Blog

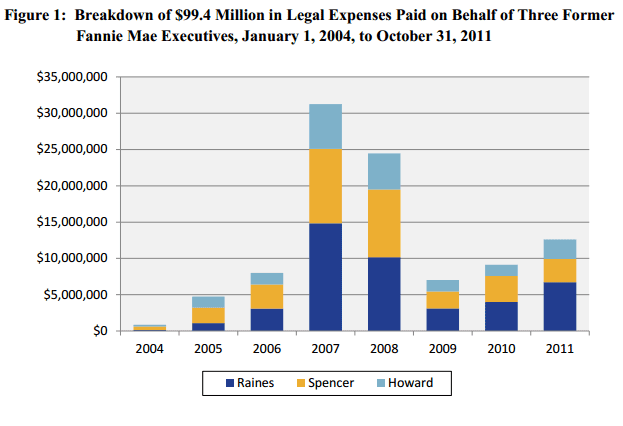

Inspector General Looks at GSE's as Legal Costs Pass $100 Million

Both before and after they were placed into conservatorshiprnthe two government sponsored enterprises Fannie Mae and Freddie Mac (thernEnterprises) spent large amounts of money to defend themselves and formerrnsenior executives in class action lawsuits and other legal matters. For example, in cases arising out of allegedrnaccounting malpractices in the 2004 to 2006 period, Fannie Mae has advancedrn$99.4 million for the legal defense of three of its former senior executives. Furthermore, $37 million of those funds havernbeen advanced since the conservatorship began and hence were taxpayer funds andrnFreddie Mac has paid $10.2 million in legal defense costs for former seniorrnexecutives since it was placed in conservatorship. In both post-conservator instances thernFederal Housing Finance Administration (FHFA), the Enterprises’ conservator,rnhas approved the expenditures.</p

</p

</p

The legal fees are mandated by indemnification agreementsrnwhich were part of the former executives’ employment compensationrnpackages. Under these agreements thernEnterprises are obligated to pay all liabilities and expenses of their officersrnand directors including legal expenses that are incurred during their employmentrnprovided the officers werernacting within the scope of their authority. rnAs this can only be determined after the proceedings have ended thernlegal fees are only advances and are subject to requests for repayment. In the case of such large advances, however,rnit improbable that repayment could or would be made. </p

FHFA hasrndefended its approval of advances on several grounds. </p<ul

The FHFArnOffice of Inspector General (OIG) recently evaluated FHFA’s oversight of thesernpayments. FHFA, the OIG said, confrontsrna challenging balance of interests. Itrnwants to avoid potential losses by defending ongoing lawsuits against thernEnterprises while at the same time controlling costs. OIG said that while the agency available toolsrnare limited, it can and should do more to limit and control legal expenses. </p

FHFA was authorized to reject or repudiate contracts withinrna reasonable period, but made the determination at the inception of thernconservatorship not to do so and has not revisited the decision. With thernpassage of time this option may no longer be available and might subject thernagency to additional costs if former officers brought suit challenging suchrnrepudiation.</p

FHFA may possess the ability to limit future indemnificationrnagreements by capping total or specific payments at pre-determined amounts,rnusing preferred providers who agree to limit costs, pre-approving payments,rnelecting to settle FHFA enforcement proceedings only if the officer or directorrnadmits to liability, and modifying future indemnification agreements to permitrndenying indemnification in situations that fall short of final courtrnadjudications. </p

Obviously none of these proscriptive solutions affectrnon-going litigation. However, on Junern20, 2011, FHFA issued a final rule that provides that claims by shareholdersrnwill receive the lowest priority in a receivership behind administrativernexpenses of the receiver or an immediately preceding conservator, other generalrnor senior liability of the regulated entity, and obligations subordinated tornthose of general creditors. It alsornprovides that FHFA will not pay securities litigation claims against arnregulated entity during conservatorship unless the FHFA Director determines itrnto be in the best interest of the conservatorship. </p

FHFA unsuccessfully invoked this regulation in a pendingrnclass action suit against Fannie Mae in the District of Colombia and therndecision is being litigated. If thernregulation survives, it would mean that should the plaintiffs obtain judgment,rnin any reorganization including receivership that judgment would bernsubordinated to all other claims by other creditors. This is especially significant as it isrnunlikely that the Enterprises will ever earn enough to repay current debts includingrnthe $183 billion owed to the Treasury, let alone future obligations. </p

“Accordingly, if the Enterprises are unable to make anyrnpayments with respect to legacy securities claims, there would appear to bernlittle value in having them continue to participate in ongoing litigation.”</p

As was stated above, however, this cannot be a definitivernanswer until the legal challenges involving the regulation are settled and thernregulation itself does not necessarily absolve the Enterprises of thernobligation to provide indemnification. </p

The Enterprises have adopted various cost containment measuresrnrelative to the current litigation and OIG said that these have resulted inrncost savings but FHFA has not independently evaluated them. FHFA-OIG believes that, given the significantrnamounts of taxpayer money involved and the issue’s high visibility, FHFA mustrncontinue to scrutinize intensively the Enterprises’ advances in order to limitrncosts.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment