percent compared to 6.63 percent thernprevious quarter and 4.74 one year earlier and prime 2.91 percent of prime FRMsrnwere over 90 days delinquent compared to 2.34 percent in the third quarter andrn1.20 percent in the 4th quarter of 2008. Delinquent FHA loans increased 50 basisrnpoints to 5.85 percent in the fourth quarter. rnThe rate was 4.55 percent one year earlier.

Brinkmann said he did not expect that problems resultingrnfrom option mortgage resets were going to be “the tidal wave that wasrnexpected”. Many of the people whornhad those mortgages are thought to have refinanced already and some peoplerndefaulted before their loans reset. Arnlot of option loans have already reset so those people may be included inrnpresent foreclosure statistics or they may be paying their loans. <pThe Federal Reserve'srnrate increase announced yesterday was generally anticipated by the financialrncommunity, he said, and he did not expect it would have any immediate effect onrnmortgage rates. The termination of thernFederal Reserve's bond purchase program will have a bigger impact and hernexpects that mortgage rates will begin to rise gradually in April. READ MORE

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment