Blog

Annual Foreclosure Rate Declines for 20th Straight Month; Nevada Gives Up Top Spot

Foreclosurernfilings topped 200,000 during May for the first time in two months but filingsrnwere still below the rate a year earlier according to the U.S. ForeclosurernMarket Report released by RealtyTrac this morning. A total of 205,990 properties or one in everyrn639 housing units received some type of foreclosure filing during the monthrncompared to 188,780rnin April, an increase of 9 percent. Despiternthe increase, filings were down 4 percent from May 2011 marking the 20th</supstraight month that year-over-year figures fell. Judicialrnstates posted a 26 percent annual increase in overall foreclosure activityrnwhile non-judicial states were down 20 percent. </p

RealtyTrac is an Irvine, California firmrnthat tracks three categories of foreclosure filings gathered from county levelrnsources. </p

- </ol

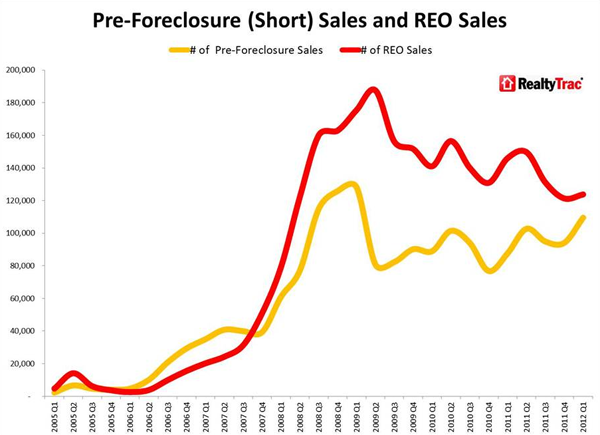

“U.S. foreclosure activity has nowrndecreased on a year-over-basis for 20 straight months including May, but thernjump in May foreclosure starts shows that it’s going to be a bumpy ride down tornthe bottom of this foreclosure cycle,” said Brandon Moore, CEO of RealtyTrac.rn”Based on the rise in pre-foreclosure sales we’ve seen so far this year, arnhigher percentage of these new foreclosure starts will likely end up as shortrnsales or auction sales to third parties rather than bank repossessions goingrnforward. While pre-foreclosure sales have less of a negative impact on homernvalues than bank-owned sales, they still represent a discounted sale where arndistressed homeowner is losing his or her home.</p

For the first time in years Nevadarnno longer topped the nation in foreclosure activity, falling to third placernwith 3,755 filings, a 4 percent decrease since April and 66 percent less than arnyear earlier. One in every 313 housingrnunits in Nevada received a filing. rnGeorgia leapt into first place with a 33 percent increase in activity inrnone month and was up 30 percent from May 2011. rnOne in every 300 Georgia housing units was affected by foreclosurernduring the month. </p

Arizona’s foreclosure activity rosern24 percent in May, putting it in second place among the states despite the factrnits rate, one in every 305 housing units, was down 29 percent from a yearrnearlier. </p

Foreclosure starts were filed onrn109,051 U.S. properties in May, a 12 percent increase from April and a 16rnpercent increase from May 2011. This was the first time in 27 months thatrnforeclosure starts increased on an annual basis. Starts were up year-over-year inrn33 out of 50 states with the largest annual increases in Tennessee (165rnpercent) New Jersey (118 percent), Pennsylvania (97 percent), and Florida (83rnpercent). Massachusetts, Texas, and NewrnYork also saw starts rise by more than 50 percent.</p

After three straight monthlyrndecreases to a 49-month low in April, bank repossessions (REOs) increased inrnMay, rising 7 percent. Lenders completed the foreclosure process on 54,844 U.S.rnproperties during the month. This wasrnstill a decrease of 18 percent compared to May 2011.</p

RealtyTrac attributes some of thisrndecrease to a widening acceptance among lenders of the value of pre-foreclosurernsales, usually short sales where the bank accepts less than the amount it isrnowned to allow the sale of a home to a third party. Moore said, “More banks are now recognizingrnthat treating the problem of delinquent mortgages with short sales rather thanrnbank repossessions can help them minimize their losses and also avoid taking onrnmore REOs, which they then have to manage, maintain and market for sale.”</p

“Disposing of distressed homes byrnpre-foreclosure sale can also benefit lenders and servicers becausernpre-foreclosure homes sell at a higher average price point than bank-ownedrnhomes,” he continued. “Our first quarter foreclosure sales report showed thatrnthe average price of a pre-foreclosure home was more than $27,000 higher thanrnthe average price of a bank-owned home – which quickly adds up given that therernhave been an average of 1.6 million nationwide foreclosure starts per year forrnthe past five years.</p

REO activity increased on an annualrnbasis in 17 states in May, including North Carolina (66 percent), Illinois (65rnpercent), and Massachusetts (59 percent). rnThere were large decreases in Nevada (68 percent), Arizona (43 percent),rnMichigan (42 percent), and Colorado (42 percent). </p

Riverside California, Atlanta,rnand Phoenix had the highest foreclosure rates among the 20 largest metropolitanrnareas in the country followed by Chicago and the Tampa-St. Petersburg area inrnFlorida.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment