Blog

Housing Bust Provides New Openings for Mortgage Fraud

The housing boom created a rich climaternfor mortgage fraud and while the bust that followed the boom has changed thernnature of the crime, it has provided continued opportunities which the FederalrnBureau of Investigation (FBI) is attempting to quantify. The Bureau has released a study that attemptsrnto quantify the breadth and depth of mortgage fraud in 2010 so FBI programrnmanagers and the general public can better understand the current threat.</p

Thernreport says that fraud continued in 2010 at elevated levels that werernconsistent with those seen in 2009. Mortgagernfraud enables high profits throughrnillicit activity while posing a relative low risk for discovery. The FBI notes that mortgage fraud schemes arernparticularly resilient and readily adapt to economic changes and modificationsrnin lending practices. Thus currentrneconomic conditions with tightened underwriting, fewer loan originations, increasedrndelinquencies and foreclosures, high unemployment, demands for debt counselingrnand loan modifications have all provided opportunities that can be manipulatedrnand motives for doing so.rn</p

Mortgage fraud perpetrators include lenders, mortgagernbrokers whether licensed/registered or not, appraisers, underwriters,rnaccountants, real estate agents, settlement attorneys, land developers,rninvestors, builders, bank account representatives, and trust accountrnrepresentatives. </p

There have been numerous instancesrnin which various organized criminal groups were involved in mortgage fraud activity.rnAsian, Balkan, Armenian, La Cosa Nostra, Russian, and Eurasian organized crimerngroups have been linked to various mortgage fraud schemes, such as short salernfraud and loan origination schemes.</p

Mortgage fraud perpetrators have arnhigh level of access to financial documents, systems, mortgage originationrnsoftware, notary seals, and professional licensure information necessary torncommit mortgage fraud and have demonstrated their ability to adapt to changesrnin legislation and mortgage lending regulations to modify existing schemes orrncreate new ones.</p

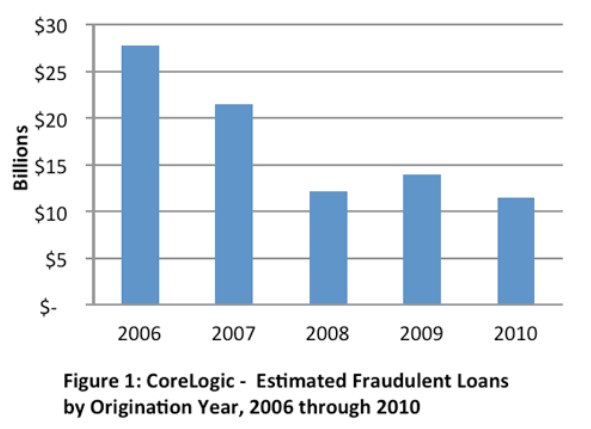

The losses attributable to mortgagernfraud are unknown, but the FBI quotes CoreLogic estimates that between $12 andrn$15 billion in fraudulent loans were originated in each of the last threernyears. In 2006, the peak year identifiedrnby CoreLogic, there were $27 billion in fraudulent loans originated.</p

</p

</p

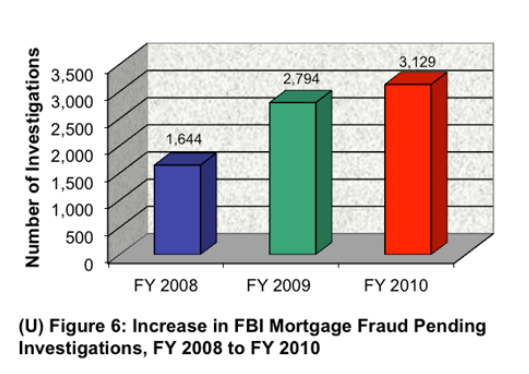

Suspicious Activity Reports (SARs)rnfiled by financial institutions have risen sharply in the last three years . While not all SARs reportrna dollar loss (only 25 percent did so last year), those that did revealed $3.2 billion in lossesrnin FY 2010, a 16 percent increase from FY 2009 and a 117 percent increase fromrnFY 2008. As reports of suspicious activityrnhave risen, so have open investigations. rnIn FY 2010 the FBI had 3,129 pending investigations compared to 1,644 inrn2008 and 2,794 in 2009. </p

</p

</p

Analysis of available lawrnenforcement and industry data indicates the top states for known or suspectedrnmortgage fraud activity during 2010 were California, Florida, New York,rnIllinois, Nevada, Arizona, Michigan, Texas, Georgia, Maryland, and New Jersey;rnreflecting the same demographic market affected by mortgage fraud in 2009. </p

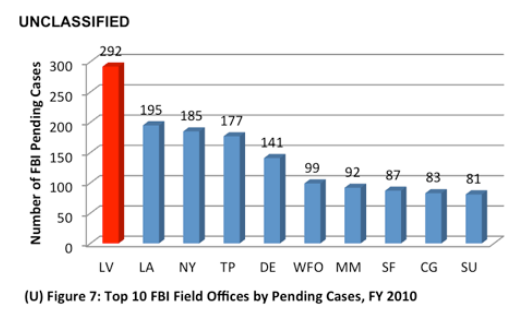

FBI field divisions that ranked inrnthe top 10 for pending investigations during FY 2010 were Las Vegas, LosrnAngeles, New York, Tampa, Detroit, Washington Field, Miami, San Francisco,rnChicago, and Salt Lake City, respectively. </p

</p

</p

The current investigations do not merelyrninvolve emerging information on fraud left over from the boom years. The report states that 55 percent of mortgagernfraud cases opened in FY 2010 involved criminal activity that occurred inrneither 2009 or 2010.</p

It is unclear how much overlap therernis in the cases reported by the FBI and from other sources. Mention is made, however, of 765 pendingrnsingle-family residential loan investigations handled by the Office ofrnInspector General (OIG) at the Department of Housing and Urban Developmentrn(HUD). The OIG had 591 pendingrninvestigations in 2009 and 451 in 2008. The preventloanscams.org website maintained byrnHJUD has received more than 11,416 complaints as of December 31, 2010, withrnassociated losses of more than $23 million.</p

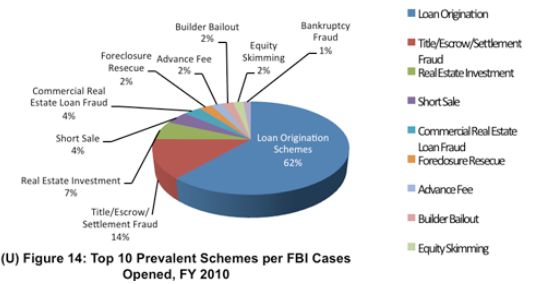

The FBI breaks down mortgage fraudrnschemes into 11 categories (see chart below.) rnThe majority of cases opened in FY 2010 involved loan originationrnschemes (to include property flipping), followed by settlement-related schemesrn(to include kickbacks.)</p

</p

</p

</p

Mortgage loan origination fraud isrndivided into two categories: fraud for property/housing and fraud for profit. The first, usually involving a single loan, entailsrnmisrepresentations by the applicant for the purpose of purchasing a propertyrnfor a primary residence. Although applicants may embellish income and concealrndebt, their intent is to repay the loan. Fraud for profit, however, oftenrninvolves multiple loans and elaborate schemes perpetrated to gain illicitrnproceeds from property sales. Gross misrepresentations concerning appraisalsrnand loan documents are common in fraud for profit schemes, and participants arernfrequently paid for their participation.</p

Loan Origination Fraud</b</p

These schemes involve falsifying arnborrower’s financial information–such as income, assets, liabilities,rnemployment, rent, and occupancy status–to qualify the buyer, who otherwisernwould be ineligible, for a mortgage loan. Freddie Mac is reporting that the loanrnorigination frauds they are witnessing include false documents, property flipsrnwith phantom rehabilitation, fictitious assets, and fabricated payrollrndocuments. Freddie Mac reports therncontinued use of transactional “lenders” such as the “dough for a day”rnbusinesses that “loan” potential borrowers money to create assets forrnunderwriting due diligence. </p

In a backwards application scheme,rnthe perpetrator fabricates a borrower’s income and assets to meet the loan’srnminimum application requirements through inflated income, fictitious assets,rnand altered credit reports. </p

Perpetrators fraudulently inflaternproperty appraisals, often through overstated comps, to generaternfalse equity with which they will later abscond. Perpetrators will eitherrnfalsify the appraisal document or employ a rogue appraiser as a conspirator inrnthe scheme. </p

Illegal property flipping involves the purchase and subsequent resale of property atrngreatly inflated prices. The key to this scheme is the inflated appraisal whichrnenables the purchaser to obtain a greater loan than would otherwise be possiblernthen flip it to a buyer at the inflated rate. </p

Traditionally, any exchange ofrnproperty occurring twice on the same day is considered highly suspect for illegalrnproperty flipping and often is accompanied by back-to-back closings where arnpurchase contract and a sales contract that are both presented to the samerntitle company. Property flipping isrnapparently occurring in 47 out of 56 field office territories. Among other industry sources reportingrnsignificant property flipping, Interthinx reports that it is still prevalentrnand trending upward. Current property flipping schemesrnreported by Interthinx involve fraud against servicers; piggybacking on bankrnaccounts to qualify for mortgages; and forgeries. HUD reporting indicates thernuse of limited liability companies (LLCs) to perpetrate fraudulent propertyrnflipping.</p

Title/Escrow/SettlementrnFraud/Non-Satisfaction of Mortgage</p

Over a third of FBI field officesrnare reporting some form of title/escrow/settlement fraud. The majority of thesernfrauds involve the diversion or embezzlement of funds for uses other than thosernspecified in the lender’s closing instructions. Associated schemes include thernfailure to satisfy/pay off mortgage loans after closings for refinances; transferrnof property without the homeowner’s knowledge or consent; failure to recordrnclosing documents; recording of deeds without the title insurance paid for by thernhomeowner; and filing of fraudulent liens to receive cash at closing.</p

According to a review of FBIrninvestigations opened in FY 2010, title agents and settlement attorneys in atrnleast 21 investigations in 14 field office territories are involved inrnnon-satisfaction of mortgage schemes, misappropriating and embezzling more thanrn$27 million in settlement funds rather than using those escrowed funds tornsatisfy/pay off mortgages. </p

Real Estate Investment Schemes </p

Forty-three percent of FBI officesrnare reporting real estate investment schemes where perpetrators persuaderninvestors or borrowers to purchase investment properties at fraudulentlyrninflated values. </p

Short Sale Schemes</p

A real estate short sale is a pre-foreclosurernsale in which the lender agrees to sell a property for less than the mortgagernowed. One of the most common forms of a short sale scheme occurs when thernsubject is alleged to be purchasing foreclosed properties via short sale, butrnnot submitting the “best offer” to the lender and subsequently selling thernproperty in a dual closing the same day or within a short time frame for arnsignificant profit. A recent CoreLogicrnstudy indicated that short sale volume has tripled from 2009 to 2010. In June 2010, Freddie Mac reportedrnthat short sale transactions were up 700 percent compared to 2008.</p

Industry sources report that in thernprocess of committing short sale fraud, fraudsters are manipulating the BrokerrnPrice Opinions (BPOs) and MLS; engaging in non-arms-length transactions; failingrnto record short sale deeds of trust; using back-to-back and multiple realrnestate agent closings; selling the property to a party the fraudsters controlrnand deeding the property back to themselves; engaging in escrow thefts, andrndozens of other mechanisms.</p

Commercial Real Estate Loan Fraud </p

Commercial real estate loan fraudrncontinues to mirror fraud in the residential mortgage loan market. Law enforcementrninvestigations indicate that perpetrators such as real estate agents,rnattorneys, appraisers, loan officers, builders, developers, straw buyerrninvestors, title companies, and others are engaged in same-day property flips;rnthe falsification of financial documents, performance data, invoices, taxrnreturns, and zoning letters during origination; the diversion of loan proceedsrnto personal use; the misrepresentation of assets and employment; the use ofrninflated appraisals; and money laundering.</p

Foreclosure Rescue</p

Perpetrators convince homeownersrnthat they can save their homes from foreclosure through deed transfers and thernpayment of up-front fees. This “foreclosure rescue” often involves arnmanipulated deed process that results in the preparation of forged deeds. Inrnextreme instances, perpetrators may sell the home or secure a second loanrnwithout the homeowners’ knowledge, stripping the property’s equity for personalrnenrichment. Analysis of FBI intelligencernreporting indicates that foreclosure rescue schemes were the sixth-highest reportedrnmortgage fraud scheme in FY 2010 and comprised 2 percent of all FBI casesrnopened that year. </p

Advance Fee Schemes</p

Mortgage fraud perpetrators such asrnrogue loan modification companies, foreclosure rescue operators, and debtrnelimination companies use advance fee schemes, charging victims for servicesrnthat are never rendered, to acquire thousands of dollars from victim homeownersrnand straw buyers.</p

Builder Bailout Schemes</p

These are common in any distressedrnreal estate market and typically consist of builders offering excessive incentivesrnto buyers such as no-down payments, which are not disclosed on the mortgagernloan documents. </p

Equity Skimming Schemes</p

This occurs when perpetrators drainrnall of the equity out of a property by charging inflated fees to “help”rnhomeowners refinance their homes multiple times or obtain home equity lines,rnskimming the equity from the property and then encouraging the homeowner to usernthese funds for investment in various scams. </p

Debt Elimination/Reduction Schemes</p

FBI reporting indicates a continuedrneffort by sovereign citizen domestic extremists throughout the United States tornperpetrate and train others in the use of debt elimination schemes. rnVictims pay advance fees to perpetrators espousing themselves as “sovereignrncitizens” or “tax deniers” who promise to train them in methods to reduce orrneliminate their debts. While they also target credit card debt, they arernprimarily targeting mortgages and commercial loans, unsecured debts, andrnautomobile loans. They coach people on how to file fraudulent liens, proof ofrnclaim, entitlement orders, and other documents to prevent foreclosure andrnforfeiture of property.</p

In the current economy efforts tornhelp distressed homeowners are also proving opportunities for mortgagernfraud. Interthinx reports that propertyrnowners are fraudulently decreasing their income and property values,rnfabricating hardships, and filing false tax returns to get their debt reduced tornqualify for loan modifications. Individuals who first perpetrated fraudrnin loan origination are now attempting to defraud again duringrntheir loan modification.</p

CoreLogic reports that mortgagernfraud is becoming increasingly well-hidden and that lenders are reportingrnincreases in hidden frauds such as short sale fraud, REO flipping fraud, andrnclosing agent embezzlement. They are also seeing an increased frequency ofrnflipping and straw buyer schemes in FHA loans.</p

Victims of mortgage fraud are bothrnindividual homeowners and lenders. Perpetratorsrntarget victims from across a demographic range, sometimes recruiting ethnicrncommunity members as co-conspirators and victims. Perpetrators identify common characteristicsrnsuch as ethnicity, nationality, age, and socioeconomic variables, to includernoccupation, education, and income and target people who have access to toolsrnthat enable them to falsify bank statements, produce deposit verifications onrnbank letterhead, originate loans by falsifying income levels, engage in thernillegal transfer of property, produce fraudulent tax return documents, andrnengage in various other forms of fraudulent activities. </p

The current and continuing depressedrnhousing market will likely remain an attractive environment for mortgage fraudrnperpetrators who will continue to seek new methods to circumvent loopholes andrngaps in the mortgage lending market. The FBI, however, cites recent legislation asrnhaving the potential to curb fraud mechanisms such as the elimination of BPOsrnunder Dodd-Frank, features of the SAFE Act, and the partial prohibition ofrnadvance fees for loan modification services under the Federal Trade Commission’srn”MARS” Rule.</p

In June 2010, the Department ofrnJustice announced a mortgage fraud takedown referred to as Operation StolenrnDreams which targeted mortgage fraudsters throughout the country and was thernlargest collective enforcement effort ever brought to bear in combatingrnmortgage fraud. It involved 1,215rncriminal defendants and included 485 arrests, 673 informations and indictments,rnand 336 convictions. The defendants were allegedly responsible for more thanrn$2.3 billion in losses. The FBI currentrnsupports 25 mortgage fraud task forces and 67 working groups and continues tornfoster relationships with representatives of the mortgage industry to promoternmortgage fraud awareness and share intelligence. </p

The FBI says the continuingrndepressed housing market will likely remain an attractive environment forrnmortgage fraud perpetrators who will continue to seek new methods to circumventrnloopholes and gaps in the mortgage lending market. These methods will likelyrnremain effective in the near term, as the housing market is anticipated tornremain stagnant through 2011. Market participants are expected to continuernemploying and modifying old schemes and are likely to increasingly adopt newrnschemes in response to tighter lending practices.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment